JD.com (JD), and China-based businesses in general, were formerly considered uninvestable by many. That sentiment is changing quickly, however following the China’s central bank unloading of its monetary-policy bazooka. I believe that JD.com should benefit in the coming quarters. All in all, I am bullish on JD stock because JD.com is an income grower and is reasonably valued.

JD.com is an e-commerce company based in China. It’s not as big as Alibaba (BABA), but JD.com is still a large company with a market capitalization of around $62 billion.

Until recently, during the past year JD’s stock chart has looked like a scary rollercoaster. Yet, the stock is perking up now, and there’s an identifiable reason for this. All things considered, you might agree with my view that JD.com shares offer a good entry point for exposure to a potentially-recovering Chinese economy.

Resurgence Amidst Stimulus: A New Chapter for JD.com

China’s post-pandemic economic recovery has been uneven, and cyclical businesses like Alibaba and JD.com have had to navigate a challenging backdrop for several years. On the other hand, China’s government is now responding with a massive wave of monetary stimulus. This supports my bullish outlook because a boost to China’s business activity generally should provide a tailwind for JD.com’s top and bottom lines.

Last week was eye-opening, as China’s technology stocks experienced their best week since 2008. China’s aggressive fiscal and monetary policy action is spurring a reappraisal of the view that Chinese businesses are uninvestable. JD.com stands to benefit significantly from China’s liquidity support to its businesses, potentially leading to a surge in e-commerce sales and income for the company.

Growing Income Signaling Strength: JD.com’s Performance

Investors may ask why JD stock is a standout opportunity. JD.com’s solid financial profile, boasting $28.8 billion in cash and minimal debt, supports a bullish outlook. Additionally, JD.com’s income growth has been remarkable, with significant increases in diluted net income per ADS year over year.

Despite challenging conditions, JD.com has consistently exceeded earnings per share estimates for over 15 quarters. With China’s support for the economy, JD.com is poised for even greater success ahead.

Valuable Investment: Evaluating JD.com’s Potential

Following the China stimulus news, JD stock has shown promise. With a reasonable price-to-earnings ratio compared to sector peers, JD.com presents an attractive opportunity for value-conscious investors interested in U.S.-listed Chinese stocks.

JD.com’s adjusted P/E ratio is favorable in comparison to sector medians and historical averages, suggesting that adding JD.com stock to investment portfolios may be a prudent move.

Analysts’ Perspective on JD Stock

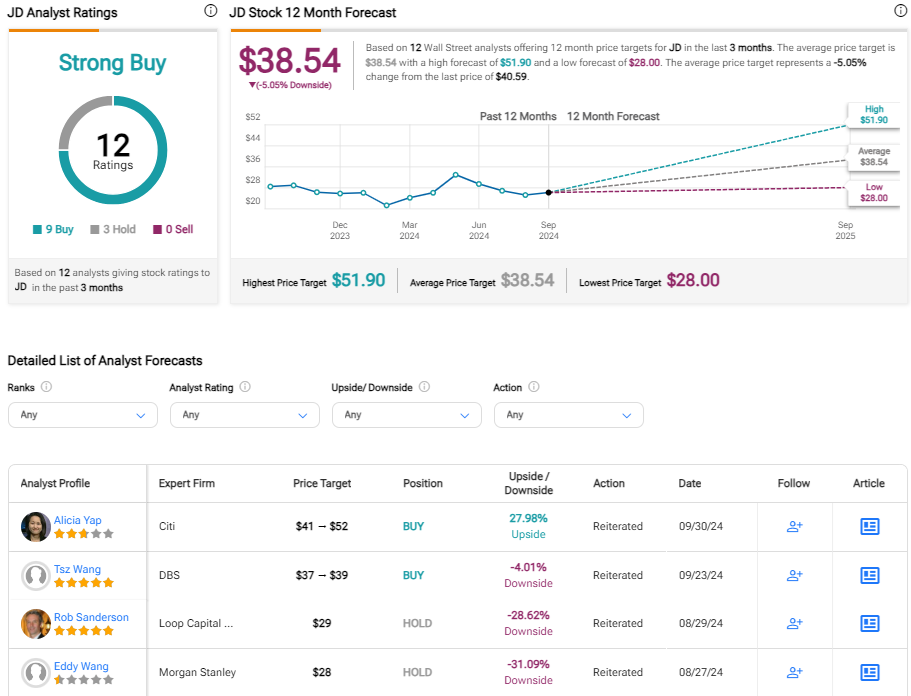

On TipRanks, JD is rated as a Strong Buy based on Wall Street analysts’ recommendations. With a positive consensus and a stock price target not far from the latest trade price, JD.com appears to have considerable potential for growth.

Final Thoughts: Embracing the Potential of JD.com

Despite recent stock price movements, JD.com remains reasonably valued, with a track record of growing profitability. Set to benefit from China’s stimulus measures, JD.com’s strong position in the e-commerce sector and analyst confidence make it an intriguing investment opportunity.

While risks persist, taking a long-term view on JD.com amidst changing market dynamics could prove to be a rewarding strategy.