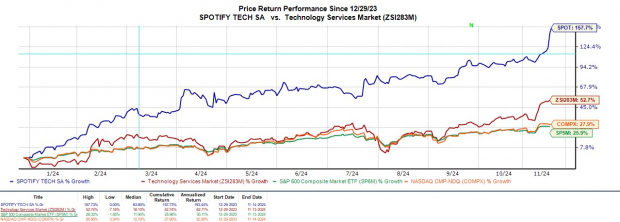

Able to appease investor sentiment toward its compelling growth narrative, Spotify Technology SPOT shares have rallied more than +15% since reporting Q3 results on Tuesday.

Despite missing lofty earnings expectations, there was a lot to like about the music streaming company’s Q3 report. That said, let’s see if investors should chase the rally with SPOT hitting new 52-week highs of $489 a share today.

Image Source: Zacks Investment Research

Spotify’s Favorable Q3 Results

Moving toward a full year of probability, Spotify’s Q3 EPS soared 341% to $1.59 compared to $0.36 a share in the comparative quarter. However, this missed the Zacks EPS Consensus of $1.75 although Q3 sales of $4.38 billion exceeded estimates of $4.36 billion. Year over year, Q3 sales increased 20% from $3.65 billion in the prior period.

Notably, Spotify reported record operating income of $478 million and record gross margins of 31.1%. This came as Spotify’s Monthly Active Users (MAUs) grew 11% YoY to 640 million with paid subscribers increasing 12% to 252 million. In comparison, Spotify has more than double Apple AAPL Music’s year-to-date tally of 93 million subscribers.

Subscriber Guidance & Outlook

Emerging as the preferred choice in today’s age of music streaming, Spotify expects to add 25 million MAUs in Q4 to 665 million total. Spotify projects its subscriber base to expand by 8 million during Q4 to 260 million.

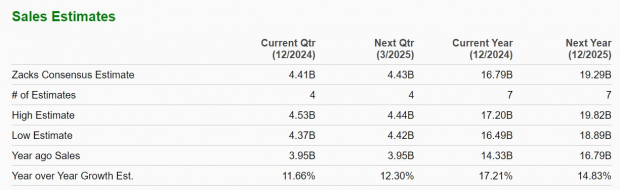

Spotify forecasts Q4 sales at $4.31 billion which is slightly beneath the current Zacks Consensus of $4.41 billion or 11% growth (Current Qtr below). Based on Zacks estimates, Spotify’s total sales are expected to rise 17% in fiscal 2024 and are projected to leap another 15% in FY25 to $19.29 billion.

More importantly, Spotify’s annual earnings are expected to skyrocket to $6.19 per share in FY24 versus an adjusted EPS loss of -$2.95 last year. Plus, FY25 EPS is slated to expand another 44% to $8.92, based on Zacks estimates.

Image Source: Zacks Investment Research

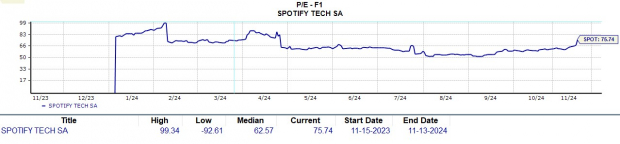

Monitoring Spotify’s Valuation

In terms of price to sales, Spotify’s stock has a P/S ratio of 5.4X which is on par with the S&P 500 but a noticeable premium to its Zacks Technology-Services Industry average of 1.7X.

Image Source: Zacks Investment Research

Optimistically, Spotify’s stock can now be critiqued on a price to earnings basis with SPOT having a forward P/E multiple of 75.7X. This is still nicely beneath its one-year high of 99.3X forward earnings but above the median of 62.5X.

Image Source: Zacks Investment Research

Final Thoughts

While investors have been inclined to pay a premium for Spotify’s very expansive growth, SPOT currently lands a Zacks Rank #3 (Hold). Better buying opportunities will depend on the trend of earnings estimate revisions in the coming weeks as Spotify’s underlying financial metrics have vastly improved although its revenue guidance was weaker than expected.

Free: 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in Federal funds have been earmarked to repair and upgrade America’s infrastructure. In addition to roads and bridges, this flood of cash will pour into AI data centers, renewable energy sources and more.

In, you’ll discover 5 surprising stocks positioned to profit the most from the spending spree that’s just getting started in this space.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Apple Inc. (AAPL) : Free Stock Analysis Report

Spotify Technology (SPOT) : Free Stock Analysis Report