The Zacks Rank Unveiled

Stocks that ride the wave of rising earnings estimates have consistently outshone the S&P 500 year after year. Contrastingly, stocks tethered to dwindling earnings estimates have languished beneath the S&P 500’s soaring heights.

Enter the Zacks Rank.

Flickering like a lighthouse on a stormy night, the Zacks Rank illuminates the murky waters of the stock market, guiding traders towards the promising shores of profitability. Offering solace and profitability, it stands as a guiding star regardless of one’s trading persona or risk appetite.

Employing a complex alchemy of four factors intricately linked to earnings estimates, the Zacks Rank sorts stocks into five distinct categories ranging from ‘Strong Buy’ to ‘Strong Sell.’ This unique classification system extends a helping hand to individual investors, allowing them to seize the essence of the shifting tides in earnings estimate revisions and bask in the brilliance of institutional investors.

Zacks Rank in Action: Illuminating Stocks

NVIDIA Unveiled

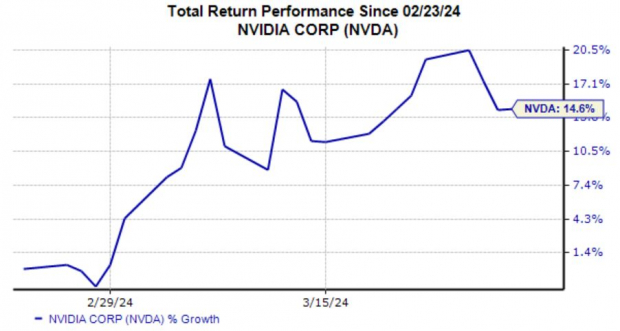

Like a phoenix rising from the ashes, NVIDIA has ridden the swirling winds of the AI frenzy to dizzying heights. Witnessing a meteoric ascent in tandem with earnings estimate revisions, the stock soared back into a Zacks Rank #1 (Strong Buy) on Feb. 23rd. Since then, NVIDIA shares have surged by a robust 15% in value.

Image Source: Zacks Investment Research

Blossoming like a rare orchid, NVIDIA reported a standout Q4 revenue of $22.1 billion, marking a jaw-dropping 409% year-over-year leap fueled by insatiable demand for AI chips.

Progressive Rising

Progressive has been on a winning streak, outpacing expectations with consistently stellar quarterly results. Carrying the esteemed Zacks Rank #1 (Strong Buy) badge, the stock has surged by an impressive 15%.

Image Source: Zacks Investment Research

Cementing itself as a beacon for growth-focused investors, Progressive showcases consensus projections for FY24, hinting at a robust 60% earnings surge on a 15% sales elevation. Looking further into the horizon of FY25, an additional 12.5% earnings growth is anticipated along with nearly 13% higher sales.

HCA Healthcare Ascending

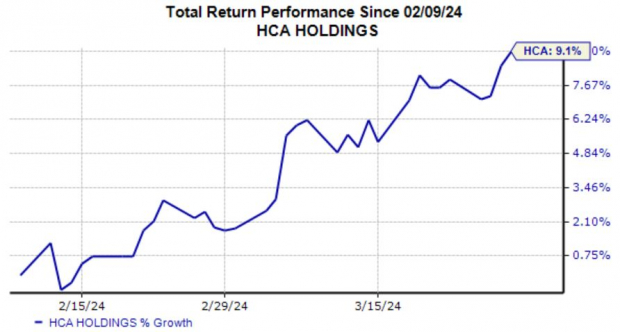

Basking in the glow of positive earnings estimate revisions spanning multiple timeframes, HCA Healthcare ascended to a Zacks Rank #1 (Strong Buy) on Feb. 9th, reaping a 9% gain since.

Image Source: Zacks Investment Research

Emanating shareholder appeal, HCA Healthcare bears fruits of 0.8% yield complemented by a sustainable payout ratio resting at 13% of earnings. The company flaunts an 11% five-year annualized dividend growth rate, painting a promising picture for ardent investors.

The Light at the End of the Tunnel

Embarking on a journey guided by the Zacks Rank promises to unveil a treasure trove of market-beating profits. Harnessing the energy emanated by positive earnings estimate revisions, these examples epitomize the newfound heights achievable by listening attentively to the Zacks Rank.

The trio of NVIDIA, The Progressive Corp., and HCA Healthcare currently stand adorned with the coveted Zacks Rank #1 (Strong Buy) accolade, symbolizing a trajectory gilded with soaring earnings estimate revisions.