The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

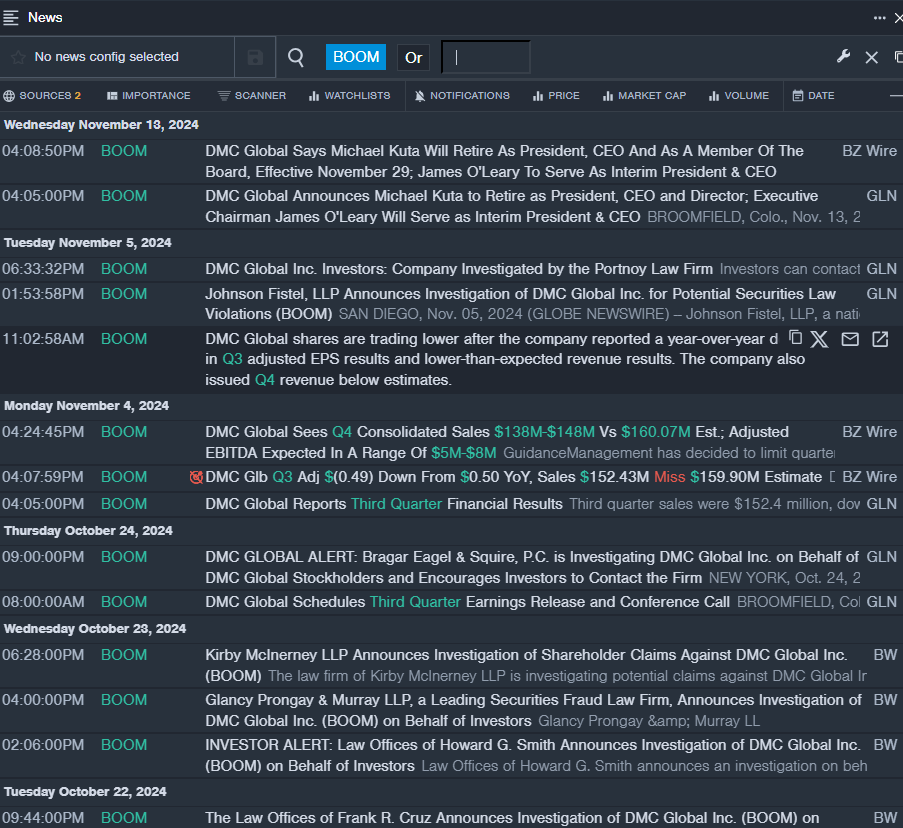

Dmc Global Inc BOOM

- On Nov. 13, DMC Global said Michael Kuta will retire as President, CEO and as a member of the board, effective Nov. 29. James O’Leary will serve as Interim President & CEO. The company’s stock fell around 35% over the past month and has a 52-week low of $7.96.

- RSI Value: 28.02

- BOOM Price Action: Shares of Dmc Global rose 1.1% to close at $8.23 on Thursday.

- Benzinga Pro’s real-time newsfeed alerted to latest BOOM news.

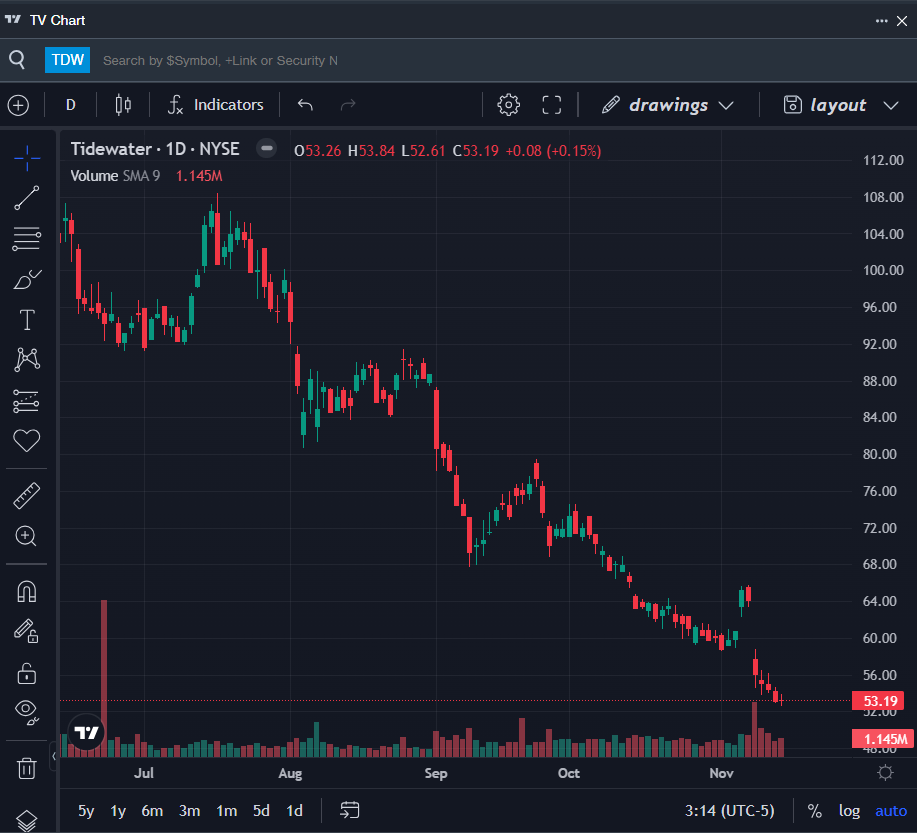

Tidewater Inc TDW

- On Nov. 7, Tidewater reported worse-than-expected third-quarter financial results and issued FY24 revenue below estimates. Quintin Kneen, Tidewater’s President and Chief Executive Officer, said, “Third quarter revenue of $340.4 million and gross margin of 47.2% came in as expected, with our consolidated average day rate up over 5% to $22,275. In particular, the average day rate and average leading-edge day rates in our large PSV and anchor handler fleets continued to show sequential quarterly improvement.” The company’s stock fell around 16% over the past month and has a 52-week low of $52.61.

- RSI Value: 28.57

- TDW Price Action: Shares of Tidewater gained 0.2% to close at $53.19 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in TDW stock.

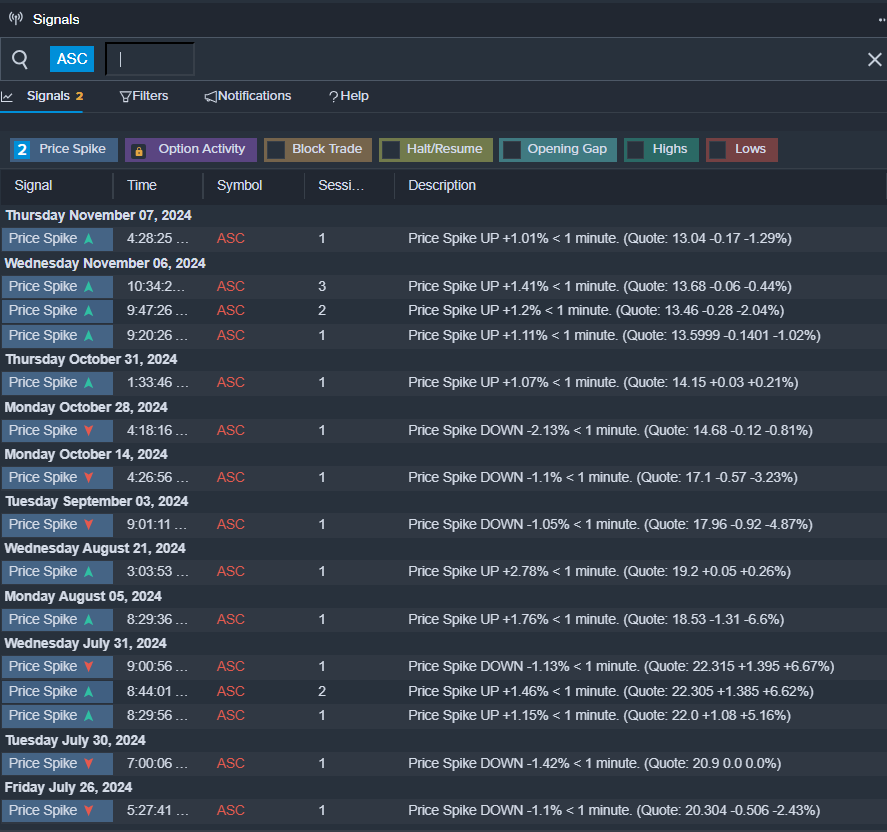

Ardmore Shipping Corp ASC

- On Nov. 6, Ardmore Shipping reported quarterly earnings of 55 cents per share which missed the analyst consensus estimate of 62 cents per share. The company reported quarterly sales of $96.118 million which beat the analyst consensus estimate of $74.252 million. The company’s stock fell around 28% over the past month and has a 52-week low of $11.85.

- RSI Value: 11.32

- ASC Price Action: Shares of Ardmore Shipping rose 0.1% to close at $11.95 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in ASC shares.

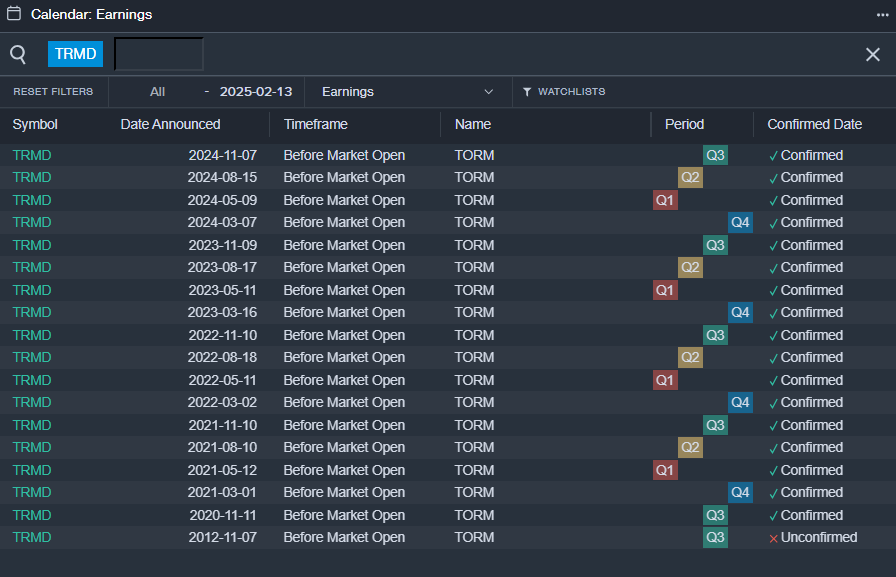

Torm PLC TRMD

- On Nov. 7, TORM reported quarterly earnings of $1.38 per share which missed the analyst consensus estimate of $1.51 per share. The company reported quarterly sales of $372.100 million which beat the analyst consensus estimate of $285.996 million. The company’s shares lost around 21% over the past month. The company’s 52-week low is $22.77.

- RSI Value: 20.94

- TRMD Price Action: Shares of Torm fell 0.4% to close at $23.63 on Thursday.

- Benzinga Pro’s earnings calendar was used to track upcoming TRMD earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs