Quarterly results from Home Depot HD and Disney DIS highlighted this week’s earnings lineup despite the broader market taking a breather following an extensive presidential election rally.

However, both were able to exceed earnings expectations making it a worthy topic of whether it’s time to buy stock in these historic American enterprises.

Home Depot’s Q3 Review: Seeing an incremental boost from hurricane-related renovations, Home Depot reported Q3 sales of $40.21 billion on Tuesday. This increased 6% from $37.71 billion in Q3 2023 and passed estimates of $39.36 billion. Notably, Home Depot has beaten top line estimates in three of its last four quarterly reports posting an average sales surprise of 0.9%.

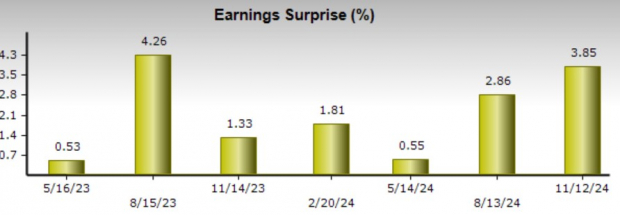

On the bottom line, Q3 EPS of $3.78 dipped from $3.81 in the prior period but beat the Zacks Consensus of $3.64 by nearly 4%. As the world’s largest home improvement retailer, Home Depot has exceeded earnings expectations for 19 consecutive quarters dating back to August of 2020. The company has posted an average earnings surprise of 2.27% over the last four quarters.

Image Source: Zacks Investment Research

Disney’s Q4 Review: Reporting results for its fiscal fourth quarter on Thursday, Disney also saw a 6% top line increase with Q4 sales at $22.57 billion versus $21.24 billion a year ago. Despite slightly missing Q4 sales estimates of $22.59 billion, Disney’s Q4 EPS of $1.14 beat expectations of $1.09.

More impressive, Disney’s earnings spiked 39% from $0.82 a share in the comparative quarter thanks to cost-saving initiatives, particularly among its streaming services. Delivering its second straight quarterly profit for its streaming business, Disney+ subscribers came in at 123 million topping Zacks estimates of 120 million although this was down from 150 million in the prior-year quarter. That said, combined streaming users came in at 200.6 million when including ESPN+ and Hulu which keeps Disney firmly in the second spot behind Netflix NFLX in regards to total streamers.

The media conglomerate has beaten earnings expectations for eight straight quarters with an average EPS surprise of 13.56% in its last four quarterly reports. Disney has exceeded top line estimates in two of the last four quarters with an average sales surprise of 0.33%.

Image Source: Zacks Investment Research

Tracking DIS & HD:

Price Performance

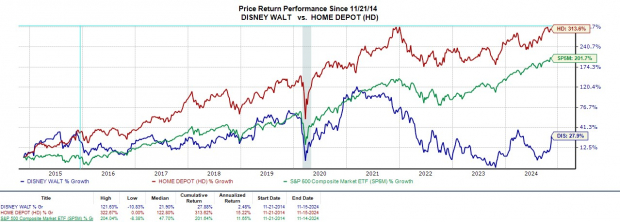

Seeing a sharp post-earnings rally, Disney’s stock is now up +27% this year to edge the S&P 500’s +25% and Home Depot’s +17%. From a historical perspective, it has been more rewarding to keep Home Depot shares in the portfolio. HD is sitting on gains of over +300% in the last decade which has topped the benchmark’s +200% with DIS up a subpar +28% during this period.

Image Source: Zacks Investment Research

Valuation Comparison

While Home Depot’s stock has had a clear edge in terms of price performance, Disney shares have stood out in terms of valuation. DIS trades at 21.4X forward earnings which is a pleasant discount to the benchmark’s 25.2X with HD at 27X.

Furthermore, Disney trades well below its decade-long high of 134.4X forward earnings and is on par with its decade-median of 21.3X. As for Home Depot, HD trades slightly beneath its own decade-long high of 28.1X forward earnings but above the median of 21.5X. Reassuringly, Disney and Home Depot both trade near the optimum level of less than 2X sales.

Image Source: Zacks Investment Research

DIS & HD Dividends

Following a three-year hiatus, Disney reinstated its dividend at the end of 2023 and currently has a 0.82% annual yield. With its dividend remaining intact since 1987, HD has a clear edge here as well as Home Depot’s payout is at 2.22% to edge the S&P 500’s average of 1.2%

Image Source: Zacks Investment Research

Takeaway

Continuing their impressive streaks of surpassing earnings expectations, Disney and Home Depot stock both land a Zacks Rank #3 (Hold). More upside may largely depend on the trend of earnings estimate revisions in the coming weeks with Home Depot showing the canny ability to reward investors over the years while Disney’s return to growth has become very compelling.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

The Home Depot, Inc. (HD) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report