Nvidia (NASDAQ: NVDA) is a blazing star among artificial intelligence (AI) stocks. Delving into a lesser-known facet, Nvidia also dishes out dividends. Yet, the twist in the dividend tale earlier this year left many astounded. Amplifying the stock’s allure, Nvidia’s dividend history has been a wild roller coaster ride.

Nvidia’s Surprising Dividend Odyssey in 2024

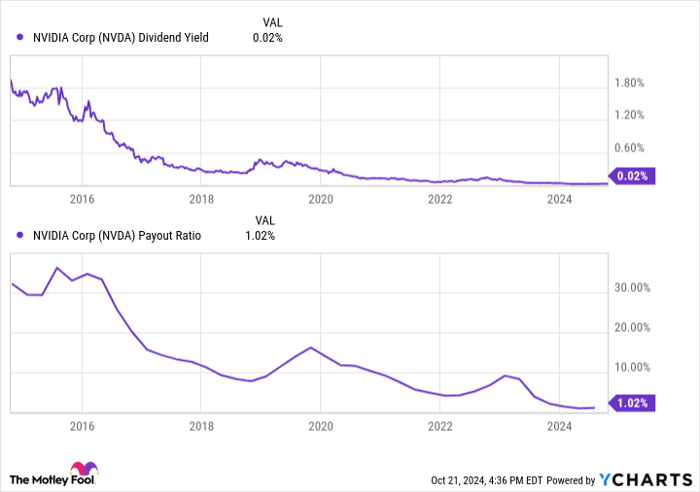

Traditionally, robust companies witnessing exponential sales growth tend to ramp up their dividend payouts over time. However, Nvidia seems to be charting a different course. In 2020, the quarterly dividend stood at $0.16 per share. Fast forward to 2021, and the payout dwindled to $0.04 per share. Come early 2024, the figure plunged once more to a meager $0.01 per share per quarter. Consequently, Nvidia’s dividend yield now hovers at a paltry 0.02%, with the payout ratio merely scratching 1% of the bottom-line earnings.

Nonetheless, these figures barely paint the complete picture. Stock splits, capable of camouflaging a rising dividend, add a layer of complexity. Earlier in the year, Nvidia executed a 10-for-1 stock split. Adjusting for this move reveals that the current $0.01 quarterly dividend actually translates to $0.10 per share on a pre-split basis—more than doubling the previous payout. A mirror image scenario unfolded in 2020, with the company splitting its shares 4 for 1.

Exemplifying this roller coaster, Nvidia’s dividend yield has fluctuated dramatically over the years, masking a deeper narrative beneath the numbers.

NVDA Dividend Yield data by YCharts

Nvidia stands as a titan in a financial realm, flaunting over 1,000% value surge in shares since 2020. A colossal upsurge in AI GPU demand, a market segment where Nvidia stakes a hefty 70% to 95% ownership share, has driven profits to astronomical heights. Beyond the smoke and mirrors of dividend figures, earnings have balloons significantly. A rising dividend rate, veiled by immense stock splits, plays second fiddle to an even grander earnings escalation, precipitating a steep fall in the payout ratio.

In a nutshell, Nvidia straddles the paradigm of a growth stock rather than an income stock. Beware of the deceiving top-line figures, as Nvidia notches up its dividend rate, nestled amidst sweeping stock splits.

Seizing the Redemption Wave for a Second Shot at Lucrative Opportunity

Ever experienced FOMO, fretting over missing the gravy train on premier stocks? Here’s a redemption arc for you.

Perchance, once in a blue moon, our ensemble of analysts churn out a “Double Down” stock recommendation. These picks are primed for a market upheaval. If the boat has seemingly sailed on your investment inlet, now beckons the most opportune juncture for venturing in, reaping the rewards before the window slams shut. The annals of performance underscore the potential:

- Amazon: From a $1,000 ante during the 2010 double down, your jackpot would amass to a staggering $20,803!*

- Apple: Pledging $1,000 in the 2008 double down would balloon to a splendid $43,654!*

- Netflix: Embarking with $1,000 in the 2004 stock double down gambit would burgeon to an awe-inspiring $404,086!*

The present pulses with “Double Down” sirens for three enthralling companies, a window of opportunity that might not unlatch again any time soon.

Snap Up 3 “Double Down” Hotshots Now »

*Stock Advisor returns as of October 21, 2024