Solar energy stocks had been on a tear over the last few trading sessions thanks to a wave of favorable policy changes and investor optimism around clean energy incentives.

Prior to the rally, many solar stocks had lost momentum in recent months, stemming from news that they would no longer be as privy to federal tax credits.

However, the U.S. Treasury Department and IRS have released updated rules for clean energy tax credits that were less restrictive than expected, clarifying how solar projects qualify for federal incentives.

This has led to analysts, including those at UBS and Citi, to highlight the new rules as a win for solar developers. With uncertainty surrounding the solar industry being reduced, it may certainly be a more favorable time to invest in a power source that drastically reduces greenhouse gas emissions.

Solar energy is also one of the cheapest sources of electricity in many parts of the world, and has created a surplus of jobs in manufacturing, installation, and maintenance. In the U.S. alone, solar jobs have grown five times faster than the overall job market.

Keeping the strengthening outlook for the solar industry in mind, here are three stocks and an ETF that investors may want to consider in particular.

First Solar – FSLR

Zacks Rank #3 (Hold)

Seeing as the new Treasury guidance on tax credits is geared toward large-scale installations, First Solar FSLR is well-positioned to benefit as the largest solar panel manufacturer in the United States.

Thanks to its U.S.-based manufacturing, First Solar is expected to earn over $1 billion in credits this year, with analysts at UBS naming FSLR a top stock pick due to the company’s strong growth potential under the revised framework for the Inflation Reduction Act.

Looking more likely to hit projections of high double-digit top and bottom line growth in fiscal 2025 and FY26, First Solar stock has now rebounded and risen +20% year to date, but is still nearly 20% from its 52-week high of $262 a share.

Sunrun – RUN

Zacks Rank #3 (Hold)

In addition to the positive solar industry tax credit news, strong Q2 results a few weeks ago have made Sunrun RUN one of the hottest momentum stocks of late. Sunrun smashed Q2 earnings expectations, delivering a profit of $1.07 per share, with estimates calling for a loss of -$0.18 a share.

The driver for Sunrun’s jaw-dropping earnings beat was increased demand for solar and battery storage solutions. Achieving a record storage attachment rate during Q2, 70% of Sunrun’s customers added battery storage to their solar systems, with storage installations jumping 48% year over year.

Although EPS estimates for Sunrun have soared in the last 30 days for FY25 and FY26, this has been priced into its stock movement as RUN has skyrocketed +50% this month and is now sitting on gains of more than +65% YTD. Still, favorable policy changes could lead to a further uptick in the already positive trend of earnings estimate revisions, with RUN trading at $15 and edging closer to its 52-week high of $22 a share.

Image Source: Zacks Investment Research

Shoals – SHLS

Zacks Rank #2 (Buy)

Trading just above penny stock status at around $6 a share, the risk-to-reward looks favorable to invest in Shoals Technologies SHLS stock. With SHLS spiking over +10% this month and now up +8% for the year, Shoals’ diverse portfolio of solar balance systems products has become attractive, which includes combine/re-combiner boxes, disconnect boxes, custom harnessing solutions, and junction boxes, among other equipment.

Going public in 2021, Shoals is already profitable, and investors have the opportunity to get in on the company’s expansion at a 71% discount to its IPO price of $21. Notably, Shoals’ top line is expected to expand 15% in FY25, with FY26 sales projected to increase another 18% to new peaks at over $540 million.

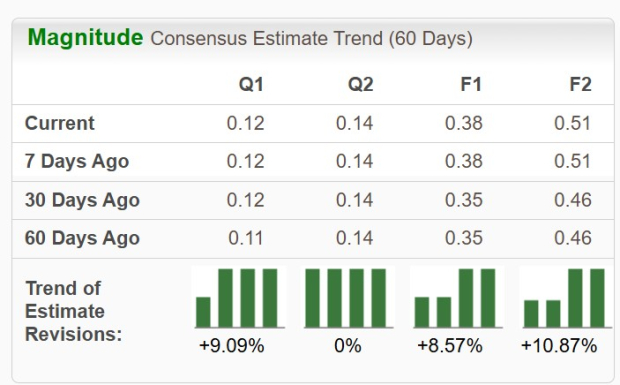

Shoals’ annual earnings are currently slated to be up 8% this year to $0.38 per share, and FY26 EPS is forecasted to pop another 33% to over $0.50 and near the company’s all-time high. Reassuringly, Shoals’ FY25 and FY26 EPS estimates are nicely up in the last 30 days.

Image Source: Zacks Investment Research

Exposure Through the TAN ETF

For investors looking to divert some of the direct risk of individual stock picking among solar companies, the Invesco Solar ETF TAN is a way to do so.

Having an inception date that goes back to 2008, TAN currently lands a Zacks Rank #3 (Hold), with its largest holdings being First Solar and NexTracker NXT at over 9% respectively. Over 4% of this ETF’s holdings are in Sunrun, with 2.82% in Shoals Technologies. TAN currently trades at $40 a share, spiking +13% in August, and is up +26% for the year.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next big thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Invesco Solar ETF (TAN): ETF Research Reports

Sunrun Inc. (RUN) : Free Stock Analysis Report

Shoals Technologies Group, Inc. (SHLS) : Free Stock Analysis Report

Nextracker Inc. (NXT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).