Ford Motor Company in the Investor Spotlight

Ford Motor Company (F) has found itself under the watchful gaze of Zacks.com visitors lately. The recent rollercoaster ride of its stock price prompts a closer look into the various dynamics that could potentially sway the company’s future fortunes.

Over the past month, Ford Motor’s shares have stumbled by -13.7%, contrasting sharply with the mere +0.1% change in the Zacks S&P 500 composite. In the same period, the Zacks Automotive – Domestic industry, to which Ford Motor belongs, has seen a robust increase of 11.9%. Now, the burning question is: which way will the wind blow for this automotive giant?

Unmasking Earnings Estimate Revisions

When it comes to assessing a company’s trajectory, Zacks firmly places its bet on scrutinizing shifts in earnings forecasts. The underlying principle here is that a firm’s stock value hinges on the present worth of its forthcoming earnings stream. The ebb and flow of how analysts recalibrate earnings projections in response to prevailing market trends plays a vital role in this evaluation. An upwards revision in earnings estimates acts as a magnet, pulling the stock’s fair value above its current market price, stirring investor enthusiasm, and propelling the price trajectory upwards. Studies stand witness to the strong link between earnings estimate trends and immediate stock price shifts.

Forecasts indicate that Ford Motor is poised to announce earnings of $0.50 per share for the current quarter, denoting a ritzy year-over-year surge of +28.2%. Over the past 30 days, the Zacks Consensus Estimate has nudged upwards by +5.7%.

As for the full fiscal year, the average earnings forecast clocks in at $1.94, signaling a downturn of -3.5% from the previous year. This estimate has endured a -3.9% modification over the past month.

Looking towards the subsequent fiscal year, the consensus earnings projection of $1.98 points to a modest uptick of +1.8% from Ford Motor’s previous fiscal report. Recent trends reveal a -2.2% adjustment in the estimate within the last month.

The credibility of Zacks’ stock rating tool – the Zacks Rank – shines through its reliability, bolstered by a rigorous external audit. By nimbly integrating the pulse of earnings estimate revisions, the tool dishes out a Zacks Rank #3 (Hold) for Ford Motor, reflecting the recent consensus estimate dynamics alongside three other components linked to earnings prognostications.

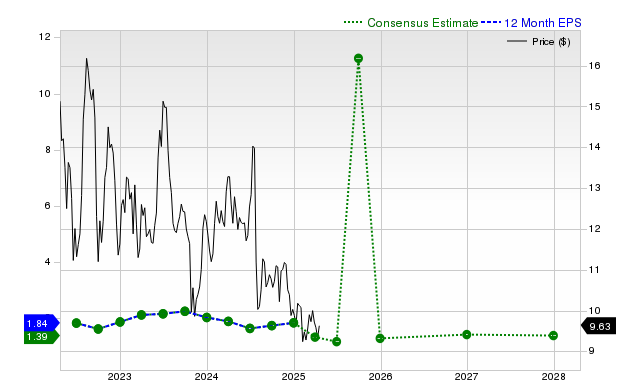

The following chart traces the journey of the company’s 12-month forward consensus EPS estimate:

12 Month EPS

Gauging Projected Revenue Growth

Though earnings surge might paint a rosy picture, the lifeline of any business orbits around revenue growth. Without this vital ingredient, sustaining profits becomes an uphill climb. This is akin to a delicious dish missing its essential seasoning – it just won’t taste the same. Thus, a close eye on a company’s revenue growth trajectory is paramount.

For Ford Motor, the predicted sales tally for the current quarter stands at $40.97 billion, hinting at a slim year-over-year drop of -0.5%. As for the ongoing and forthcoming fiscal years, revenue estimates portend +3.3% and -1.3% fluctuation, pegged at $171.47 billion and $169.25 billion, respectively.

Unveiling Financial Results and Track Record

In the latest quarterly report, Ford Motor flaunted revenues hitting $44.81 billion, marking a sprightly year-over-year upsurge of +5.6%. On the earnings front, an EPS of $0.47 was clocked for the same period, contrasting with the $0.72 from a year before.

Exceeding expectations, the reported revenue outpaced the Zacks Consensus Estimate by a zesty +7.97%, while the EPS surprise played contrarian at -26.56%. Ford Motor has impressively surpassed consensus EPS projections in two of the past four quarters, beating revenue forecasts thrice in the same period.

The Yardstick of Valuation

Conducting an investment analysis sans appraising a stock’s valuation is akin to navigating uncharted waters without a compass. Peering into a stock’s valuation metrics – such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) among others – sheds light on whether the current stock price mirrors the company’s intrinsic status and growth potential accurately. By juxtaposing a company’s historical valuation with its present standing, one can decipher if the stock stands at par, overvalued, or undervalued. A comparative evaluation against industry peers on these metrics is equally critical in gaining a panoramic view of a stock’s pricing.

Under the Zacks Value Style Score system, Ford Motor scoops an A grade, signaling that it is trading at a discount relative to its peers. This assessment underscores the company’s value proposition within its competitive landscape.

In Conclusion

Engaging with the data points discussed and other pertinent material on Zacks.com should equip investors with a clearer compass amidst the cacophony surrounding Ford Motor. Whereas the Zacks Rank #3 suggests the company might tread in sync with the broader market in the short haul, it certainly doesn’t hurt to ponder the finer details before jumping on the bandwagon.

A leap of +10-20% in a day on the back of positive earnings reports spells the dream scenario for investors. Fortune might just favor the prepared, so why not dive into Zacks’ exclusive report spotlighting 5 potential stocks set to outperform earnings projections? The sign-up is on the house!