Bitcoin, the pioneering cryptocurrency that birthed the digital asset craze, has had a wild journey.

Its ascent from obscurity to fame was swift, with prices skyrocketing by over 1,200 percent reaching US$69,044 in November 2021.

However, the rollercoaster ride of Bitcoin values was on full display as it plummeted to US$15,787 amidst economic uncertainty and negative media coverage the following year.

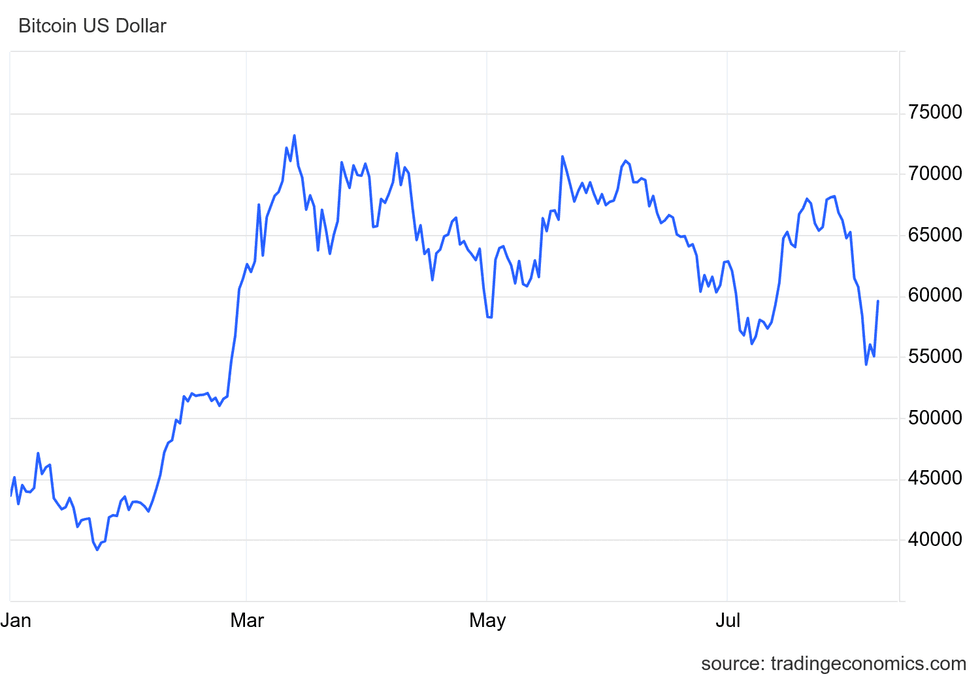

At the beginning of 2024, Bitcoin stood just under US$45,000, but the first half of the year saw impressive gains with Bitcoin hitting an all-time high of US$73,115 on March 11, 2024.

Now, let’s delve into where it all began and what has fueled Bitcoin’s price swings over the years.

The Modest Beginnings of Bitcoin

Bitcoin debuted in 2009 with a humble starting price of US$0.0009, laying the groundwork for its remarkable price trajectory.

Emerging in response to the 2008 financial crisis, Bitcoin’s inception via the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” by the elusive Satoshi Nakamoto set the stage for a revolutionary cyber-currency.

Its transparent, censorship-resistant design utilizing blockchain technology appealed to early adopters seeking to democratize finance post the 2008 collapse.

Notably, the Genesis Block, birthed on January 3, 2009, carried a poignant message critiquing bank bailouts, epitomizing Bitcoin’s anti-establishment ethos.

The first Bitcoin transaction in January 2009 paved the way for real-world value, with October 12, 2009, marking the first Bitcoin exchange.

The Evolution of Bitcoin’s Value

Serenko Natalia / Shutterstock

Bitcoin’s Ascendancy and Market Resilience

January 1, 2016, marked the beginning of Bitcoin’s uptrend, soaring from US$433 to US$989 by year-end, a 128 percent surge driven by mainstream adoption.

Amidst global tumult in 2016 – Brexit and Trump’s election – Bitcoin emerged as a “safe-haven” asset, gaining favor among investors seeking stability.

The allure of blockchain technology captivated tech and finance giants culminating in a US$60 million investment in blockchain firm Digital Asset Holdings elevating Bitcoin’s standing.

By May, Bitcoin’s value surged by 21 percent, closing the month at US$539, hinting at the cryptocurrency’s enduring market presence.

The Ebb and Flow of Bitcoin’s Market Influence

The Rollercoaster Journey

Bitcoin has been nothing short of a financial rollercoaster throughout its market journey. Starting with its surge to US$764 in June, the digital currency experienced dramatic fluctuations, dipping to US$517 in August, only to climb back up again. Microsoft and Bank of America Merrill Lynch’s partnership in September of the same year had minimal impact on Bitcoin’s price, but it continued on an upward trajectory. Ripple’s collaboration with 12 banks in October further boosted investor confidence, propelling Bitcoin from US$629 to US$736.

The Rise to Prominence

Bitcoin’s rise to fame continued into 2017, with its value skyrocketing from US$1,035.24 in January to an astounding US$18,940.57 by December. The introduction of futures contracts on the Chicago Mercantile Exchange in December 2017 marked a turning point, legitimizing Bitcoin as a viable investment. The market frenzy that ensued was fueled by media coverage of celebrity endorsements and initial coin offerings (ICOs).

The Test of Time

As regulators began to intervene in 2018, issuing warnings and guidelines to protect investors, Bitcoin emerged as the “gold standard” of cryptocurrencies, albeit with extreme volatility. The year 2019 saw Bitcoin valiantly weathering market storms, from a high of nearly US$13,000 in June to trading around US$7,200 by December.

What factors led to Bitcoin’s rise in the early 2020s?

The year 2020 posed a significant challenge for Bitcoin as a global selloff triggered by the pandemic caused its value to plummet by 30 percent in March. However, this downturn created a buying opportunity that spurred Bitcoin’s recovery, culminating in an impressive year-end value of US$29,402.64, a 323 percent increase from the previous year.

By contrast, gold, the star performer of 2020, saw a 38 percent increase from its March low to reach a record high of US$2,060 per ounce. In 2021, Bitcoin continued its ascent, reaching an all-time high of US$68,649.05 in November, driven by investor appetite for risk and increased money printing in response to the pandemic.

However, market uncertainties in 2022 shook Bitcoin’s value, leading to a significant dip below US$20,000 in the second quarter. The collapse of Terra Luna and the subsequent fallout in the cryptocurrency industry further eroded investor confidence, with Bitcoin plummeting to US$19,047 after Celsius network’s filing for bankruptcy in July.

The industry faced its biggest crisis yet in November 2022 when CoinDesk uncovered questionable practices at cryptocurrency trading firm Alameda Research, shaking investor trust and causing a liquidity crisis that reverberated throughout the digital asset market.

Bitcoin Price Experiences Volatility Amidst Sector Turbulence

Bitcoin’s Meteoric Rise and Fall

When Bitcoin peaked at an all-time high of US$73,737.94 on March 14, 2024, many celebrated its remarkable ascent. However, hindsight illustrates the tumultuous journey that led to this pinnacle. Bitcoin’s triumphant climb followed a turbulent period marked by sector scandals and regulatory crackdowns.

The Fallout of the FTX Scandal

Amidst the euphoria of Bitcoin’s record-breaking surge, the industry was rattled by the FTX scandal, involving money laundering and securities fraud. The aftermath of this debacle sent shockwaves across the sector, engendering a crisis of credibility and intense regulatory oversight.

The 2024 Bitcoin Halving and Price Fluctuations

Bitcoin’s price volatility was further amplified by the 2024 halving event, an occasion known to catalyze price surges. As the mining rewards were halved, Bitcoin’s price oscillated within a precarious range, leading to a series of fluctuations that mirrored the uncertainty engulfing the sector.

Bitcoin price chart via TradingEconomics.com.

Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.

Evolution of Bitcoin: From Speculation to Risk-Oriented Asset

In a landscape where traditional financial institutions embrace digital assets, Bitcoin has transitioned from a speculative anomaly to a “risk-on” asset. This metamorphosis underscores its growing influence on market sentiment, investor confidence, and broader economic conditions.

The Ongoing Saga: Bitcoin’s Rollercoaster Ride in Financial Markets

Bitcoin’s Price Swings Post Political Events

Following the unexpected events surrounding US political figures, Bitcoin experienced a tumultuous ride in the markets. The attempted assassination of former President Donald Trump and subsequent changes in political landscapes significantly impacted Bitcoin’s price trajectory. The crypto surged from US$57,899 to US$66,690 in response to perceived odds of a Trump victory, highlighting how regulatory uncertainty can swiftly influence market dynamics. Conversely, the withdrawal of current US President Joe Biden from the race showed no significant impact on Bitcoin’s price as Vice President Kamala Harris took the reins.

Market Volatility and Economic Turmoil

Additional developments, such as Ether ETF underperformance, fears of a US government Bitcoin sell-off, Trump’s proposed national Bitcoin stockpile, and fluctuating election prospects, have contributed to Bitcoin’s recent price volatility. The highest levels of market turbulence occurred in early August, triggered by a widespread economic scare that led to a substantial sell-off event across global markets and cryptocurrencies.

Bitcoin Price Update

As of August 8, Bitcoin was valued at US$59,490, showing signs of recovery from previous losses. The sell-off event on August 5, fueled by weak economic data and unexpected interest rate hikes in Japan, led Bitcoin to lose over 18% of its value within 24 hours. Despite this sharp decline, the market stabilized as investors gauged the long-term implications of the economic landscape.

Blockchain Technology and Investment Space

Blockchains, the cornerstone of digital currency transactions, continue to expand in various sectors such as banking, cybersecurity, supply chain management, and healthcare. Its decentralized nature and chronological recording of completed blocks have made it a sought-after investment avenue with diverse applications.

Insights on Bitcoin Halving

Bitcoin’s finite nature, with only 21 million in existence and a current circulation of 19,787,175, underscores its anti-inflationary design. The process of halving, which occurs every four years and reduces new coin issuance by half, maintains scarcity and bolsters the cryptocurrency’s value. The next halving, anticipated in 2028, will significantly impact mining activity and supply dynamics in the Bitcoin ecosystem.

Crypto’s Influence on Banking Sector

Cryptocurrencies offer an alternative to traditional banking systems, attracting individuals seeking assets beyond mainstream domains. With 53% of crypto owners aged between 18 and 34, the industry is capturing the interest of younger demographics embracing decentralized digital solutions. Privacy and autonomy from central authorities are key draws for crypto enthusiasts seeking financial independence.

The Evolution of Cryptocurrencies and Bitcoin Investments

Unveiling the Ripple Effect in Banking

Cryptocurrencies, with their swift and fee-lean transactions, have been turning traditional banking systems on their head. Transactions now move through the financial sphere with the grace and speed of a gymnast, leaving behind a slimmer trail of associated fees.

Is Bitcoin Still a Golden Opportunity?

2024 witnessed soaring heights for Bitcoin, yet its inherent volatility remains a poignant characteristic. For the intrepid investor ready to brave the tumultuous waters, the cryptocurrency frontier still presents a promise of riches, indicated by Bitcoin’s recent resurgence following a notable plunge in 2022. However, caution reins the hearts of more risk-averse investors, nudging their gaze towards steadier investment avenues.

Curious minds may ponder, is now truly the propitious moment to delve into the world of Bitcoin investments? Dive into the depths of this inquiry with our publication, Is Now a Good Time to Buy Bitcoin?

Unmasking the Dominators of the Bitcoin Realm

Folklore spins tales of Satoshi Nakamoto, the enigmatic progenitor of Bitcoin, rumored to hold the leading stake in this digital asset. Investigations into the early Bitcoin coffers unveiled Nakamoto’s potential ownership of over 1 million tokens among the near 19.5 million Bitcoins in circulation.

The Enigmatic Stance of Elon Musk

Ambassador to both the Bitcoin realm and the whimsical Dogecoin, Elon Musk’s magnetic association with cryptocurrencies is well-documented. Through the ripples of his tweets and Tesla’s maneuvers, the trajectories of these digital currencies sway and dip.

Intriguingly, it remains a mystery to ascertain the extent of Musk’s Bitcoin bounty. Nonetheless, he has openly acknowledged holdings in Bitcoin, Dogecoin, and Ether. Whispers in the wind suggest Musk’s covert backing of Dogecoin unveiled in a Forbes expose from September 2023.

Peering into Tesla’s foray into the crypto dimension, the company’s notable acquisition of US$1.5 billion Bitcoin in 2021 reverberated across the industry. However, a swift divestment of 75% in the succedent year painted a cautious picture. As of February 2024, the electric vehicle colossus hoarded an estimated 9,720 Bitcoins, securing a place as one of the largest Bitcoin holders among publicly-traded entities.

Notably, Musk’s astute declaration in a January 2024 social media post cast light on his considerable holdings in both Dogecoin and Bitcoin, mentioning, “I still own a bunch of Dogecoin, and SpaceX owns a bunch of Bitcoin.”

This riveting narrative revisits an article by the Investing News Network from its inception in 2021.

Stay tuned for real-time updates by following us @INN_Technology!

Securities Disclosure: You won’t catch Meagen Seatter with any investments in the companies featured in this work.