Investors often rely on Wall Street analysts’ recommendations to gauge the attractiveness of a stock. The current buzz around Alibaba (BABA) presents an opportune moment to delve into the reliability of such endorsements and how investors can leverage them judiciously.

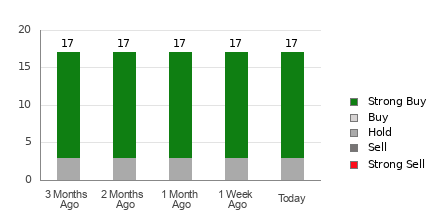

Alibaba currently boasts an impressive average brokerage recommendation (ABR) of 1.35, indicating a strong inclination towards “Buy.” A cumulative analysis of 17 brokerage firms’ recommendations underscores the overwhelmingly positive sentiment towards the stock, with 82.4% of the recommendations leaning towards a “Strong Buy.”

Analyzing the Trend of Brokerage Recommendations for BABA

The high ABR for Alibaba might signal a buying opportunity. However, sole reliance on this metric could be precarious. Studies reveal that brokerage advice often lacks the efficacy of guiding investors towards stocks with maximum potential for price ascension.

Brokerage recommendations, laden with a positive bias, are influenced by firms’ vested interests in the stocks they evaluate. For every “Strong Sell” recommendation, there are five “Strong Buy” endorsements. This skew underscores the need to validate such data against personal research or reliable predictive indicators.

The Role of Zacks Rank in Investment Decisions

Zacks Rank, a well-vetted stock rating tool with a history of objective audits, classifies stocks into five categories. It extends from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), serving as a credible predictor of a stock’s near-future price performance. Therefore, leveraging the ABR in conjunction with Zacks Rank assessments can potentially inform astute investment decisions.

It’s vital to distinguish between ABR and Zacks Rank. While ABR is pinned on brokerage recommendations and ranges in decimals, Zacks Rank is hinged on earnings estimate revisions and is expressed in whole numbers. Analysts at brokerage firms, swayed by their employers’ interests, tend to offer overly favorable ratings, often misleading investors. Conversely, Zacks Rank’s foundation in earnings estimate revisions underscores its reliability in anticipating stock price movements.

Unraveling Alibaba’s Investment Viability

Currently, Alibaba’s earnings estimate remains unchanged at $8.68 for the current year as per the Zacks Consensus Estimate. This static projection, backed by analysts’ unwavering outlook on the company’s earnings potential, has attributed a Zacks Rank #3 (Hold) to Alibaba.

Considering the subtle consensus estimate alteration and other earmarks related to earnings forecasts, exercise caution with Alibaba’s Buy-equivalent ABR. An insightful approach to stock analysis, one that integrates various metrics, is essential for prudent investment decisions.