Historical Performance Trends after Rate Cuts

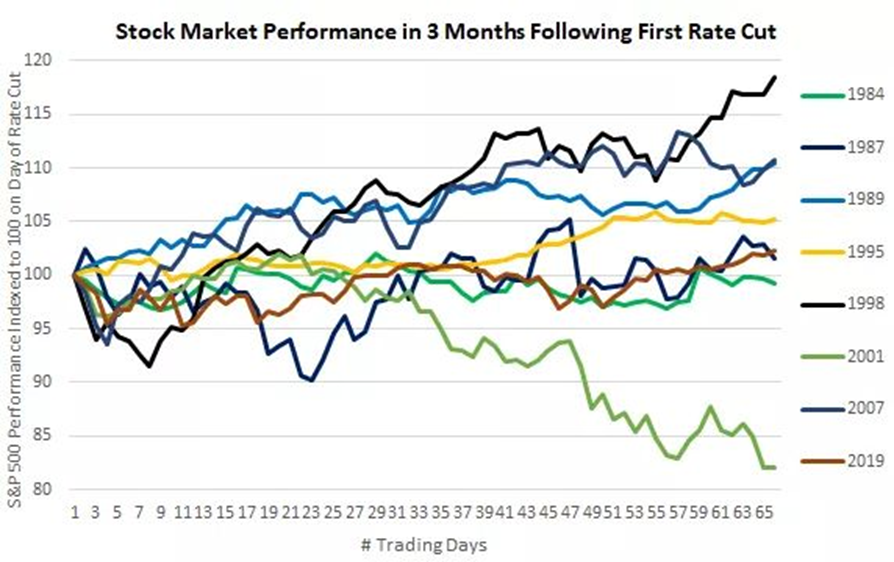

As the first rate-cut looms, investors ponder the market’s trajectory. Traditional wisdom gleaned from historical averages may not hold as past outcomes post rate-cuts exhibit immense variance. The 3-month S&P performance following the last eight rate-cutting cycles paints a picture of unpredictability.

Source: Markets & Mayhem

Source: Markets & Mayhem

The bull camp hinges on our robust economy’s relative strength. Despite acknowledged weakening, current economic conditions surpass those at the onset of prior rate-cutting cycles. Rate cuts are often reactive measures in times of economic distress, which don’t align with our present situation of impending but not overt crisis.

This scenario suggests that rate cuts could catalyze economic and market growth.

Market Trends in Election Years

Conversely, bearish sentiment arises from historical market data in election years, particularly September and October, typically unfavorable for stocks. In election cycles, these months display heightened brutality. Trend Spider data from the past 25 election years paints a dreary picture of September and October averages.

Source: Trend Spider

Source: Trend Spider

Amidst these diverging views, expert Luke Lango advises looking beyond short-term market fluctuations. He advocates seeing volatility as a long-term investment opportunity.

His advice in Innovation Investor stresses the potential for market growth post-rate cuts and AI investment expansion, urging investors to stay invested and focus on AI and consumer stocks.

A Potential Crypto Surge

Looking at digital assets, Bitcoin’s recent price movements have tantalized investors. Luke Lango projects a substantial rally if Bitcoin breaches a key resistance level, potentially soaring to $100,000 in the coming months, offering significant returns.

Furthermore, Bitcoin’s transaction volume surpassing giants like Mastercard and Visa suggests its widespread adoption and challenges conventional halving cycle predictions, hinting at a promising future.

The Future Landscape of AI: An Intriguing Insight

Delving into the realm of Artificial General Intelligence (AGI), concerns and possibilities arise. Experts like Eric Fry contemplate a future where AGI reshapes industries and societies, raising questions about human-AI collaboration and societal power dynamics.

California’s deliberations on an AI safety bill underscore the increasing need to regulate AI developments to prevent potential harm, signaling a new era where tech legislation grapples with profound ethical implications.

The financial markets dance on a precipice, where the whims of rate cuts, election cycles, cryptocurrency rallies, and AI advancements converge. Investors must navigate uncertainty with caution and strategic insight.

The post Brace for Pullback? Or a Blastoff? appeared first on InvestorPlace.