Nvidia’s Journey to Dominance in AI

Witness the remarkable ascension of Nvidia, a company that, like a phoenix rising from the ashes of the tech world, has transformed itself from a humble designer of graphics-processing-units used in video games to a colossus in the artificial intelligence (AI) landscape.

Founded in 1993, Nvidia’s initial foray into GPUs back in 1999 marked a turning point in graphical performance. However, it was the strategic shift towards data center GPUs in the early 2010s that catalyzed the company’s meteoric rise.

The Impact of Cloud Technologies on Nvidia’s Growth

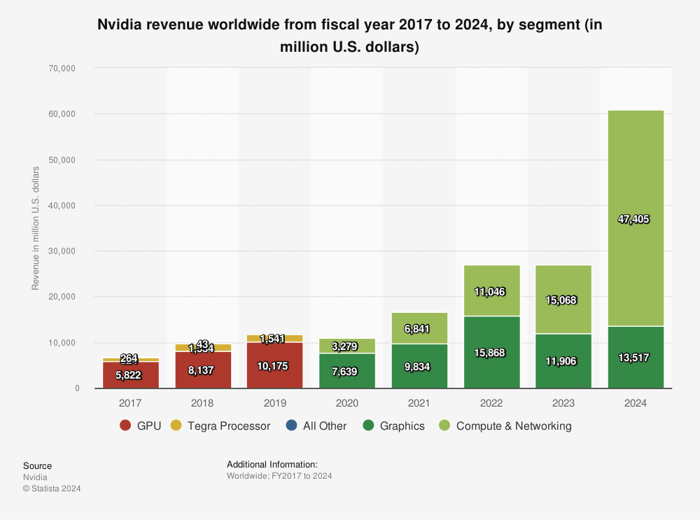

By focusing on designing GPUs tailored for data centers, Nvidia tapped into the burgeoning world of cloud technology. As a result, its compute and networking segment emerged as the primary revenue driver, setting the stage for exponential growth in subsequent years.

Amidst the expanding universe of large-scale AI operations reliant on cloud infrastructure, Nvidia’s cutting-edge processors have emerged as the bedrock supporting the AI revolution, commanding a formidable 90% share of the market for advanced GPUs central to AI and accelerated computing applications.

Market Domination and Soaring Performance

The combination of surging demand for AI technologies and Nvidia’s technological prowess has propelled the company’s sales, earnings, and share price to unprecedented heights. With a market capitalization soaring to approximately $1.96 trillion, Nvidia now stands as one of the world’s most valuable companies, symbolizing its unrivaled dominance in the industry.

As we reflect on Nvidia’s path to success, it beckons us to ponder the sheer magnitude of its transformation, reminiscent of legendary tales of reinvention and growth in the annals of business history.

Source: Statista.

As Nvidia continues its upward trajectory, investors are left to wonder if this remarkable growth story will endure or if new challengers will emerge to reshape the landscape of AI and computing technologies in the years to come.