Investors frequently seek guidance from Wall Street analysts to inform their investment decisions. The current climate is awash with chatter about brokerage recommendations and their potential influence on stock prices. But does Wall Street’s outlook on Interactive Brokers Group, Inc. (IBKR) hold any real significance?

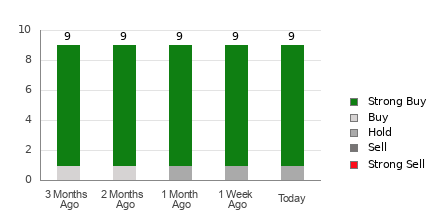

As it stands, Interactive Brokers boasts an average brokerage recommendation (ABR) of 1.22, falling between Strong Buy and Buy on a scale ranging from 1 to 5. This metric is formulated from recommendations (Buy, Hold, Sell, etc.) put forth by nine brokerage firms. Notably, a substantial 88.9% of all recommendations for IBKR are classified as Strong Buy.

Decoding the IBKR Recommendation Trends

While the ABR leans towards favoring a Buy position on Interactive Brokers, prudence is advised when basing investment choices solely on this indicator. Research indicates that brokerage recommendations often fall short in guiding investors towards stocks with optimal price surge potential.

The underlying issue stems from the partiality of brokerage firms towards stocks they cover, resulting in an overly optimistic bias in their analysts’ ratings. Studies have shown that for every “Strong Sell” recommendation, brokerage firms assign a concerning five “Strong Buy” ratings.

The misalignment of these institutions’ interests with those of everyday investors offers little foresight into the future trajectory of a stock’s price. Hence, using brokerage recommendations as validation for personal analysis or employing a reliable predictive tool is advisable.

Encompassing a proven track record, the Zacks Rank serves as a powerful stock rating mechanism, categorizing stocks into five ranks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It has been a reliable precursor to a stock’s performance in the imminent future. Thus, juxtaposing the ABR with the Zacks Rank could possibly yield profitable investment decisions.

Navigating ABR vs. Zacks Rank

The ABR and Zacks Rank may share a scale from 1 to 5, but they diverge in essence. The ABR solely relies on brokerage recommendations, typically presented in decimals, while the Zacks Rank is grounded in earnings estimate revisions, depicted as whole numbers from 1 to 5.

Brokerage analysts, driven by their employers’ interests, showcase unwarranted positivity in their recommendations. In contrast, the Zacks Rank hinges on earnings estimate trends, which research confirms to be intricately linked to short-term stock price movements.

Moreover, while the ABR can lack timeliness, the Zacks Rank maintains current relevance. The swift incorporation of analysts’ earnings estimate alterations ensures the Zacks Rank’s accuracy in predicting future price shifts.

Exploring the Investment Landscape for IBKR

Within the realm of earnings estimate revisions for Interactive Brokers, the Zacks Consensus Estimate for the current year has recently ascended by 0.7% to $6.81. Analysts’ unified positivity surrounding the company’s earnings outlook, epitomized through significant EPS estimate hikes, could potentially propel the stock to greater heights in the near term.

With an observable surge in consensus estimates and three other earnings-related facets in play, Interactive Brokers proudly flaunts a Zacks Rank #1 (Strong Buy), positioning it as a compelling investment choice. The ABR equivalence to a Buy recommendation for IBKR might indeed prove beneficial for prospective investors.

Opportunities Abound in the Infrastructure Sector

An imminent wave of infrastructure rejuvenation is set to engulf the United States, promising bipartisan support and substantial capital injections. The potential profits are staggering, awaiting adept investors to seize them.

The critical query remains, “Will you identify the prime stocks early on, maximizing their growth possibilities?”

Zacks has unveiled a Special Report tailored to assist in this endeavor, available at no cost. Discover 5 standout companies primed to reap the rewards of extensive infrastructure refurbishments, spanning a spectrum from roadworks to energy overhauls on an unprecedented scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Secure a Free Stock Analysis Report for Interactive Brokers Group, Inc. (IBKR)