While the majority of stocks pay quarterly dividends, investors can still construct a portfolio that allows them to get paid monthly.

How? Let me explain –

The first stock pays its dividend in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

So, with just a little positioning, investors can reap steady monthly paydays.

Together, three stocks – Coca-Cola Company KO, AbbVie ABBV, and Exxon Mobil XOM – would allow payouts to roll in each month.

For income-focused investors, let’s take a closer look at each one.

Coca-Cola Keeps Paying

Coca-Cola is an American multinational corporation best known for its flagship Coca-Cola beverage. Shares have nearly matched the S&P 500’s performance in 2025 so far, gaining 10%.

Notably, KO is a Dividend King, showing an unparalleled commitment to shareholders through 50+ years of increased payouts. The company’s annual yield currently sits at 3.0%, also boasting a 4.8% five-year annualized dividend growth rate.

Below is a chart illustrating the company’s dividends paid on an annual basis. Please note that the final value is tracked on a trailing twelve-month basis, as the company’s current fiscal year is still ongoing.

Image Source: Zacks Investment Research

KO pays dividends in January, April, July, and October.

AbbVie Outperforms

AbbVie enjoys leadership positions in key therapeutic areas, including immunology, hematologic oncology, neuroscience, aesthetics, eye care, and women’s health. Shares have outperformed nicely in 2025 so far, up 21%.

Like KO, AbbVie is a Dividend King, reflecting the company’s shareholder-friendly nature in a big way. Currently, ABBV’s annual dividend yields a sizable 3.9%, with the company also sporting a 6.5% five-year annualized dividend growth rate.

Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

ABBV pays dividends in February, May, August, and November.

XOM Generates Serious Cash

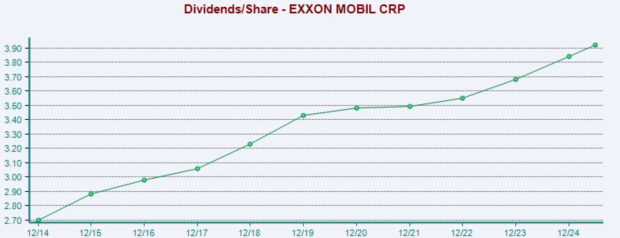

Exxon Mobil is a U.S.-based oil and gas entity, one of the world’s largest publicly traded energy companies. Shares have underperformed relative to the S&P 500 in 2025 so far, gaining a modest 5%.

Exxon’s annual dividend yield currently stands at a solid 3.6%, with the company carrying a 3.1% five-year annualized dividend growth rate.

Below is a chart illustrating the company’s dividends paid on an annual basis

Image Source: Zacks Investment Research

XOM pays dividends in March, June, September, and December.

Bottom Line

Dividends can amplify any portfolio, cushioning the impact of drawdowns in other positions and providing the ability to reap passive income.

And if investors select their dividend-paying stocks in a structured manner, they can create a portfolio that provides monthly paydays.

When combined, all three stocks above – Coca-Cola Company KO, AbbVie ABBV, and Exxon Mobil XOM – construct a portfolio that allows monthly income.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don’t build. It’s uniquely positioned to take advantage of the next growth stage of this market. And it’s just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>

CocaCola Company (The) (KO) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).