Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

For those interested in viewing the Thematic lists, please click here >>> Thematic Screens – Zacks Investment Research.

Let’s take a closer look at the Artificial Intelligence theme and analyze a few stocks that the screen returned, such as Broadcom AVGO and Palantir PLTR.

Artificial Intelligence

Artificial Intelligence (AI) refers to the technology that enables computers and machines to simulate human intelligence and problem-solving capabilities to perform the cognitive functions usually associated with human minds.

In general, AI systems work by ingesting large amounts of data with fast, iterative processing and intelligent algorithms. It then analyzes the data using neural networks for correlations and patterns and allows the software to learn automatically from these patterns to make predictions.

This screen features diverse companies involved in AI, ranging from creators of software and hardware that power AI to those applying and utilizing this technology through automation, diagnostics, cognitive tasks, and more.

Please click here for a direct link to the Zacks Artificial Intelligence Thematic Screen.

Palantir Enjoys Business Momentum

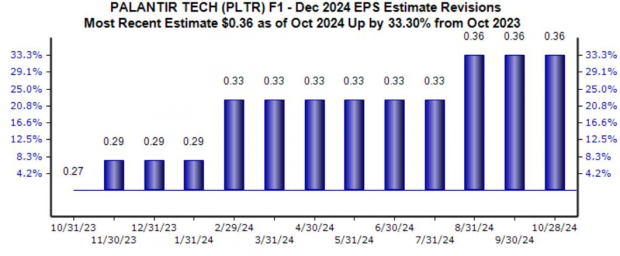

Palantir builds software that empowers organizations toeffectively integrate their data, decisions, and operations. The company maintains a bullish outlook for its current fiscal year, with analysts revising their earnings expectations well higher over recent months.

Image Source: Zacks Investment Research

Its latest quarterly release brought post-earnings positivity, with the company exceeding both earnings and revenue expectations while also lifting its current-year sales outlook. Revenue soared 27% year-over-year, whereas adjusted EPS climbed 200%.

The company’s platform continues to be highly attractive, reflected by 41% year-over-year customer growth. Impressively, PLTR closed over 27 deals worth $10 million throughout the period, further reflecting snowballing demand.

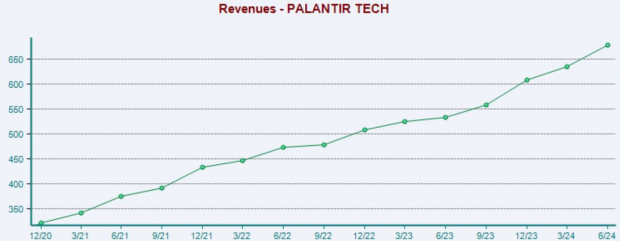

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Broadcom Reports Record AI Revenue

Broadcom is evolving a broad portfolio of technologies to extend its leadership in enabling next-generation AI infrastructure. This includes foundational technologies and advanced packaging capabilities aimed at building the highest performance, lowest power custom AI accelerators.

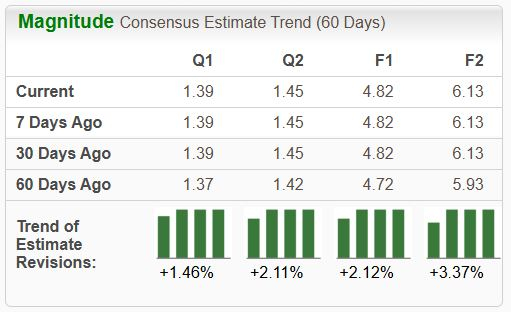

The stock currently sports a favorable Zacks Rank #2 (Buy), with its earnings outlook shifting bullishly across the board over recent months.

Image Source: Zacks Investment Research

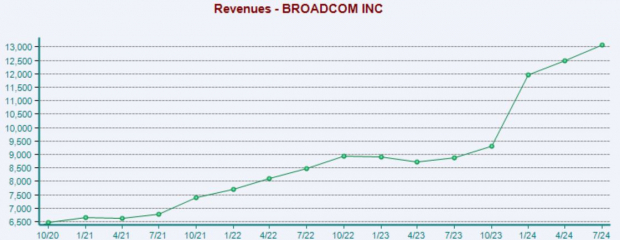

Like PLTR, its recent set of quarterly results brought post-earnings fireworks, with record revenue from AI products of $3.1 billion pleasing investors in a big way. The quarter’s results were driven by robust demand for its AI solutions, leading it to up its current year sales and adjusted EBITDA guidance.

Analysts have accordingly raised their current year sales expectations, with AVGO forecasted to enjoy 43% Y/Y sales growth in FY24. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

Upon running the Zacks Artificial Intelligence Thematic screen, both stocks above – Palantir PLTR and Broadcom AVGO – were returned.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report