Vail Resorts, Inc. MTN is carving a path through the financial wilderness with a robust season pass program and savvy business maneuvers, including mountain resort upgrades and digital facelifts.

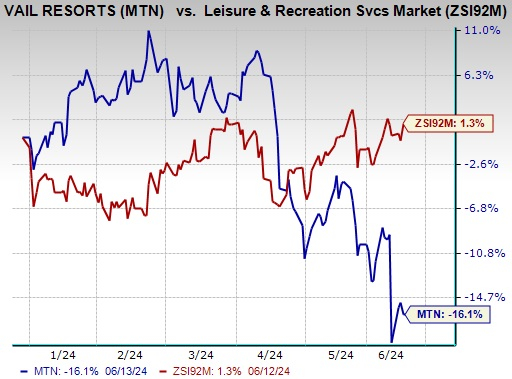

Despite the company being labeled as Zacks Rank #3 (Hold), MTN’s shares have tumbled 16.1% year-to-date, a stark contrast to the mere 1.3% growth seen in the Zacks Leisure and Recreation Services industry.

MTN is facing a slippery slope marked by declining visitor numbers, rising expenses, and challenging weather conditions. As a business deeply intertwined with winter seasons, Vail Resorts found the frosty winds blowing against its fiscal sails in the third quarter of 2024.

Image Source: Zacks Investment Research

Let’s hit the slopes.

Accelerators of Growth

A Season Pass Program in Full Swing: Vail Resorts has been confidently cruising with its season pass program, offering an array of pass products across all mountain resorts and urban ski havens in domestic and global markets. The company highlighted a stellar 62% surge in pass product sales for the 2023/2024 North American ski season during the recent fiscal third-quarter earnings call, with sales dollars up by a notable 43% over the past three years. Moreover, pass product pricing saw a 25% uptick through spring 2024.

The forecast for the upcoming 2024/25 North American ski season is looking promising, with a reported approximately 1% increase in pass product sales dollars compared to the same period last year.

Strategic Tweaks: The strategic maneuvers of Vail Resorts are in full swing, with substantial investments in resort upgrades and digital finetuning to steer customer traffic. Upgrades such as a fresh six-person high-speed lift at Whistler Blackcomb, accompanied by additional lift enhancements at Hunter Mountain, underscore the company’s commitment to enhancing guest experiences. Not to be outdone, plans for a new 10-person gondola at Park City in 2025, in partnership with the Canyons Village Management Association, promise improved access and overall guest satisfaction.

Digital enhancements have also been on the rise, with the launch of the My Epic app in the fiscal first quarter. Boasting features like Mobile Pass, interactive trail maps, and real-time lift line wait times, this digital companion has elevated the guest experience. The recent addition of Direct to Lift Benefit Tickets proved valuable during the 2023/2024 North American ski season and is primed to boost the incoming season of 2024/25.

Impediments to Progress

Eroding Visitor Trends: Vail Resorts’ North American bases have seen a decline in visitor footfall due to unfavorable conditions over an extended period. The dip from both previous years’ figures and the company’s initial expectations based on guest numbers indicates a rough patch. During the fiscal third quarter of the 2023/2024 North American and European ski season, total skier visitation plummeted by 7.7% compared to the same period in the fiscal year 2023. Contributing factors include adverse conditions and a broader industry shift post-COVID, following a record-high visitation in the United States during the 2022/2023 ski season. Particularly impacted were skier visitations from lift ticket guests, which saw a significant 17% decline.

Weather-Induced Perils: Vail Resorts finds itself at the mercy of fickle weather patterns, particularly during winter seasons when its operations are most active. A tough winter season was highlighted during the recent fiscal third-quarter earnings call, revealing a staggering 28% decrease in snowfall across its Western North American resorts compared to the previous year. Additionally, the Eastern U.S. resorts, including Midwest, Mid-Atlantic, and Northeast regions, faced challenges with limited natural snow and fluctuating temperatures. These weather woes translated to a decline in skier visits, ultimately denting the company’s revenue stream.

Rising Costs: To navigate the storm of challenges, Vail Resorts has been investing strategically in resort upgrades, which come with a hefty price tag. The introduction of new high-speed lifts, coupled with expanded snowmaking systems and digital enhancements like the My Epic app, have inflated the company’s expenses. Total operating expenses for the fiscal third quarter surged to $631.1 million from $616.7 million in the prior year. The rise can be attributed to increased operating expenses in the Mountain and Lodging segments, along with elevated general and administrative costs and variable expenses linked to rising revenues.

Top Picks

Here are some promising stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA, currently holding a Zacks Rank #1 (Strong Buy), has been a standout performer with a trailing four-quarter earnings surprise of 36.2% on average. The stock has soared by 43.9% in the past year, and the future looks bright with forecasts indicating a 6.4% increase in 2024 sales and a 33.3% surge in earnings per share (EPS) compared to the previous year.

Netflix, Inc. NFLX boasts a Zacks Rank of 1 and a trailing four-quarter earnings surprise of 9.3%. The stock has seen a 47.2% growth in the past year, with 2024 sales and EPS estimated to rise by 14.8% and 52.2%, respectively, from the year before.

Royal Caribbean Cruises Ltd. RCL is another top contender, holding a Zacks Rank of 1 with an 18.3% average trailing four-quarter earnings surprise. The stock has surged by 62.9% over the past year, and the 2024 sales and EPS forecasts reflect a growth of 16.8% and 63.8%, respectively.

These stocks promise a thrilling ride, akin to riding the winning wave of a presidential election year. Don’t hesitate to grab a pair of binoculars and spot these potential gems before the day of reckoning.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.