Investors often rely on analyst recommendations to make decisions about stocks. Media reports of rating changes by brokerage firms can sway stock prices, but how valuable are these recommendations really?

Let’s explore the significance of brokerage recommendations and how they relate to Marvell Technology (MRVL).

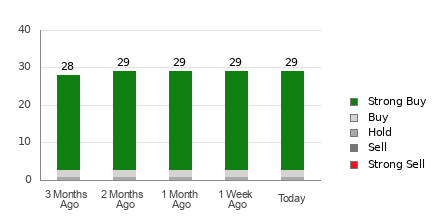

Marvell currently holds an average brokerage recommendation (ABR) of 1.14, indicating a consensus between Strong Buy and Buy, based on ratings provided by 29 brokerage firms. Among these ratings, 26 are Strong Buy and two are Buy, constituting 89.7% and 6.9% of all recommendations, respectively.

Examining Brokerage Recommendation Trends for MRVL

The ABR indicates a buy recommendation for Marvell. However, it’s important to note that relying solely on this metric for investment decisions may not be advisable. Research indicates that brokerage recommendations have limited success in identifying stocks poised for substantial price appreciation.

Brokerage analysts often exhibit positive bias towards stocks they cover due to their firms’ vested interests, resulting in a disproportionate number of “Strong Buy” recommendations compared to “Strong Sell” ratings. This divergence in interests may not provide meaningful insights into a stock’s future price trajectory.

One effective tool investors can consider is the Zacks Rank, a proprietary stock rating system with a strong track record. By aligning the ABR with the Zacks Rank, investors can enhance their decision-making process and potentially identify profitable investment opportunities.

Comparing Zacks Rank and ABR

While both Zacks Rank and ABR are graded on a scale from 1 to 5, they serve distinct purposes. ABR relies on brokerage recommendations, typically displayed with decimals, whereas the Zacks Rank leverages earnings estimate revisions, displayed as whole numbers.

Brokerage analysts, influenced by their firms’ interests, tend to offer overly optimistic ABRs, potentially misleading investors. In contrast, the Zacks Rank focuses on earnings estimates, which are strongly correlated with stock price movements based on empirical studies.

The Zacks Rank’s consistent application across all stocks with earnings estimates, and its responsiveness to changes in earnings forecasts, provides investors with timely insights into potential price movements.

Evaluating Marvell’s Investment Potential

For Marvell, the Zacks Consensus Estimate for the current year remains steady at $1.39. This stability in analysts’ earnings projections may indicate that the stock will mirror the broader market’s performance in the short term.

Considering the Zacks Rank #3 (Hold) assigned to Marvell, it may be prudent to exercise caution despite the Buy-equivalent ABR for the stock.

Exploring Alternative Investment Opportunities

As investors navigate the market landscape, it’s crucial to assess various metrics beyond brokerage recommendations to make informed decisions. Exploring diverse investment avenues and utilizing reliable tools like the Zacks Rank can enhance investors’ chances of success in the stock market.

Want more insights on profitable investment strategies? Delve into the realm of stock analyses and uncover hidden opportunities today!

Remember, in the realm of investing, a holistic approach and prudent decision-making are key to achieving financial goals!