- Nvidia briefly claimed the top spot as the most valuable company globally but was overtaken by tech conglomerates such as Microsoft and Apple.

- Amidst antitrust probes in Europe and potential penalties for its dominant market presence, Nvidia faces regulatory challenges.

- Despite these hurdles, analysts exhibit optimism, pointing to Nvidia’s robust financial standing and promising growth prospects.

Nvidia’s ascent in 2024 witnessed turbulence. Following a slight setback in April, the chipmaker skyrocketed to become the world’s most valuable company by market capitalization on June 18th.

Source: Investing.com

CEO Jensen Huang’s firm now confronts the task of reclaiming its former glory. Can Nvidia once again seize the crown of market capitalization?

Nvidia Navigates Antitrust Heat in Europe

France has complicated Nvidia’s trajectory with antitrust investigations, echoing issues encountered by tech behemoths like Apple, Microsoft, and Meta.

The European regulatory bodies are apprehensive about Nvidia’s dominant position in the graphics processing card (GPU) market, where it commands an 84% market share in competition with Intel and AMD. Here’s the twist: Nvidia’s GPUs currently lead in running generative AI systems, a sector with extensive future promise.

This scenario presents a dual-edged sword. While Nvidia offers top-tier products to consumers, it alerts regulators. Breaching European antitrust regulations could yield a substantial fine—potentially up to 10% of the annual global turnover, equating to about a $6 billion penalty based on Nvidia’s 2023 revenue.

Nvidia’s Financial Triumph Underpins Its Ascent

Nvidia’s stellar financial figures underscore its status as an unchallenged leader in today’s critical industry. The company reported $60.9 billion in revenues for 2023, a 125.9% surge year-over-year, with profits totaling $44.3 billion. This remarkable growth cements Nvidia’s strategic positioning and market supremacy.

Nvidia’s meteoric rise sharply contrasts with the tech bubble that propelled Cisco to the pinnacle in 2000, culminating in the dot-com crash. Unlike Cisco’s hype-driven downfall, leading to an 80% loss in value, Nvidia’s ascent is grounded in tangible outcomes and industry innovation. Initially skewed towards gaming enthusiasts, Nvidia has garnered widespread acclaim through its consistent performance and financial triumph, transcending mere brand recognition.

Analysts Rally Behind Nvidia’s Prospects

Market experts express confidence in Nvidia’s future. Morgan Stanley recently upped its stock target price from $116 to $144 per share, a 17.4% surge from the July 2 closure of $122.67. This “overweight” rating from Morgan Stanley resonates across many industry professionals, who view Nvidia’s shares as a strong buy.

Nvidia’s sustained growth and sturdy financial standing continue to lure investor trust, reinforcing its status as a pivotal player in the tech landscape.

Source: Investing.com: data as of July 3, 2024

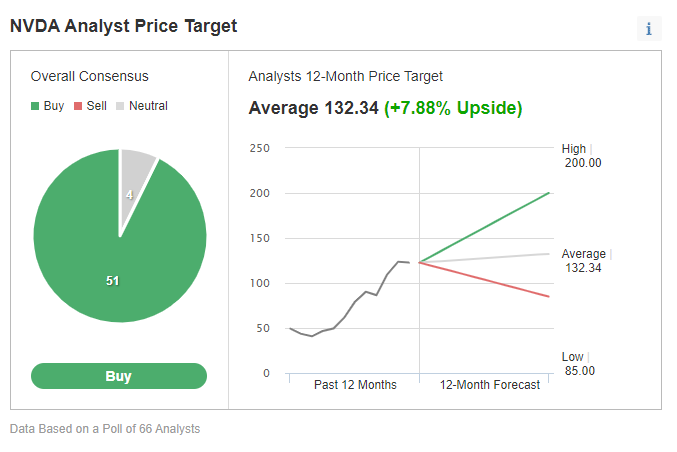

On average, analysts polled by InvestingPro peg Nvidia’s target price at $132.34 per share, a 7.88% improvement from the July 2 price. A total of 51 experts suggest a Buy rating for the stock, 4 label it as Hold, with none advising a sale.

Nvidia: Fairly Valued, Sustaining the Meteoric Surge

InvestingPro’s Fair Value assessment, grounded in 13 investment models, indicates Nvidia’s present price might already mirror its intrinsic value. The analysis forecasts a potential 6.6% decline. Yet, this metric frequently updates with fresh data, hinting that the company’s sound fundamentals justify its extensive $3 trillion market cap.

Source: InvestingPro

In simpler terms, Nvidia isn’t necessarily overvalued based on Fair Value scrutiny. However, after a rapid surge, it’s natural to experience consolidation phases as the stock readies for its next upswing.

All signals point to Nvidia’s robust financial health. The firm boasts a Piotroski score of 9, the highest accolade for financial robustness.

The Greatest Challenge: Meeting Its Own Success Bar

Arguably, Nvidia’s most significant uncertainty revolves around its explosive growth. According to Chris Metcalfe, IBOSS Asset Management’s chief investment officer, Nvidia has contributed a staggering 30% to the market’s returns this year. Essentially, Nvidia’s chief obstacle might not be French regulators but rather surpassing the exceptionally high standards it has established through its phenomenal performance.