On Tuesday, Taiwan Semiconductor Manufacturing Company Limited TSM, or TSMC, saw its shares touch a record high in Taipei following gains among its key customers, such as NVIDIA Corporation NVDA. TSMC’s shares have surged 99.3% this year, and the stock is set for its strongest annual performance since 1999, thanks to the thriving generative artificial intelligence (AI) market.

Image Source: Zacks Investment Research

Given that TSMC stock is primed for success, is it a good stock to buy in the new year? Let’s find out –

TSMC Plans to Launch New Chip Technology in 2025

TSMC is producing its cutting-edge 2-nanometer (nm) chips and is expected to introduce them in 2025. The 2nm chips will reach full-scale production in 2026, with its pre-order demand surpassing that of 3nm and 5nm chips.

The 2nm chips feature nanosheet transistor technology that enhances the efficiency level. They are designed to consume 25-30% less energy, boost battery life and curtail costs. So, along with continued demand for the present 3nm chips, the upcoming next-generation chip will boost the TSMC stock next year.

TSMC Sees Multiple Growth Prospects

TSMC not only produces chips for graphic processing unit companies like NVIDIA but also smartphone chips for players like Apple Inc. AAPL and QUALCOMM Incorporated QCOM. Both Apple and QUALCOMM recently witnessed an uptick in smartphone sales, a positive signal for TSMC.

TSMC also manufactures custom chips for Marvell Technology, Inc. MRVL and Broadcom Inc. AVGO. Both companies have already placed orders with TSMC to meet the growing demand for custom AI chips. TSMC’s diversified partnerships, therefore, reduce the dependence on NVIDIA, offering various growth prospects that favor the stock next year.

Semiconductor Market Growth Benefits TSMC Stock

The global semiconductor market is estimated to generate $2 trillion and more in revenues by 2032 at a CAGR of almost 15%, according to Precedence Research. Similarly, McKinsey expects the worldwide semiconductor market to surpass annual revenues of $1 trillion by the end of 2030.

The growing semiconductor market is a tailwind for the TSMC stock next year since it’s the largest semiconductor foundry with a 62% market share. Moreover, TSMC’s rivals are struggling. Intel Corporation INTC, for instance, is spinning off its foundry business and reducing capital expenditures.

TSM Stock to Buy Hand Over Fist

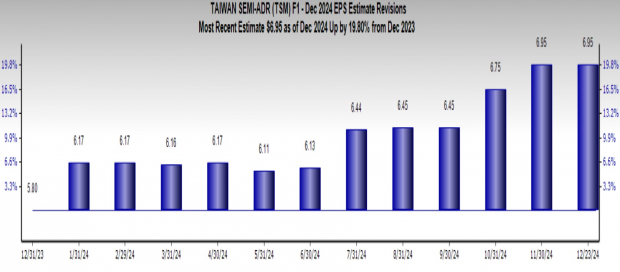

With the TSMC stock destined to scale upward in the new year banking on advanced chip technology, a diversified business model, and market dominance, it surely is a compelling buy. As a result, TSMC’s earnings per share are projected to increase by 19.8% compared to last year, with a Zacks Consensus Estimate of $6.95.

Image Source: Zacks Investment Research

Brokers also assume that the TSMC stock will rise in the near term, raising the average short-term price target to $226.14 from the last closing price of $197.21 and setting the highest target at $250, an upside of 26.8%.

Image Source: Zacks Investment Research

TSMC stock at the moment has a Zacks Rank #2 (Buy) (read more: 3 Reasons to Buy TSM Stock Besides 54% Q3 Net Profits Surge).

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Intel Corporation (INTC) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report