Newmont NEM has shown notably strong momentum in 2025, gaining nearly 130% and widely outperforming on the back of strong quarterly results.

Shares have recently made a fresh all-time high, further reinforcing the positive momentum. For those interested in the positivity, let’s take a closer look at how the company currently stacks up.

Gold Prices Surge

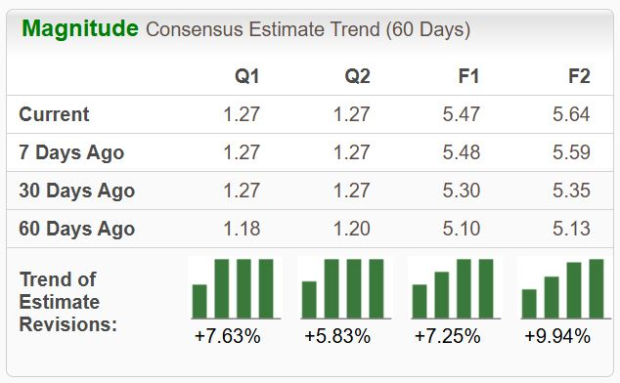

Newmont, one of the world’s largest producers of gold, has benefited significantly from the rise in gold. The favorable operating environment has led analysts to revise their EPS expectations notably higher across the board, a bullish sign concerning near-term share performance.

Image Source: Zacks Investment Research

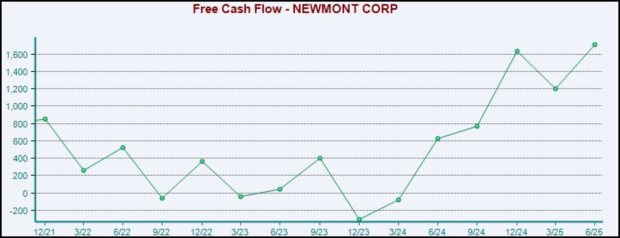

The average gold price per oz reached $3,320 throughout Newmont’s latest period, melting higher from the $2,347 mark in the same period last year. Free cash flow of $1.7 billion throughout the period was the company’s highest read ever.

As shown below, the company’s cash-generating abilities have been a notable boost over recent periods. The amplified cash-generating abilities bring about many positives, such as increased dividends and buybacks.

Image Source: Zacks Investment Research

And speaking of buybacks, NEM announced an additional $3 billion repurchase program following the above-mentioned release, further adding to the positivity.

Bottom Line

A favorable operating environment has led to Newmont’s NEM share surge, benefiting in a big way from elevated gold prices. Its amplified cash-generating abilities have brought many positives, including buybacks.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.5% per year. So be sure to give these hand picked 7 your immediate attention.

Newmont Corporation (NEM) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).