The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Sunnova Energy International Inc NOVA

- On April 1, Sunnova named Robyn Liska as interim CFO. “Robyn has deep industry knowledge and a proven record of driving financial transformation,” said Paul Mathews, Sunnova Chief Executive Officer. “Her expertise will be invaluable as we continue to work to stabilize our foundation, sharpen our execution, and position Sunnova to succeed in today’s evolving solar energy market.” The company’s stock fell around 44% over the past month and has a 52-week low of $0.25.

- RSI Value: 26.3

- NOVA Price Action: Shares of Sunnova Energy fell 11.3% to close at $0.33 on Tuesday.

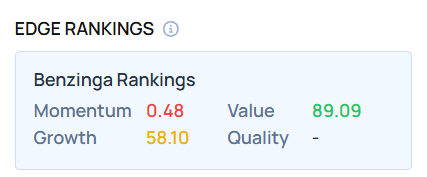

- Edge Stock Ratings: 0.48 Momentum score with Value at 89.09.

Cadiz Inc CDZI

- On March 7, Cadiz Inc. announced a $20 million registered direct offering. The offering involves the sale of 5,715,000 shares of its common stock at $3.50 per share. The company expects to use the net proceeds for capital and other expenses related to the development and construction of its Mojave Groundwater Bank project.. The company’s stock fell around 28% over the past month and has a 52-week low of $2.12.

- RSI Value: 29

- CDZI Price Action: Shares of Cadiz gained 0.7% to close at $2.95 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in CDZI stock.

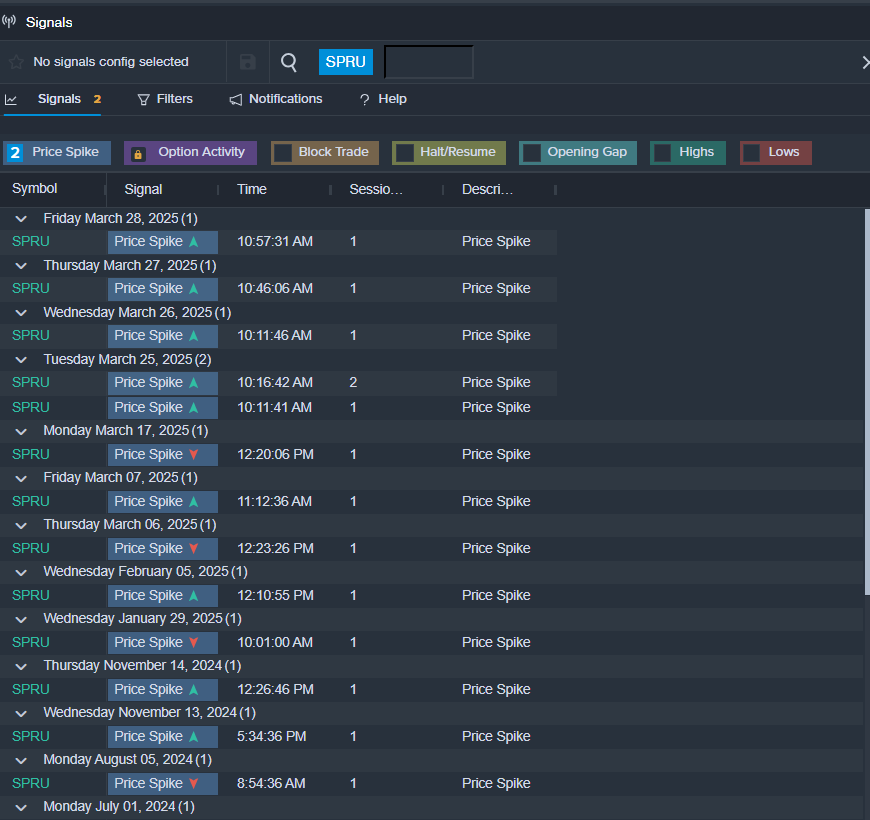

Spruce Power Holding Corp SPRU

- On March 31, Spruce Power Holding reported a quarterly loss of 29 cents per share, versus a year-ago loss of $1.60 per share. “In this time of heightened uncertainty across the residential solar market, Spruce offers investors greater stability and predictability given that our business is predicated on generating long-term contracted cash flows from existing solar assets through operational efficiencies, maintenance and superior asset management,” said Chris Hayes, Spruce’s Chief Executive Officer. The company’s stock fell around 20% over the past five days and has a 52-week low of $2.08.

- RSI Value: 25.4

- SPRU Price Action: Shares of Spruce Power fell 12% to close at $2.12 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in SPRU shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Momentum72.44

Growth97.68

Quality–

Value15.05

Market News and Data brought to you by Benzinga APIs