The fourth quarter earnings season has begun, and three highly-ranked stocks are poised for long-term investment. Wall Street, unfazed by moderate inflation concerns, is now honing in on quarterly financial reports. The S&P 500 is eyeing new record highs, setting the stage for potential investment opportunities. Amongst these, Fastenal (FAST), Stride (LRN), and Netflix (NFLX) stand out with their strong market positions.

Inflation Data and Market Trend

Despite a slight increase in headline inflation, the S&P 500 and the Nasdaq remained steady, mitigating earlier losses and instilling confidence in the market’s solid performance. Wall Street is now transitioning its focus to the highly anticipated earnings reports.

Analysis of Highly-Ranked Stocks

Fastenal, a leading wholesale distributor of industrial supplies, displayed a remarkable track record of sales growth, proving its resilience amid economic and industrial fluctuations. With its upcoming Q4 earnings on January 18, the company is projected to sustain its revenue and earnings growth, backed by a robust business model and positive EPS revisions, earning a Zacks Rank #2 (Buy).

Fastenal’s Strong Performance and Market Position

Fastenal has defied industry benchmarks, surging ahead in the last 20 years, outperforming its peers and the S&P 500. The company’s stock valuation, marked by a 28% surge in the past 12 months, and a 20% discount to its forward earnings, underscores its potential for further growth.

Educational Sector and Growth Outlook

Stride, Inc. has emerged as a standout player in the digital education domain, delivering comprehensive services to K–12 students, adult learners, and diverse educational institutions. The company’s impressive revenue growth and earnings projections, buoyed by strong market demand and positive Zacks Rank assessment, make it an appealing prospect for investors.

Stride’s Resilient Growth Trajectory

Stride’s resilient revenue growth and outperformance over the S&P 500 in the last decade, coupled with its robust earnings forecast and substantial discount to its average price targets, position it as a compelling investment opportunity in the educational sector.

Conclusion

As the earnings season unfolds, investors are presented with lucrative prospects in the form of highly-ranked stocks like Fastenal, Stride, and Netflix. These companies’ strong market positions, resilient performance, and impressive growth trajectories stand as testimony to their potential to yield long-term value and returns for investors.

The Evolving Landscape: Netflix’s Resilience in the Face of Changing Entertainment Dynamics

Netflix, Inc. (NFLX) – Q4 Earnings on January 23

Streaming Pioneer Amid Growing Competition and Industry Concerns

Netflix, with its disruptive impact, has forever transformed the entertainment industry, reshaping the consumption of movies and TV shows. Despite facing challenges from streaming behemoths like Disney (DIS), Apple, and Amazon, the stalwart status and expanding content library have positioned Netflix at the forefront of the streaming world.

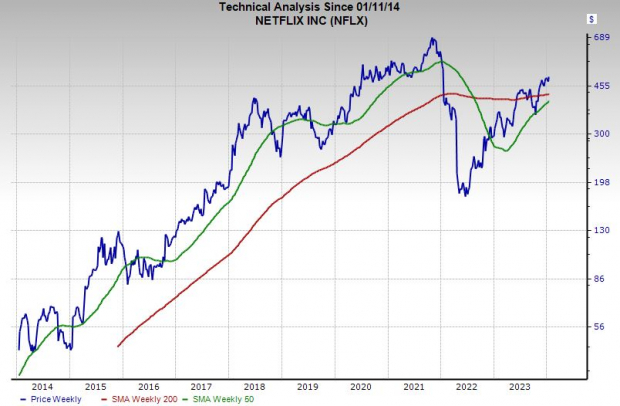

Image Source: Zacks Investment Research

However, concerns about slowing top-line growth and mounting competition have caused volatility in Netflix’s stock value. The current unease also stems from apprehensions about potential consolidation within the streaming industry.

Financial Performance and Strategic Maneuvers

The streaming giant has assuaged some of these apprehensions by surpassing earnings estimates in Q1, Q2, and Q3, demonstrating a robust business performance. Notably, the company impressively augmented its paid membership by 8% in Q2 and a further 11% in the third quarter, culminating in a subscriber base exceeding 247 million, outpacing Disney+ at 150 million.

Moreover, Netflix’s lower-cost ad-based subscription tier has gained significant traction, and the company has recently announced substantial user growth. Netflix is also taking measures to curtail the widespread sharing of accounts, a move aimed at bolstering long-term revenue.

Financial Projections and Market Position

Looking ahead, Netflix is anticipated to record a revenue increase of over 6% in 2023 and 14% in FY24, which is expected to catalyze a corresponding 22% and 32% surge in adjusted earnings. The impressive EPS revisions, coupled with optimistic business developments, support Netflix’s Zacks Rank #2 (Buy) status.

Image Source: Zacks Investment Research

Despite climbing nearly 200% from its lows, Netflix’s stock valuation still remains 30% below its historical peaks. Notably, in the last decade, the stock has surged by an astonishing 933%, significantly outpacing the broader tech sector, which recorded a growth of 250% during the same period. Furthermore, Netflix currently trades above significant short-term and long-term moving averages.

From a valuation perspective, Netflix is trading at a substantial discount, approximately 60% below its decade-long median and 95% beneath its peak valuation, with a forward 12-month earnings multiple of 29.8X, which reveals the stock’s potential for investor interest.