It was 27 years ago when the prodigal son of Silicon Valley, Steve Jobs, returned to the helm of Apple Inc. After enduring a 12-year exile, Jobs orchestrated a miraculous revival, rescuing the tech giant from the throes of bankruptcy and steering it to unprecedented heights of success.

Jobs’ visionary leadership not only revolutionized the music and smartphone industries but also propelled Apple into the echelons of the world’s most formidable technology companies. His legacy transcends mere corporate triumph, touching the lives of millions of loyal consumers globally.

A Grueling Journey Back to the Top

Steve Jobs faced monumental challenges during his tenure at Apple. Following an acrimonious departure in 1985, the company he co-founded saw him ousted by his own recruit, CEO John Sculley. Salvation arrived in the form of a timely lifeline from arch-rival Microsoft Corp. led by Bill Gates.

Jobs’ resurrection narrative involved a strategic acquisition of NeXT in 1996, culminating in his reinstatement as Apple’s interim CEO in 1997. Drawing inspiration from Nike’s marketing prowess, Jobs spearheaded a transformative restructuring of Apple’s operations.

His tenacious spirit and unparalleled creativity solidified his status as an indomitable legend within the tech sphere.

A Financial Odyssey: Apple’s Stock Soars

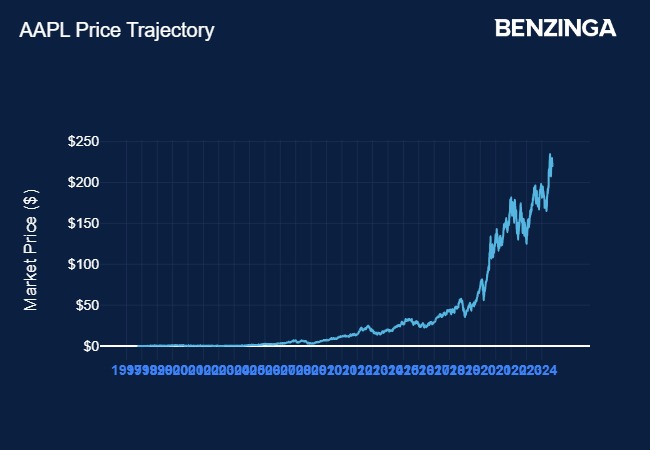

Since Jobs’ pivotal return in 1997, Apple’s stock has witnessed meteoric growth, symbolizing the company’s remarkable resurgence. Adjusted for stock splits and corporate actions, Apple’s stock price surged from $0.1958 on September 16, 1997, to $222.50 today—an astounding 113,536% increase.

An investment of $1,000 in Apple stock back in 1997 would have blossomed into a staggering $1.14 million today. Comparatively, the same investment in the Invesco QQQ ETF would yield $10,960, while the SPDR S&P 500 ETF Trust would amount to $5,928.

The Phoenix Rises: Jobs’ Vision and Apple’s Triumph

Steve Jobs’ renaissance at Apple stands as a testament to one of the most remarkable turnarounds in tech history. He inherited a fragmented product lineup devoid of inspiration, streamlined it ruthlessly, and introduced groundbreaking innovations such as the colorful Macs, iPod, iPhone, and iPad.

The iPhone, Apple’s magnum opus, remains the cornerstone of its success. In 2023 alone, it generated a staggering $200 billion in revenue—a figure surpassing the total revenue of many leading corporations.