The Future Fund LLC Managing Partner and Tesla TSLA bull Gary Black said on Friday that the EV company’s earnings per share (EPS) revisions have not kept pace with the stock price surge since Donald Trump’s victory in the Presidential elections.

What Happened: “We know that $TSLA is up +51% YTD (vs NDX +28%), all of which is since the Nov election (TSLA +50% vs NDX +7%) on the belief that ally Trump can streamline TSLA’s efforts to secure autonomous deployment licenses. The question is: Have TSLA Adj EPS ests increased as well? The short answer is not much,” Black said on Friday.

Black noted that Tesla’s FY2025 adjusted EPS estimates are up by only 1.6% since the election.

“Put differently, all of TSLA’s +50% price appreciation since the election reflects P/E expansion, which on FY’25 eps ests have increased from 77x before the election to 114x today (+48%),” he said while adding that he continues to be “very bullish” on the stock.

However, Black also said that he is “cautious” as he believes multiple expansions should reflect an acceleration in earnings growth. The expansion, he said, could come next year if Tesla gets robotaxi deployment permits from Texas and California or if other automakers attempt to license the company’s full self-driving driver assistance software.

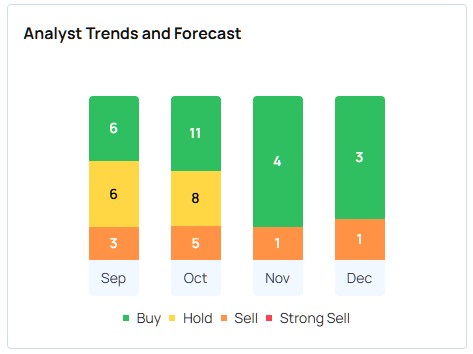

Why It Matters: Overall, analysts have a consensus rating of “Buy” on the Tesla stock, with the highest price target being $411. The most recent analyst ratings by Guggenheim, BofA Securities, and Roth MKM have an average price target of $318.33, implying an 18% downside.

Tesla shares closed up 5.3% at $389.22 on Friday. The stock is up by nearly 57% year-to-date, taking its market capitalization over $1 trillion, according to data from Benzinga Pro.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Tesla

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs