Starbucks is in the midst of a financial tempest, shedding $23.2 billion in market value since the dawn of the new year. The storm reached a crescendo on April 30th following the unveiling of the coffee giant’s Q2 2024 earnings report.

Amidst a turbulent sea where the company navigates, posting a year-to-date plummet of 19%, investors are left pondering – is this the perfect storm to dive into Starbucks stock or a sign of darker days ahead?

The Bitter Taste of Starbucks’ Decline in Sales

By the closing of March 31st, 2024, Starbucks unveiled a harsh truth – a 4% dip in global comparable store sales. Consolidated net revenue sounded a mournful note at $8.6 billion, a 2% downturn from the year before. Rachel Ruggeri, Starbucks’ chief financial officer, chalked this up to a “complex and dynamic environment.”

On home soil, North America witnessed a 6% plunge in operating income to $1.1 billion compared to the previous year. The net earnings symphony played a somber tune as well, dipping to $772.4 million from $908.3 million in Q2 2023. Noteworthy, Starbucks doubled down on stock buybacks during this quarter, marching to $1.26 billion versus $479.3 million previously.

These melodies resonated with the symphony of cash dividends amounting to $1.29 billion. Echoes of the recent Apple saga, where stock buybacks proved a pivotal instrument in fostering investor trust, are still fresh in memory.

Peeking Behind the Starbucks’ Counter: Are the Fundamentals Frothy?

As a provider of joy in a cup, Starbucks teeters low on the hierarchy of human necessities. Hinging on brand allure and in-store ambiance, Starbucks waltzes on the same stage as Apple, captivating patrons with an experience to savor.

For those who find little solace in Starbucks’ hospitality, a pilgrimage to the discount emporium, Costco, might prove more rewarding. Costco (NASDAQ: COST) was held aloft in January, soaring from $657 to $787 per share in contrast to Starbucks’ descent from $93 to $75 per share.

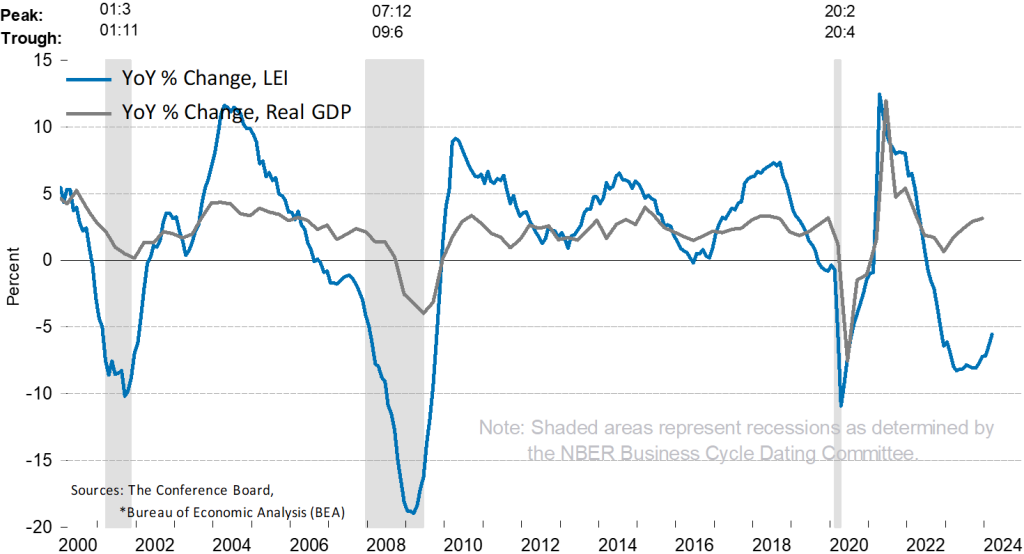

Mounting inflation pressures have molded spenders into vigilant savers. The San Francisco Federal Reserve unveiled that the well of pandemic-era excess savings has run dry, sinking from $2.1 trillion in August 2021 to a deficit of $72 billion by March 2024. The specter of an unrecognized U.S. recession looms, though the updated mid-April Conference Board Leading Economic Index (LEI) suggests a silver lining of recovery.

Yet, stepping into the realm of electoral chaos, the verity of economic data hangs by a thread. Federal Reserve Governor Christopher Waller laments the tumult of economic revisions, complicating sagacious monetary policymaking.