Surging Market Expectations and Ongoing Developments

The stock market is currently at an all-time high as it braces for the much-anticipated wave of corporate earnings, including heavyweights like Meta Platforms, Amazon, and Apple. Recent earnings reports from companies such as Netflix, United Rentals, and American Airlines have revealed the enduring strength of U.S. consumers and the broader economy.

Even as some giants like Tesla underperformed, they are not too unlike a top athlete who has stumbled but is expected to soon catch up, and the Wall Street is expected to respond accordingly considering their current trading levels. However, such fluctuations are intrinsically common, even in robust bull markets, and are illustrative of the intricate nature of timing the market. Nevertheless, many discerning investors have cultivated a resilient “buy-and-hold” mindset, recognizing the lasting allure of mega-cap tech stocks, despite the occasionally deceptive ease of investing in them.

The Magnificent 7 Tech Stocks: A Closer Look

Meta Platforms, Inc. (META)

Trading near its all-time highs, Meta has experienced a staggering 160% surge in the past year. Nevertheless, the company’s valuation exhibits an intriguing dichotomy, with shares trading at a 16% discount to the Zacks tech sector and 10% below its 10-year median. Meta is still nearly 70% below its peak at 22.1X forward 12-month earnings. Yet, the stock upholds its position above all key short-term and long-term moving averages. Meta’s apps, such as Facebook, Instagram, and WhatsApp, cater to distinct user segments and stand to benefit from the continued rise in ad spending in an era dominated by smartphone dependency. Additionally, Meta’s ongoing investments in AI hold the potential for yielding long-term returns, especially in a prospective metaverse future. Currently, analysts foresee Meta’s earnings growing by 46% in FY23 and 23% in FY24, propelled by 15% and 14% revenue growth, respectively, alongside a recent Zacks Rank #2 (Buy) rating.

Amazon (AMZN)

Emphasizing efficiency and profitability, Amazon’s strategic approach encompasses various facets, from optimizing AWS cloud computing margins to enhancing its fulfillment network structure and bolstering its digital advertising unit. With a Zacks Rank #2 (Buy), Amazon is anticipated to witness a 280% surge in adjusted earnings in FY23, reaching $2.70 per share, and a further 36% expansion in FY24. Revenue growth is also in the cards, projected at 11% and 12%, respectively, culminating in a climb from $514 billion to $637 billion by 2024. Amazon’s stock, which has skyrocketed by 785% in the last decade, presently trades around 15% below its all-time highs. Although its forward earnings multiple appears elevated, the company’s strong focus on bottom-line growth bodes well for its future, portending a potential decline in its P/E ratio in the long run.

Apple (AAPL)

As one of the Magnificent 7, Apple is set to release its quarterly earnings results on February 1. Although many are mindful of Apple’s more recent ups and downs, its stock has a rich history of scaling significant peaks and overcoming adversities. Since its landmark initial public offering in 1980, Apple has weathered numerous storms and triumphed astoundingly. The company, under the shrewd leadership of Steve Jobs, accomplished miraculous turnarounds in the past, a testament to its resilience and enduring appeal. Its consistent innovation and adept management have proven pivotal in solidifying its position as a tech titan. Today, Apple is still going strong and stands as a promising investment option, especially as it gears up for its impending earnings release.

In conclusion, the allure and endurance of mega-cap tech stocks, particularly the Magnificent 7, resonate with investors seeking long-term dynamism in their investment portfolios. These stocks, Meta Platforms, Amazon, and Apple among them, embody the evergreen appeal of steady growth and resilience that have historically stood the test of time, making them compelling options for investors looking beyond short-term fluctuations to secure lasting wealth.

Apple Inc. Set to Report Earnings in February

Apple Inc., like all of the stocks on the list today doesn’t need an introduction and it reports earnings (Q1 FY24) on February 1.

Challenges and Resilience

AAPL stock closed out 2023 on a downbeat note after hitting all-time highs as Wall Street worried about slowing growth in China, a saturated high-end smartphone market, possible legal setbacks, and more. Apple’s revenue did fall by 2.8% last year, but that is rather common given its somewhat cyclical iPhone-heavy business. And the stock is already bouncing back.

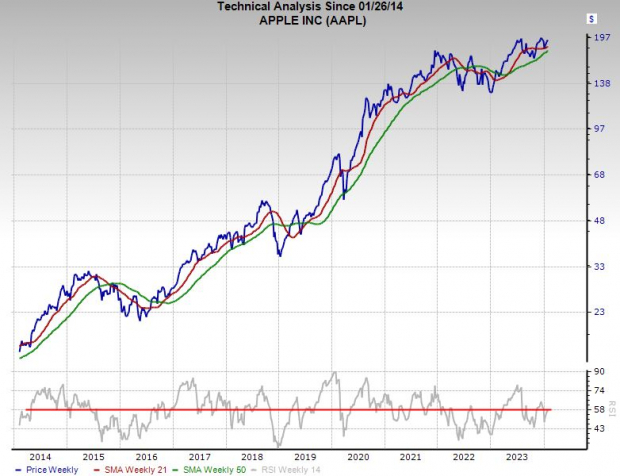

Image Source: Zacks Investment Research

Even in a ‘down year’ Apple sold $200 billion worth of iPhones in FY23 vs. $142 billion in FY19. Plus, CEO Tim Cook has helped turn its iPhones, Macs, and more, which have amassed an installed base of “over 2 billion active devices,” into a separate growth engine via services-focused subscriptions.

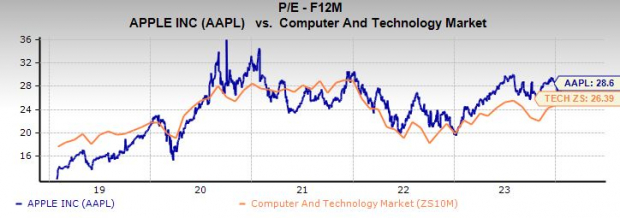

Image Source: Zacks Investment Research

Growth Trajectory

The biggest growth segment at the company includes the App Store, streaming TV, and more. AAPL has nearly doubled the number of paid subscriptions it had three years ago to over 1 billion. Apple’s revenue is projected to climb by 3% in FY23 and then jump 6% higher in FY25 to boost its adjusted earnings by 8% and 9%, respectively.

Valuation and Outlook

Apple trades above all of its key short-term and long-term moving averages and it is trading near neutral RSI levels. Meanwhile, Apple trades at a roughly 20% discount to its five-year highs at 28.6X forward 12-month earnings and not too far above its median and Tech.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%. Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research