The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

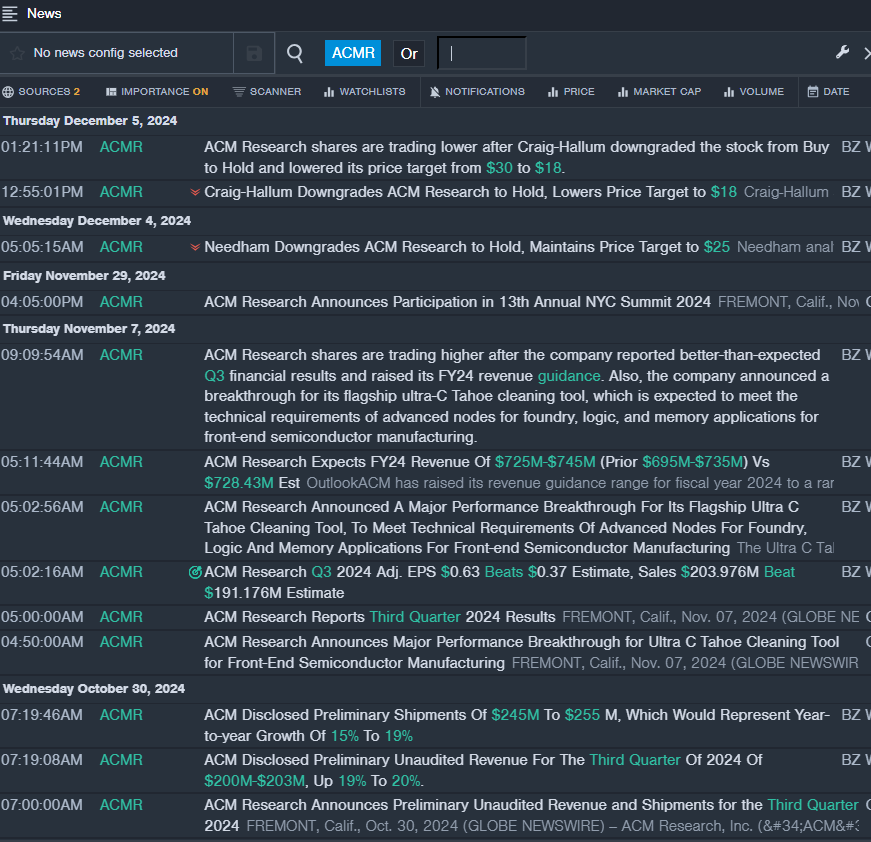

ACM Research Inc ACMR

- On Nov. 7, ACM Research reported better-than-expected third-quarter financial results and raised its FY24 revenue guidance. Also, the company announced a breakthrough for its flagship ultra-C Tahoe cleaning tool, which is expected to meet the technical requirements of advanced nodes for foundry, logic, and memory applications for front-end semiconductor manufacturing. The company’s stock fell around 26% over the past month and has a 52-week low of $13.87.

- RSI Value: 21.58

- ACMR Price Action: Shares of ACM Research fell 14.9% to close at $14.10 on Thursday.

- Benzinga Pro’s real-time newsfeed alerted to latest ACMR news.

Intel Corp INTC

- Intel interim co-CEO David Zinsner said he expects the next chief to have manufacturing and product expertise Reuters cites from the UBS technology conference on Wednesday. The company’s stock fell around 12% over the past five days and has a 52-week low of $18.51.

- RSI Value: 28.82

- INTC Price Action: Shares of Intel fell 5.3% to close at $20.80 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in INTC stock.

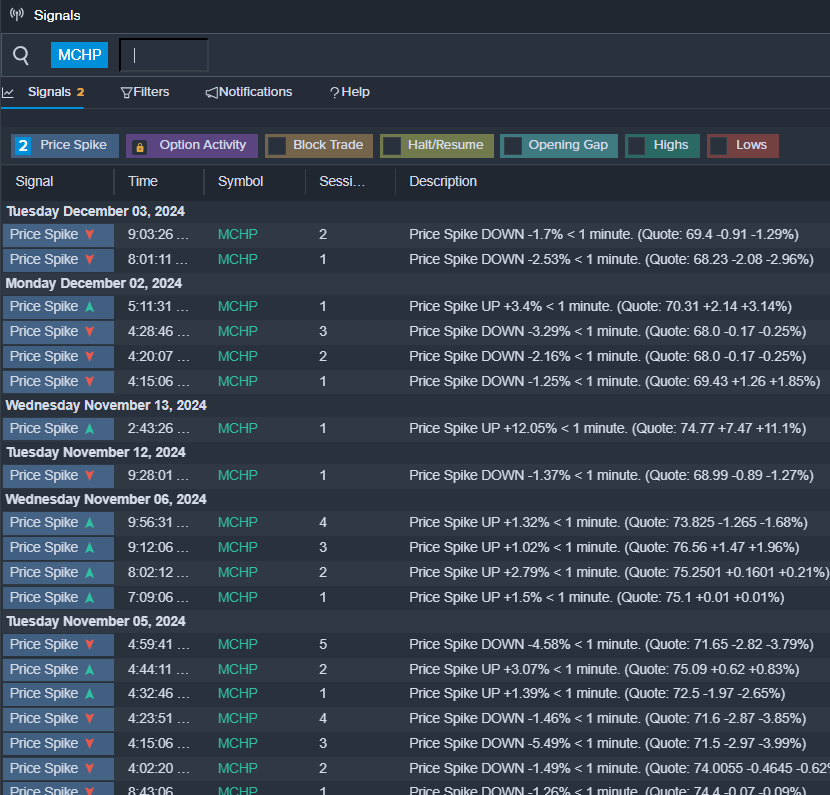

Microchip Technology Inc MCHP

- On Dec. 2, Microchip Technology cut revenue guidance for the December 2024 quarter and announced manufacturing restructuring plans after a deep dive into the company’s operations. The update followed the Biden administration’s third crackdown on China’s semiconductor industry, which focused on advanced memory chips and chipmaking tools and affected chip equipment manufacturers. The company’s stock fell around 15% over the past five days and has a 52-week low of $57.96.

- RSI Value: 25.44

- MCHP Price Action: Shares of Microchip fell 5.5% to close at $58.25 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in MCHP shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs