In a bold move that could shake up the financial landscape, President Joe Biden has proposed a massive $5 trillion tax increase, which includes a groundbreaking provision for a 25% annual minimum tax on unrealized capital gains for individuals with substantial incomes and assets exceeding $100 million.

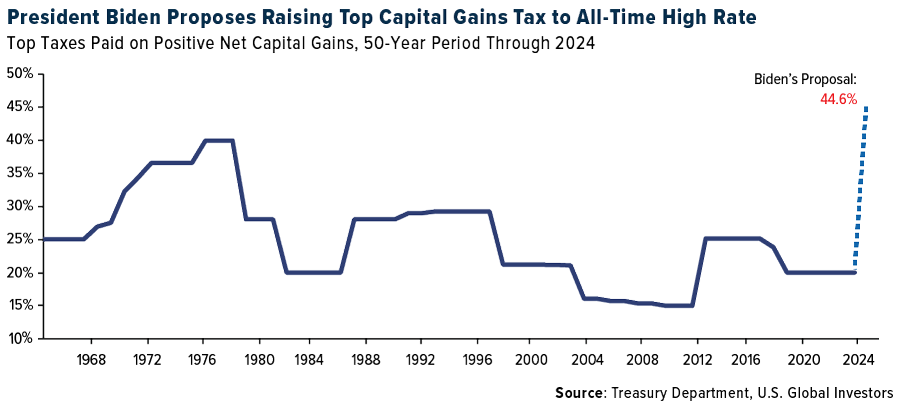

If this proposal gains traction, it would catapult the top marginal rate on long-term gains and dividends to a staggering 44.6%, a historical high in the annals of U.S. taxation.

While other alterations to the tax code have been suggested, the focus remains on the taxing of unrealized gains, a move that could have profound and unintended consequences on the economy, personal freedoms, and the core of American ingenuity.

Although the likelihood of this policy passing through a deeply divided Congress remains uncertain, it is crucial to understand the potential fallout.

The Pitfalls of Taxing Unearned Income

The notion of taxing unrealized capital gains—gains on assets like stocks and property that have not been sold—is both uncharted territory and inherently flawed.

Consider a scenario where shares bought for $1 million appreciate to $1.5 million the following year. Under Biden’s plan, taxes would be due on this $500,000 gain, despite the shares remaining unsold.

If the stock value drops back to $1 million the subsequent year, you are left paying taxes on a gain that existed only on paper without any actual profit, compounding the financial burden.

The investment community is voicing concerns, with figures like Anthony Pompliano highlighting the need for refunds on unrealized losses if unrealized gains are to be taxed.

Entrepreneur Scott Melker predicts that wealthy investors will maneuver around the tax burden by leveraging loans against their portfolios, as interests on such loans are often tax-deductible.

Financial Strain on Small Caps and Startups

This tax proposal poses a significant risk of distorting investment patterns, especially affecting small caps, startups, and burgeoning companies pivotal for economic progress.

Investors could be deterred from supporting growth-focused ventures, dampening innovation and hindering productivity improvements.

Resistance and Demographic Trends

Public opinion leans heavily against the taxation of unrealized gains, driven by a national belief in economic freedom and the principle that gains should be realized before being taxed.

Such opposition is rooted in American ideals of fairness and the autonomy in enjoying the fruits of one’s labor without undue government intervention.

Tax policies have a palpable impact on population shifts, influencing migrations to states with lower tax loads, as underscored by data from the Census Bureau.

Pressure Mounts on Small Caps

Amidst escalating Treasury yields and inflation anxieties, small-cap stocks are facing hurdles, exacerbated by doubts regarding the Federal Reserve’s potential interest rate adjustments.

The chart displaying the interplay between the 10-year yield and small-cap stocks points to an accelerated selloff when bond yields rise above their 50-day moving average.

Given the current economic landscape, small caps are struggling, trading at levels not seen since the dotcom bubble, potentially offering an intriguing investment opportunity.