Intel Corporation INTC has seen its stock plummet by 55.8% since the beginning of the year, a stark contrast to the industry’s robust growth of 97.8%. Lagging behind competitors like Advanced Micro Devices, Inc. and NVIDIA Corporation, Intel finds itself grappling with substantial financial woes and operational hurdles, prompting a thorough reassessment of its business strategies.

Contemplating various options, including a potential split of its product design and manufacturing arms, Intel is also evaluating the future of its factory projects. Furthermore, the establishment of Intel Foundry as a distinct subsidiary aims to unlock strategic advantages and enhance capital efficiency by creating a clearer separation from the rest of the company.

The Roller Coaster of Price Performance

Image Source: Zacks Investment Research

Amidst these challenges, Intel faces margin hurdles due to its ambitious expansion into artificial intelligence on various platforms, creating strains on its short-term profits. The shift towards AI-centric products and the relocation of production to high-cost facilities in Ireland have negatively impacted margins. Additionally, competitive pricing pressures and non-core business charges have added to Intel’s profit margin woes.

Despite showcasing innovations such as the Intel Gaudi 3 accelerator and the Lunar Lake architecture, featuring advanced AI processing capabilities, Intel’s short-term margins continue to suffer.

Navigating a Frigid Market Landscape

China’s significance as a key market for Intel poses additional challenges. Accounting for over a quarter of the company’s revenue, Intel faces headwinds as China seeks to replace foreign-made chips with domestic alternatives, reflecting broader geopolitical tensions. Tightened high-tech export restrictions intensify the pressure on Intel, necessitating a delicate balance between market restrictions and domestic competition.

Moreover, weakened consumer and enterprise spending, primarily in China, alongside stringent export control measures, have contributed to softer demand for Intel’s products. With increasing customer inventory levels and uncertain market dynamics, Intel is poised for below-par revenue growth, particularly in the client business.

Looking Ahead: A Bleak Picture or a Glimmer of Hope?

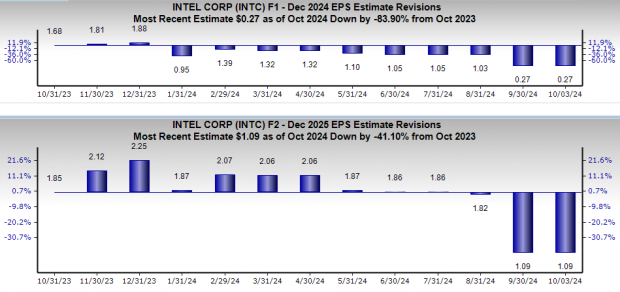

Intel’s earnings estimates for 2024 and 2025 have witnessed a downward trend, reflecting bearish sentiments towards the stock. While the company’s innovative AI solutions offer promise in the semiconductor space, its current standing, marked by declining earnings estimates, unfavorable product mix, and regulatory challenges, casts a shadow over its future.

Image Source: Zacks Investment Research

While Intel’s technological advancements could pave the way for widespread AI adoption, its recent struggles and negative investor sentiment, as evidenced by a Zacks Rank #4 (Sell), raise concerns about its future prospects. As the company navigates turbulent waters, cautious optimism tinged with skepticism is advised for potential investors considering Intel.

Market News and Data brought to you by Benzinga APIs