Earnings season continues to roll along, with the period primarily reflecting positivity.

And throughout the period, several companies, including Netflix NFLX, Palantir PLTR, and Royal Caribbean RCL, have knocked it out of the park, with the results of each notably bullish and causing share spikes post-earnings.

Let’s take a closer look at the results for those looking to ride the momentum.

Netflix Subs Keep Growing

Netflix shares have been hot over the past year on the back of strong quarterly results, gaining 80% compared to the S&P 500’s 23% gain. Its latest set of results added to the positivity, with continued user growth and tailwinds from ad-supported memberships pleasing investors.

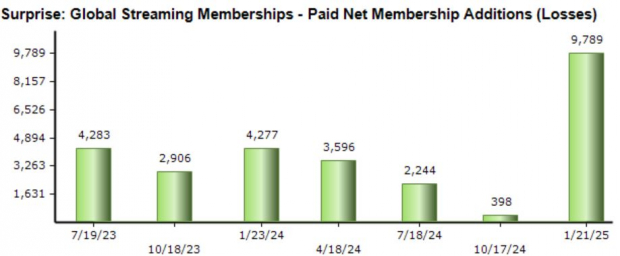

Concerning key metrics in the print, Paid Net Membership Additions throughout the period reached a sizable 18.9 million, crushing our consensus estimate of 9.1 million handily. As shown below, subscriber additions for Netflix have remained rock-solid, exceeding our consensus estimate in seven consecutive releases.

The favorable reads on subscriber additions have fueled the stock’s bullish run over the past year, with margin expansion also brightening its profitability picture.

Image Source: Zacks Investment Research

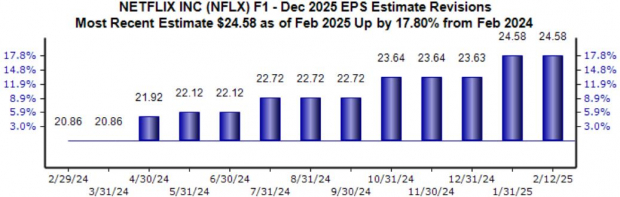

The stock currently sports a favorable Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year moving higher following its latest results. EPS is forecasted to soar 25% in its current fiscal year.

Image Source: Zacks Investment Research

Royal Caribbean Sees Record Bookings

Royal Caribbean Cruises is a cruise company that owns and operates three global brands: Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises. Its recent set of results were underpinned by continued strength in consumer demand, an established trend over the past few years overall.

Concerning headline figures in the release, adjusted EPS of $1.63 exceeded the company’s prior guidance, whereas sales of $3.8 billion grew 11% year-over-year. RCL’s sales growth has been stellar post-pandemic, as we can see in the annual chart below.

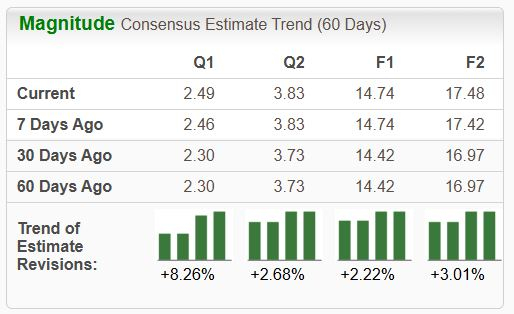

Image Source: Zacks Investment Research

The company provided positive guidance for its FY25, with WAVE season bookings off to a record start. Analysts have already dialed their earnings estimates higher following the favorable print, landing the stock into a bullish Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Palantir Again Posts Robust Results

Palantir’s results came in strong yet again, exceeding headline expectations and posting serious growth. Sales of $828 million shot 36% year-over-year and, more impressively, 14% sequentially. The strong sales growth was headlined by a 43% move higher in Customer count, reflecting the snowballing demand the company has been witnessing.

Palantir also closed a record-setting $803 million of U.S. commercial total contract value (TCV), which shot 130% higher year-over-year and 170% sequentially. U.S. results were jam-packed with positivity, with Commercial and Government revenue growing by 64% and 45%, respectively.

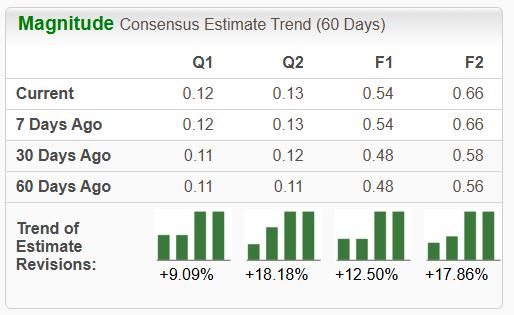

Continued robust results have led shares to an outstanding 365% gain over the last year, crushing the S&P 500. Given the consistently robust demand, it’s reasonable to expect further share momentum, with the stock also sporting a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

“Our business results continue to astound, demonstrating our deepening position at the center of the AI revolution. Our early insights surrounding the commoditization of large language models have evolved from theory to fact,” said CEO and co-founder Alexander Karp.

Bottom Line

The Q4 reporting cycle continues to be one of positivity, with many companies exceeding expectations and providing favorable outlooks.

And throughout the period, all three companies above – Netflix NFLX, Palantir PLTR, and Royal Caribbean RCL – posted notably strong results.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report