As a reminder that U.S. markets are closed on Monday for Martin Luther King Day, investors will be looking ahead to Tuesday’s (Jan 21) trading session, which features Q4 results from Netflix NFLX.

Being one of the headline names of next week’s earnings lineup, let’s see if it’s time to buy Netflix stock for more upside with NFLX up over +70% in the last year.

Image Source: Zacks Investment Research

Netflix Q4 Expectations

Netflix’s Q4 sales are thought to have increased 14% to $10.12 billion, compared to $8.83 billion in the comparative quarter. More impressive, the streaming giant’s Q4 EPS is expected to climb 98% to $4.19 versus $2.11 per share a year ago.

Netflix is slated to round out fiscal 2024 with a 15% increase in total sales at $38.86 billion, and a 64% spike in annual earnings with estimates at $19.77 per share versus EPS of $12.03 in 2023.

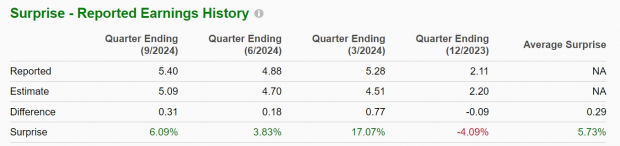

Notably, Netflix has exceeded sales estimates for five consecutive quarters and has surpassed earnings expectations in three of its last four quarterly reports with an average EPS surprise of 5.73%.

Image Source: Zacks Investment Research

Netflix Subscriber Growth

Holding on to the title of streaming king ahead of Disney DIS, Netflix is expected to have added over 7 million subscribers during Q4 to $287.48 million total subscriptions. This would be a 10% spike from the $260.28 million subscribers the company had at the end of Q3 2024.

Monitoring Netflix’s Valuation

Trading around $860 a share, NFLX is at a 35.6X forward earnings multiple which is a premium to the benchmark S&P 500’s 22.2X with Disney at 19X.

Considering Netflix stock has impressively outperformed the broader market and Disney shares in recent years, it is noteworthy that NFLX does trade well below its five-year high of 88.5X forward earnings and a slight discount to the median of 37.4X during this period.

Image Source: Zacks Investment Research

Bottom Line

Ahead of its Q4 report next week, Netflix stock lands a Zacks Rank #3 (Hold). While NFLX tends to pop after favorable quarterly results, Netflix’s Q4 report will need to reconfirm its attractive growth trajectory after an extensive rally over the last year.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report