The Visionary Stocks

Exploring the healthcare sector reveals two compelling stocks on the rise as earnings season approaches: Alcon and Prestige Consumer Healthcare are poised for growth as they gear up to announce their quarterly results on Tuesday, May 14.

Alcon: An Eye on Expansion

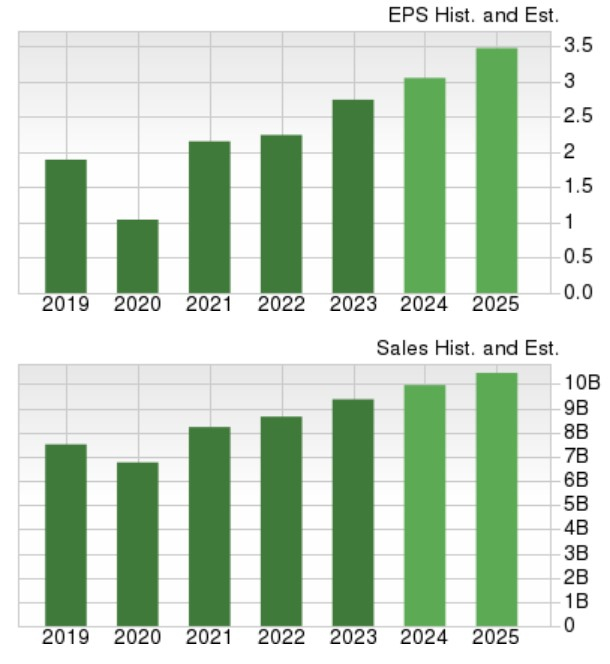

Alcon specializes in providing a diverse range of eye care products, catering to various eye surgeries and offering a comprehensive portfolio of ocular health products. Projections indicate a 5% increase in first-quarter sales to $2.46 billion, with earnings expected to rise by 3% to $0.72 per share. Alcon has a history of outperforming expectations, with recent fourth-quarter earnings surpassing estimates by 3% in February.

Image Source: Zacks Investment Research

Prestige: Setting the Bar High

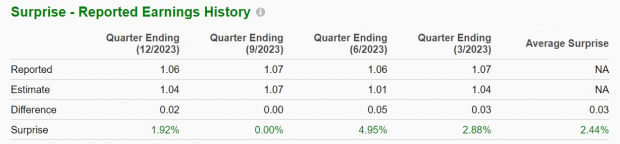

Prestige Consumer Healthcare boasts an array of over-the-counter (OTC) products under its subsidiaries, with notable brands like BC/Goody’s analgesic powders and Boudreaux’s baby ointments. Anticipated results for the fourth quarter point to a slight increase in sales to $286.91 million alongside a projected 6% jump in EPS to $1.14. Similar to Alcon, Prestige has a track record of exceeding earnings expectations, with third-quarter EPS exceeding estimates by 2% in February.

Image Source: Zacks Investment Research

On the Growth Trajectory

Alcon’s growth trajectory looks promising, with total sales expected to increase by 6% in fiscal 2024 and further expanding by 6% to $10.56 billion in FY25. Earnings forecasts suggest an 11% jump this year to $3.05 per share, with an additional 14% growth projected in FY25. As for Prestige, sales are seen to remain stable in FY24 but are projected to climb 2% in FY25 to $1.16 billion. Annual earnings for Prestige are slated to rise by 3% this year and are expected to grow by another 6% in FY25 to $4.61 per share.

Image Source: Zacks Investment Research

Key Takeaway

Investors should not ignore the robust growth potential of both Alcon and Prestige Consumer Healthcare. With a Zacks Rank #2 (Buy) designation, these stocks are worth considering as they head into their upcoming quarterly earnings reports.