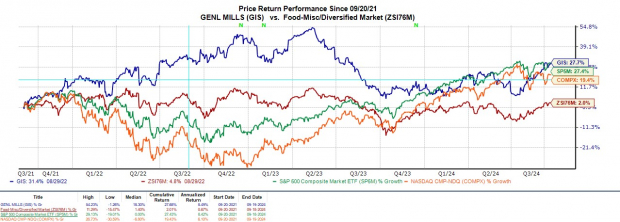

General Mills GIS stock is up +15% this year and investors may be wondering if the consumer food giant can continue to reward its shareholders.

Able to exceed top and bottom line expectations for its fiscal first quarter on Wednesday, let’s see if it’s time to buy General Mills stock for more upside.

Image Source: Zacks Investment Research

General Mills Q1 Results

General Mills reported Q1 sales of $4.84 billion which was down from $4.9 billion in the comparative quarter but beat estimates of $4.78 billion by 1%. On the bottom line, Q1 EPS of $1.07 beat expectations of $1.05 a share by 2% although this dipped from earnings of $1.09 per share a year ago.

Notably, General Mills had previously expected its Q1 results to be below the company’s full-year targets due to challenging net sales and margin comparisons. However, General Mills stated it took a significant step in reshaping its portfolio for stronger growth and probability. Correlating with such, General Mills announced the proposed sale of its North American Yogurt business to French companies Lactalis and Sodiaal for $2.1 billion.

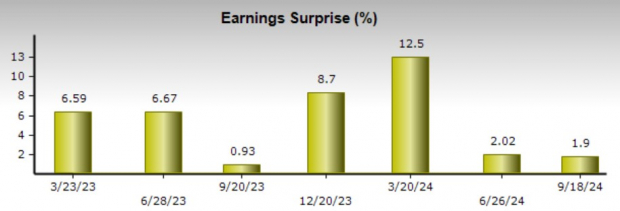

It’s also noteworthy that General Mills has surpassed the Zacks EPS Consensus for 11 consecutive quarters posting an average earnings surprise of 6.28% in its last four quarterly reports.

Image Source: Zacks Investment Research

General Mills Earnings Per Share Guidance

Despite what General Mills has described as an uncertain macroeconomic backdrop for consumers across its core markets, the company reaffirmed its fiscal 2025 EPS guidance.

General Mills still expects FY25 EPS to be down 1% or up 1% in constant currency which falls in line with the Zacks Consensus. Based on Zacks estimates, General Mills’ EPS is projected to rebound and rise 5% in FY26 to $4.72.

Image Source: Zacks Investment Research

How GIS Stock Valuation Compares

Trading around $75 a share, General Mills stock is at a 16.7X forward earnings multiple which is a pleasant discount to the S&P 500’s 23.7X.

GIS also trades beneath its Zacks Food-Miscellaneous Industry average of 17.7X forward earnings with a few of its notable peers being Kraft Heinz KHC and Mondelez International MDLZ.

Image Source: Zacks Investment Research

Takeaway

Following its favorable Q1 results, General Mills stock lands a Zacks Rank #3 (Hold). Although the price performance of GIS has been impressive this year, the trend of earnings estimate revisions in the coming weeks may largely dictate which direction the stock goes from here.

This may certainly be the case considering General Mills’ warning of broader economic concerns for its consumers despite its attractive valuation suggesting GIS remains a viable long-term investment.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

General Mills, Inc. (GIS) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Kraft Heinz Company (KHC) : Free Stock Analysis Report