The most oversold stocks in the real estate sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

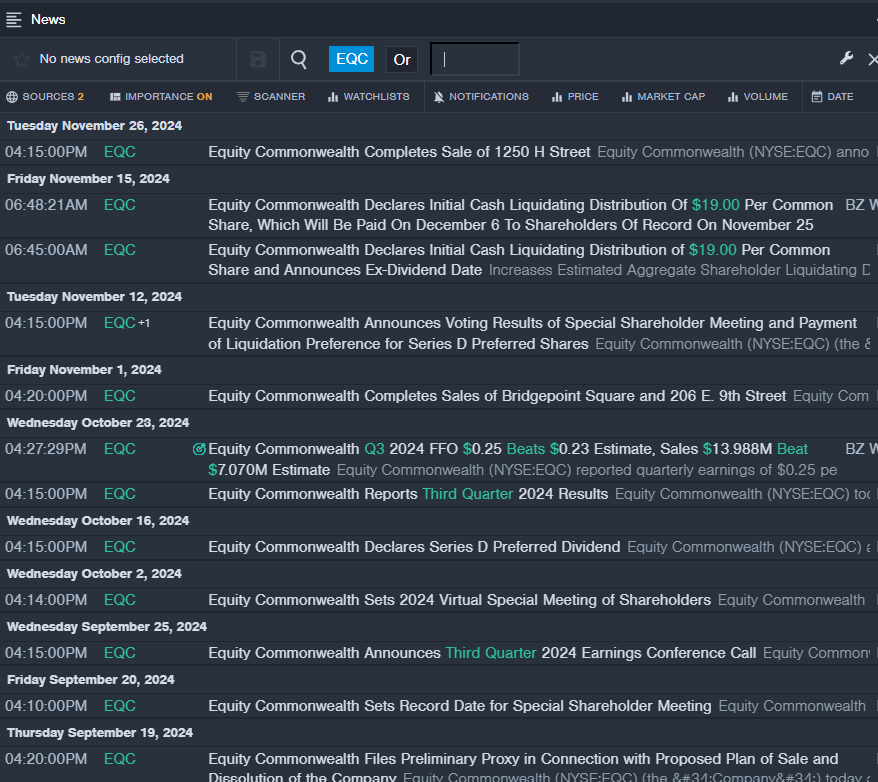

Equity Commonwealth EQC

- On Nov. 26, Equity Commonwealth completed the sale of 1250 H Street. The company’s stock fell around 91% over the past month and has a 52-week low of $1.40.

- RSI Value: 5

- EQC Price Action: Shares of Equity Commonwealth fell 1.7% to close at $1.74 on Monday.

- Benzinga Pro’s real-time newsfeed alerted to latest EQC news.

Wheeler Real Estate Investment Trust Inc WHLR

- On Nov. 15, Wheeler Real Estate Investment Trust announced a 1-for-2 reverse stock split. The company’s stock fell around 52% over the past month and <a href=”https://www.benzinga.com/quote/WHLR”><em> has a 52-week low </em></a> of $3.75.

- RSI Value: 24

- WHLR Price Action: Shares of Wheeler Real Estate Investment Trust closed at $4.05 on Monday.

- Benzinga Pro’s charting tool helped identify the trend in WHLR stock.

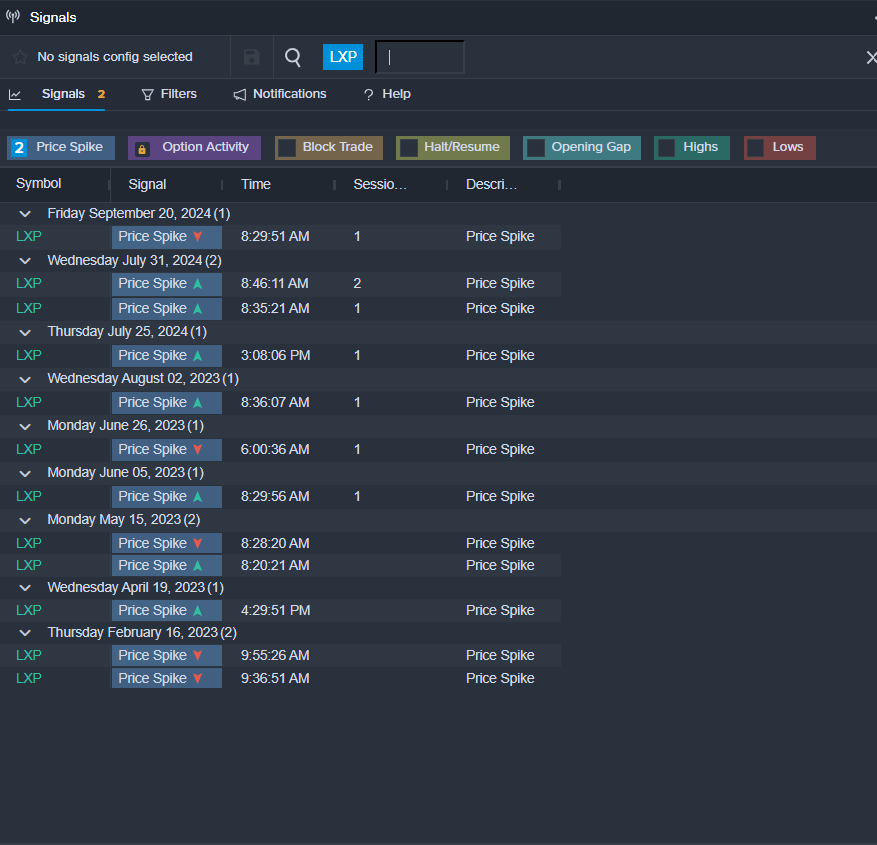

LXP Industrial Trust LXP

- On Nov. 6, LXP Industrial Trust reported better-than-expected third-quarter financial results. T. Wilson Eglin, Chairman and Chief Executive Officer of LXP, commented “We posted strong third-quarter results with same-store NOI growth of 5.4% driven by 39.1% cash rental increases on second generation leases completed through September 30, 2024. We made progress on development leasing, executing a five-year lease at our 250,000 square foot development project in Columbus with a development yield of 8.5% and 3.5% annual rental increases.” The company’s stock fell around 12% over the past month and has a 52-week low of $8.08.

- RSI Value: 29

- LXP Price Action: Shares of LXP Industrial Trust fell 0.5% to close at $8.28 on Monday.

- Benzinga Pro’s signals feature notified of a potential breakout in LXP shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs