Lundin Mining Corp LUNMF shares were climbing in early trading on Wednesday.

The company is a stalwart, boasting robust cash flows in the immediate future, yet harboring a deeper link to copper prices in the long haul, as per insights from BMO Capital Markets.

The Luminary Analyst: Jackie Przybylowski has notched up Lundin Mining from Market Perform to Outperform, simultaneously hiking the price target from $12 Canadian dollars ($8.83) to CA$16 ($11.78).

The Positive Outlook: The firm now finds itself in a fortuitous position post Tenke stake sale, bolstered by stable operations and a substantial NCIB, asserts Przybylowski in the elevation declaration.

Turning the page on operational hurdles, Lundin Mining’s assets are primed for unwavering production, poised to yield robust cash inflows come 2024, cautions the analyst.

“Embracing Josemaria and Caserones into its fold between 2021 and 2023 has armed the company with burgeoning opportunities for growth,” penned Przybylowski, hinting at Lundin Mining’s fortuitous standing for future copper price explorations via the unfolding of premier growth prospects nestling within the industry’s new era.

LUNMF Price Movements: Following suit, Lundin Mining shares had escalated by 1.86% to $9.85 at the time of print on Wednesday.

Read Next: ‘Time To Buy’ Apple Stock, Says Expert: ‘Out Of All Mag 7 Stocks, After Maybe Tesla, Apple Is Currently The Most Hated’

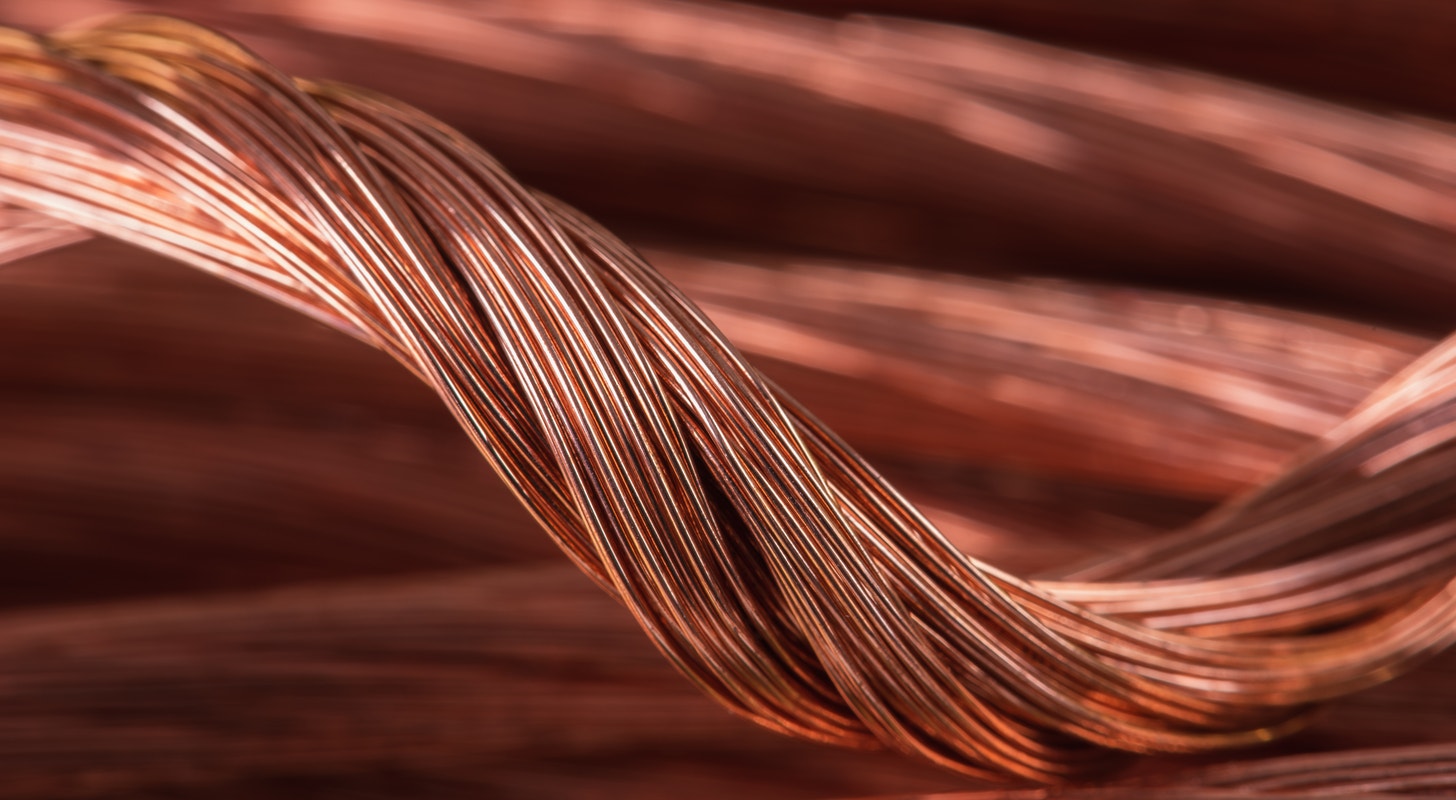

Photo: Shutterstock