Opportunity in Oversold Health Care Stocks

The health care sector is currently abuzz with opportunities as oversold stocks beckon investors with undervalued potential. A key metric, the Relative Strength Index (RSI), is signaling interesting trends in the market. When RSI dips below the 30 threshold, assets are often labeled as oversold, presenting a strategic entry point for investors aiming for short-term gains.

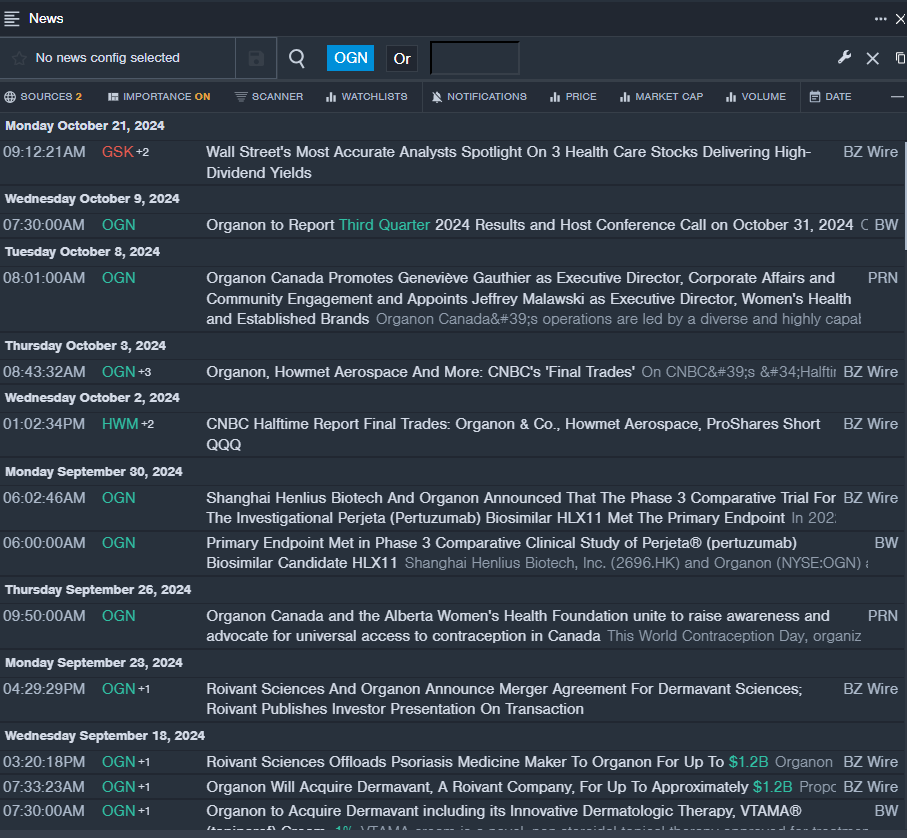

Organon & Co (NYSE:OGN)

- Organon is gearing up for its third-quarter 2024 financial results release on October 31. The stock has weathered a recent storm, witnessing a 12% drop in value over the past month and hitting a 52-week low of $10.84.

- RSI Value: 28.28

- OGN Price Action: Organon’s shares closed at $17.45 on Monday, experiencing a 0.9% decrease.

Arcutis Biotherapeutics Inc (NASDAQ:ARQT)

- Arcutis Biotherapeutics made headlines with Health Canada’s approval of ZORYVE® Foam to combat seborrheic dermatitis in individuals aged 9 and above. The stock saw a recent decline of around 14% and touched a 52-week low of $1.76.

- RSI Value: 28.13

- ARQT Price Action: Arcutis stock closed at $8.31 on Monday, down by 4.7%.

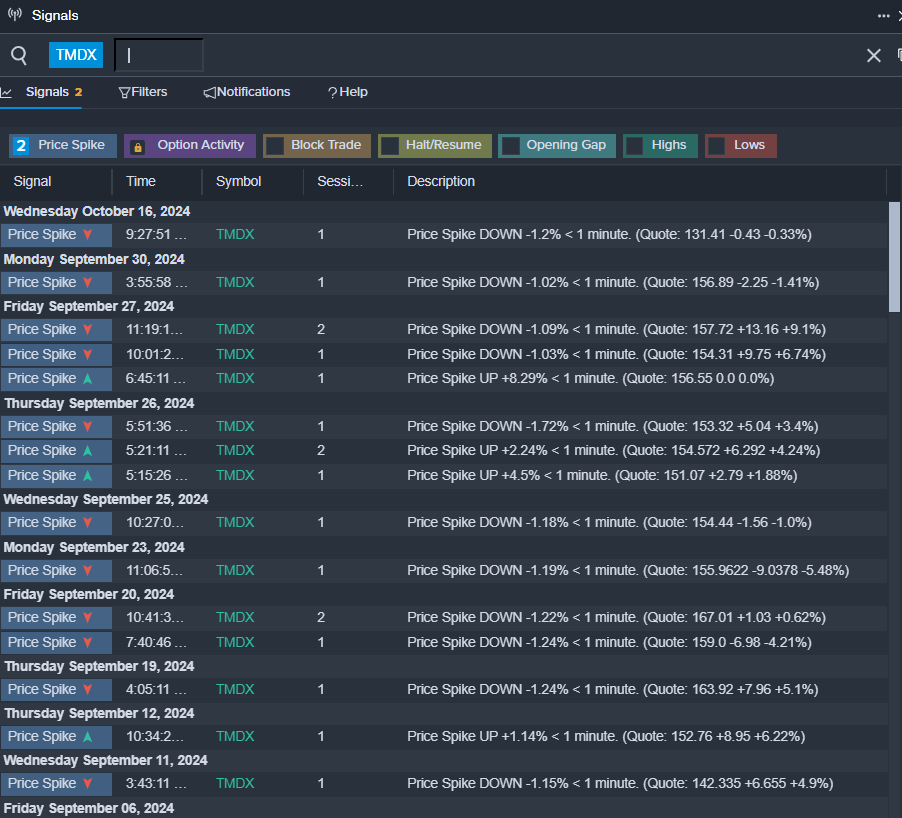

TransMedics Group Inc (NASDAQ:TMDX)

- TransMedics Group is set to unveil its third-quarter financial results after the market’s closure on October 28. The company’s stock recently faced a 22% decline and hit a 52-week low of $36.42.

- RSI Value: 29.60

- TMDX Price Action: TransMedics’ shares ended at $124.48 on Monday, marking a 1.7% decrease.

Read More: