Strong cash flows reflect financial stability, allowing companies to pay down debt, pursue growth opportunities, and shell out dividend payments.

These companies are also better equipped to weather downturns, providing another beneficial advantage for investors from a long-term standpoint.

And for those seeking cash-generating machines, two well-known tech companies – Apple AAPL and Broadcom AVGO – fit the criteria nicely. Let’s take a closer look at how each currently stacks up.

Broadcom Sees Strong AI Demand

Broadcom, currently a Zacks Rank #2 (Buy), has quickly entered the AI race, evolving a broad portfolio of technologies to extend its leadership in enabling next-generation AI infrastructure. The stock has long been a favorite among those seeking tech exposure paired with paydays, with the company’s strong cash-generating abilities allowing it to consistently reward shareholders in a big way over its history.

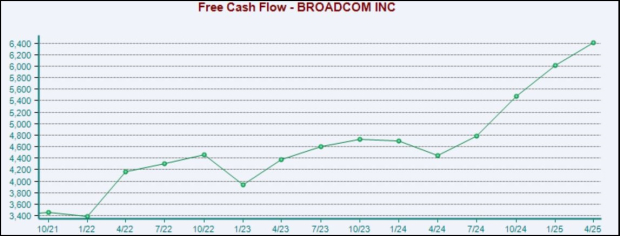

Shares currently yield 0.8% annually, with the company sporting a shareholder-friendly 13.3% five-year annualized dividend growth rate. Free cash flow of $6.4 billion throughout the latest period showed 44% YoY growth and reflected a quarterly record.

Image Source: Zacks Investment Research

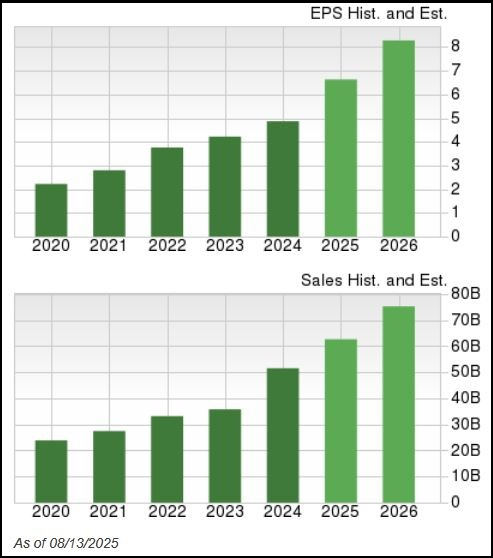

Red-hot demand for its AI solutions has bolstered the company’s optimistic outlook, with earnings and revenue forecasted to increase 36% and 21%, respectively, in its current fiscal year.

Image Source: Zacks Investment Research

Apple Shatters Records

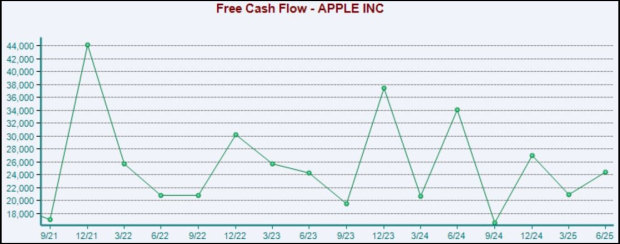

Apple’s latest release was highly positive, reporting quarterly records for sales, iPhone revenue, Services revenue, and EPS. Apple’s installed base of active devices also reached a new record, further adding to the record-breaking period. The Mag 7 member again generated serious cash throughout the period, with free cash flow totaling $24.4 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

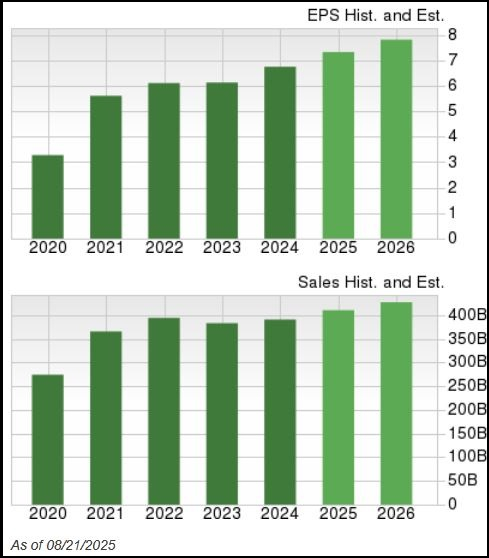

Down 8% YTD, shares have lagged the S&P 500 in a big way. Shares currently trade at a 29.3X forward 12-month earnings multiple, modestly above the five-year median and reflecting a 30% premium relative to the S&P 500.

Earnings and revenue are forecasted to climb 9% and 5%, respectively, in its current fiscal year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Companies with strong cash-generating abilities are great targets, as they have plenty of cash to fuel growth, pay out dividends, and easily wipe out debt. And as mentioned above, these companies are better equipped to handle an economic downturn, undeniably a positive.

For those seeking cash-generators, both companies above – Apple AAPL and Broadcom AVGO – fit the criteria nicely.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

Apple Inc. (AAPL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).