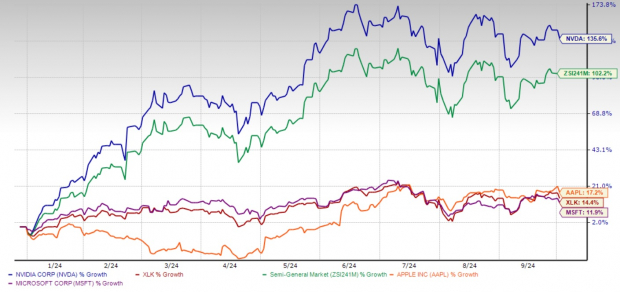

NVIDIA Corporation NVDA finds itself in a meteoric rise in 2024, with its stock soaring 135.6% year to date (YTD). This exceptional rally has elevated NVIDIA to the pinnacle of success in the semiconductor realm, overshadowing both the Zacks Semiconductor – General industry and The Technology Select Sector SPDR Fund XLK ETF, which recorded gains of 102.2% and 14.4% respectively.

As of the latest closing price, NVIDIA boasts a market capitalization of $2.87 trillion, making it the third most valuable publicly traded U.S. company, trailing only tech behemoths Apple Inc. AAPL and Microsoft Corporation MSFT. While Apple and Microsoft have delivered YTD gains of 17.2% and 11.9% respectively, NVIDIA has significantly outpaced them, underlining its robust position in the technology domain.

Amid this ascendancy, the burning question on many investors’ minds is whether NVIDIA stock still holds potential for growth or if it has reached its zenith.

Performance Surge in 2024

Image Source: Zacks Investment Research

Factors Propelling NVIDIA’s Continued Growth

NVIDIA’s stellar stock upsurge stems from its dominance in the rapidly expanding arena of artificial intelligence (AI), particularly in generative AI. The market’s anticipation of NVIDIA reaping substantial benefits from the rising AI investments has been the driving force behind this momentum. With enterprises spanning diverse sectors gearing up to modernize their workflows, the demand for generative AI applications is projected to soar. Estimates from Fortune Business Insights project the global generative AI market to hit $967.6 billion by 2032, expanding at a compound annual growth rate (CAGR) of 39.6% from 2024 to 2032.

This anticipated AI growth necessitates significant computational power, an arena where NVIDIA’s high-performance chips reign supreme. Already an integral component in AI models, NVIDIA’s graphic processing units (GPUs) are poised to meet the escalating need for upgraded network infrastructure as businesses delve deeper into AI investments. Armed with next-gen chips renowned for their potent computing prowess, NVIDIA is poised to emerge as the preferred choice for enterprises eyeing AI adoption.

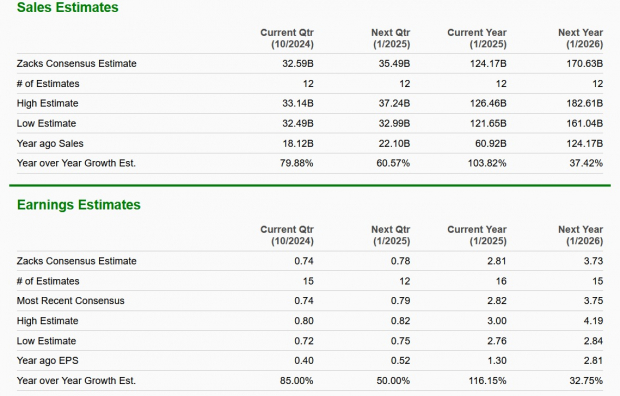

Projections for NVIDIA’s third-quarter fiscal 2025 revenues stand at $32.5 billion, a substantial leap from the $18.12 billion reported in the corresponding quarter last year. Such exponential revenue growth underscores the pivotal role NVIDIA’s technology plays in the AI landscape, solidifying its position as a key player in the semiconductor industry.

Beyond AI, NVIDIA’s influence extends to other sectors like automotive, healthcare, and manufacturing, catalyzing innovation in areas such as autonomous vehicles and medical diagnostics. With the growing demand for advanced computing solutions, NVIDIA is set to capitalize on these burgeoning trends, securing sustained growth.

Robust Financial Standing and Rosy Outlook

NVIDIA’s financial performance has been nothing short of stellar. In its second-quarter fiscal 2025 report, the company reported an astounding 122% year-over-year surge in revenues, complemented by a 152% spike in non-GAAP earnings per share (EPS). These robust financial figures underscore NVIDIA’s ability to consistently deliver exceptional results, even amidst cut-throat competition.

The Zacks Consensus Estimate for NVIDIA’s fiscal 2025 and 2026 earnings paints a promising trajectory, reflecting faith in the company’s capacity to maintain its leadership across gaming, data centers, automotive, and professional visualization sectors.

Image Source: Zacks Investment Research

NVIDIA’s financial stability is a lighthouse in stormy seas. As of July 28, 2024, the company boasted cash and cash equivalents of $34.8 billion, an increase from $31.44 billion in April 2024. This robust cash reserve not only shields NVIDIA from market volatility but also empowers it to invest in future growth prospects.

Debunking the Overvaluation Myth

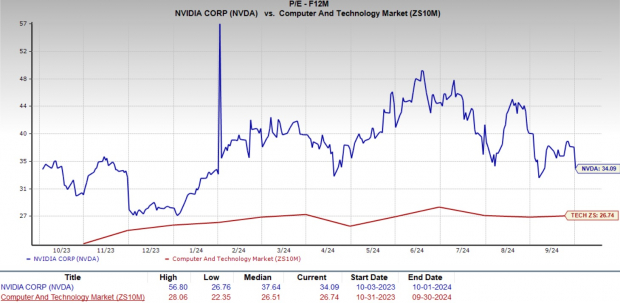

While NVIDIA’s impressive performance might raise eyebrows regarding its valuation, a deeper look reveals a different story. Currently trading at a one-year forward price-to-earnings (P/E) ratio of 34.09, NVIDIA might seem pricier than the Zacks Computer and Technology sector’s forward P/E multiple of 26.74X. Yet, this premium is warranted, given NVIDIA’s consistent financial excellence and vast growth potential in nascent domains like AI and autonomous vehicles.

Image Source: Zacks Investment Research

Moreover, NVIDIA isn’t merely a chipmaker; it leads the charge in developing the essential infrastructure for AI applications. This competitive edge cements NVIDIA’s position as AI continues reshaping industries, vindicating the company’s higher valuation.

Verdict: Invest in NVIDIA Stock Now

Despite NVIDIA’s staggering 136% surge this year, the growth narrative remains far from its climax. The company’s dominion in the AI and semiconductor spheres, coupled with its stellar financial performance and widening market footprint, signals ample room for continued expansion. For investors eyeing the AI revolution and NVIDIA’s strategic leadership, this stock continues to present an enticing opportunity.

NVIDIA currently holds a Zacks Rank #2 (Buy) and sports a VGM Score of B. Our studies affirm that stocks with a VGM Score of A or B, when paired with a Zacks Rank #1 (Strong Buy) or #2, offer optimal investment prospects for investors. NVDA stock emerges as a compelling investment avenue at present.