Wall Street analysts are like springtime weather forecasters – their predictions might influence your fashion choices for the day, but do they really determine the path of the sun? Investors, much like skeptical picnickers, are wise to take these recommendations with a grain of salt before spreading out their checkered blanket on the trading floor.

Before we dive into how to parse these analysts’ words and the value they hold, let’s explore the buzzing hive of activity surrounding Cameco (CCJ).

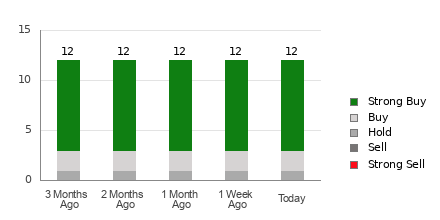

Cameco currently finds itself nestled between a rock and a hard place, boasting an average brokerage recommendation (ABR) of 1.33. While numbers don’t lie, it’s essential to remember that this rating is molded by the 12 brokerage firms’ diverse opinions, ranging from a Strong Buy to a Strong Sell. ABR of 1.33 – not quite Strong Buy, not quite Buy – sits snugly in the middle.

Of the 12 voices blended into this rating concoction, the choir sings nine tunes of Strong Buy and two of Buy. Strong Buy hits a high note, resonating through 75% of the recommendations, while Buy hums along at 16.7%.

Deciphering the Trendy World of Brokerage Recommendations in CCJ

How do these recommendations stack up for a stock aficionado contemplating a CCJ venture? While the stars seem to align in favor of buying Cameco, remember that blindly following these predictions could be akin to gambling your picnic blanket on an unpredictable breeze.

Numerous studies have shown that brokerage recommendations often resemble overly enthusiastic tour guides, leading you toward gift shops instead of hidden scenic spots. Think of it this way – for every “Strong Sell” whispered in a hush, brokerage firms shower five “Strong Buy” confetti cannons.

In this whirlwind of tips and tricks, one oasis stands out – the Zacks Rank, a beacon of hope in the desert of financial uncertainty. Unlike a mirage, this tool uses a proven methodology to sift stocks into five categories, revealing their shimmering potential, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell).

Contrasting ABR with the Illustrious Zacks Rank

Numbers don’t tell the whole tale – ABR and Zacks Rank may share a numerical scale, yet they dance to entirely different drumbeats.

ABR draws its power solely from broker recommendations, painting decimal landscapes (1.28 and the like). On the flip side, Zacks Rank harnesses the wind of earnings estimate revisions, displaying its verdict in whole numbers, creating a clear sky amid the forecasting clouds.

While brokerage analysts often bring forth sunny days in their ratings, the Zacks Rank carries the weight of empirical evidence – a sturdy umbrella against market storms, grounded in the reality of earnings. The correlation between earnings estimate revisions and stock price movement is a tune well-remembered by the Zacks Rank symphony.

Unlike a painting frozen in time, the Zacks Rank flows like a river, swiftly responding to the changing tides of earnings estimates. While the ABR might resemble a dusty road atlas, the Zacks Rank shines like a GPS, guiding you through the uncharted territory of stock investments.

Unpacking the Investment Puzzle of CCJ

Pulling back the curtain on Cameco reveals a Zacks Consensus Estimate for the current year, dropping 2.5% over a single month to $1.35. A gloomy shadow looms over the company’s earnings prospects, casting doubt on the stock’s trajectory in the near future.

Analysts, like worried seers, foresee stormy weather ahead, united in their revision of EPS estimates downward. The Zacks Rank, wielding its analytical sword, has deemed Cameco worthy of a #4 (Sell) label, a red flag fluttering on the forecasted horizon.

Given this meteorological forecast for CCJ, perhaps it’s wise to take the Buy-equivalent ABR with a pinch of skepticism, keeping your picnic plans flexible in the face of uncertain weather.

Remember, financial forecasts are akin to weather predictions – just because the weatherman predicts rain doesn’t mean you’ll see a drizzle. So, take these recommendations with a dose of skepticism, and remember to bring your umbrella.