Stock markets can be like a complex puzzle, with various pieces shifting and changing. Investors often find themselves bewildered by conflicting signals and uncertain trends.

However, there are moments of clarity when the market speaks unequivocally. The mantle of leadership falls on the shoulders of just a few select companies or sectors. And in the current landscape, Apple Inc. is standing at the forefront, shining as the Stock of the Day.

The trajectory of Apple’s stock may very well dictate the broader market movements, as it often does in such instances.

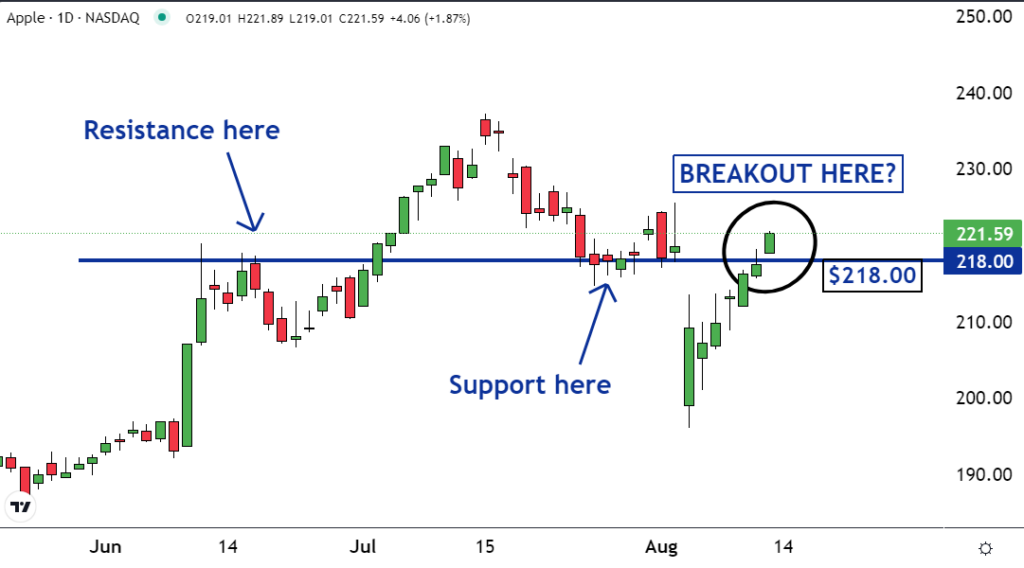

A glance at the charts reveals a breakout in Apple’s shares, signifying a significant move upwards and a breakthrough of crucial resistance levels.

Further Reading: Apple, Intel, And AMD Lead Charge In AI-Capable PC Market Surge: Report

Breakouts are not mere technicalities; they signify a crucial shift in market dynamics. The obliteration of the resistance indicates that sellers who held the line are now out of the way, having sold or withdrawn their orders.

With this selling pressure alleviated, a path seems cleared for an upward move. As new buyers enter the fray, they may find it challenging to secure shares due to the lack of willing sellers.

This imbalance could drive prices higher as buyers are forced to bid above prevailing levels, potentially setting Apple on a course for a new uptrend. Given its substantial weight of 7% in the S&P 500, such a move could have ripple effects across the entire market, ushering in a bullish sentiment.

The price obstacle at $218 holds significance, having served as a support level in late July. It is not uncommon for prior support levels to transform into resistance as buyers who once found solace in them now experience regret.

When a stock retraces to a former support level, remorseful buyers may resort to selling, creating a barrier to further upside movements.

Those who bought Apple at support and witnessed a decline below their entry points might be eager to exit their positions if a breakeven opportunity presents itself. Apple’s ability to sustain above this resistance could pave the way for broader market upswings.

Like an alpha dog leading its pack, Apple may assume the role of the alpha stock, guiding the rest of the market in its wake.

Related: Bear Market ‘Is Probably Coming’ In 2025, Veteran Investor Warns Of AI Bubble And Fed’s Insufficient Rate Cuts Amid Sluggish Economy

Image: Shutterstock