U.S. President Donald Trump has indicated that Meta Platforms META could invest up to $60 billion in the United States by the end of the year.

What Happened: While taking press questions at the Oval Office on Thursday, Trump stated that the Mark Zuckerberg-led company is likely to invest $60 billion by the end of 2025. This follows the likes of Apple AAPL and TSMC TSM. In February, the iPhone maker invested $500 billion, while TSMC invested $10 billion in the United States, in a move to avoid tariffs and give a boost to Trump’s ‘America First’ agenda. When asked about the impact of tariffs, Trump continued to defend them and stated his belief that they would boost the U.S. economy and create more jobs in the country.

An anonymous source disclosed to Reuters on Wednesday that the meeting is part of Zuckerberg’s continuous discussions with the administration concerning the leadership of American technology. However, Andy Stone, a spokesperson for Meta, did not confirm the White House visit to the publication.

Notably, Meta has not officially announced the investment yet. The company did not immediately respond to Benzinga’s request for comments.

See Also: Ross Gerber Finds Tesla Stock Expensive Despite Its 50% Plunge: Why The Investor Says EV Giant’s ‘Fundamental Story Has To Be Revalued’

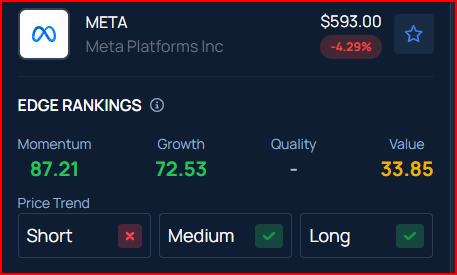

Why It Matters: The possible meeting between Zuckerberg and the Trump administration officials comes at a time when Meta’s shares are experiencing a downward trend. Meta’s shares traded lower on Thursday amid an overall market weakness that has been impacting social media and tech stocks.

The decline in Meta’s shares is attributed to the erasure of Wednesday’s gains by Wall Street, with market sentiment being negatively affected by tariff threats and economic data. The possible meeting with the Trump administration could be seen as a strategic move by Zuckerberg to discuss these issues and potentially influence future policies that could impact Meta and the tech industry at large.

Meta holds a momentum rating of 87.21% and a growth rating of 72.53%, according to Benzinga’s Proprietary Edge Rankings. The Benzinga Growth metric evaluates a stock’s historical earnings and revenue expansion across multiple timeframes, prioritizing both long-term trends and recent performance. For an in-depth report on more stocks and insights into growth opportunities, sign up for Benzinga Edge.

Read More:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Momentum76.32

Growth60.93

Quality84.34

Value7.80

Market News and Data brought to you by Benzinga APIs