Investors often lean on analyst recommendations to navigate the choppy waters of the stock market. These recommendations, hailing from the ivory towers of Wall Street, can trigger a flurry of buy, sell, or hold actions. But do these pronouncements hold the key to untold riches, or are they merely a red herring?

Before we delve into the reliability of brokerage reports, let’s scrutinize the sentiment of Wall Street mavens towards CrowdStrike Holdings (NASDAQ: CRWD) and explore how investors can leverage this information.

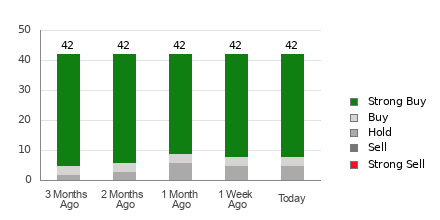

CrowdStrike presently boasts an Average Brokerage Recommendation (ABR) of 1.31, nestled between Strong Buy and Buy on the rating spectrum that spans from 1 to 5. This figure materializes from inputs by 42 brokerage firms, with 34 singing the chorus of Strong Buy and a trio vouching for Buy. This coalition translates to a dominance of 81% and 7.1% respectively.

The Glamour and Glitter of Brokerage Views on CRWD

While the ABR seems to be the guiding star for CrowdStrike investors, prudence dictates that decisions should not hinge solely on this metric. Studies have whispered tales of brokerage ratings failing to steer investors towards the promised land of soaring stock prices.

But why is this so? The analysts at these esteemed brokerage firms, in thrall to the stocks they cover, often cast a rose-tinted glow over their recommendations. An intriguing discovery reveals that for every “Strong Sell” battle cry, five “Strong Buy” trumpets blare from the ramparts of Wall Street.

The interests of these institutions, unfortunately, do not always align with the average Joe investor, leading to a hazy crystal ball regarding the future trajectory of a stock’s value. Thus, it may serve investors well to view brokerage inputs as a compass for validating their personal analysis or employing another tool that might paint a clearer picture of market movements.

The Zacks Rank emerges as a gallant contender in this financial joust. This illustrious tool, with a track record polished by external audits, slices stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It stands tall as a harbinger of a stock’s dance with price performance in the near term, making it a companion worthy of consideration alongside the ABR.

ABR: A Doppelganger Not to Be Confused with Zacks Rank

Although both the ABR and Zacks Rank share a 1 to 5 scale, they are cast from entirely different molds.

Broker recommendations are the soul behind the ABR’s essence, typically dressed in decimals (a guise like 1.28). Conversely, the Zacks Rank is a numbers game, crafted to harness the power of earnings estimate revisions and displayed in whole integers from 1 to 5.

Brokerage analysts, carrying the optimism of explorers, continue to float their recommendations towards sunlit shores. Their ratings often outstrip their research-backed findings, thanks to a nudge from their corporate benefactors. In stark contrast, the Zacks Rank follows the trail of earnings estimates, drawing a curtain that reveals the puppet strings connecting earnings trend and stock price movement.

The Zacks Rank dances nimbly across all stocks adorned with brokerage analysts’ current-year earnings prophecies, ensuring an equitable distribution among the five rungs. It stands as a steadfast guardian, keeping a watchful eye on the gate to stock market fortunes.

When dawn breaks on the hour of freshness, the ABR might find itself trapped in yesteryears. Yet, the Zacks Rank, sprinting on the rapid feet of actionable earnings estimate revisions, stands as a beacon, offering timely insights into the labyrinth of stock price predictions.

Is CRWD a Shakespearean Tragedy in the Making?

The whispers around CrowdStrike paint a somber picture – the Zacks Consensus Estimate for this year’s journey has taken a 34.2% plunge over the past moon to $3.70.

This chorus of analyst voices, harmonizing in pessimism over the company’s profit fate, has sculpted a Zacks Rank #4 (Sell) for CrowdStrike, hinting at a storm brewing on the near horizon.

As such, it might be prudent for investors to season the seemingly succulent ABR for CrowdStrike with a pinch of salt, lest they find themselves supping at a bitter table.

© 2024 Benzinga.com. Benzinga humbly refrains from casting pearls of investment advice. All rights reserved.