Investors often steer their ships by the stars of Wall Street analysts’ forecasts, but how reliable are these compasses in guiding us through the turbulent seas of stock market investment? Let’s set sail into the waters of BigBear.ai Holdings, Inc. (BBAI) and uncover the treasure trove of recommendations shaping its destiny.

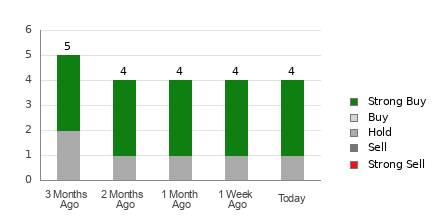

As the sun rises on BigBear.ai, a glance at its average brokerage recommendation (ABR) reveals a modest figure of 1.50, hovering between Strong Buy and Buy in the analyst realm. Out of the four brokerage firms casting their votes, a whopping 75% have donned the Strong Buy mantle, painting a rosy picture for this fledgling company.

Decoding the Rollercoaster of Brokerage Recommendations for BBAI

While a chorus of “Buy, Buy, Buy!” echoes from Wall Street, it’s essential to tread cautiously on this path. Studies whisper that these brokerage recommendations may not be the North Star investors seek; their allegiances to the stocks they cover can skew forecasts. For every somber “Strong Sell,” expect a cheery quintet of “Strong Buys” beckoning you towards potential reefs.

Unlike these whimsical winds of change, the Zacks Rank offers a sturdy lighthouse in the storm. The earnings-driven model categorizes stocks into five clear tiers, foreseeing their financial future with an eagle eye. By juxtaposing the ABR with the Zacks Rank, investors can navigate a clearer course in the unpredictable stock market sea.

Untangling the Webs of ABR & Zacks Rank

ABR dances to broker whims, swaying between decimals to paint a biased picture. In contrast, the Zacks Rank cuts through the fog, harnessing the power of earnings estimates to unveil a stock’s true colors. The choir of brokerage analysts may sing sweet melodies, but the Zacks Rank cuts through the noise with its earnings-driven harmony.

As the Wall Street tides ebb and flow, the Zacks Rank remains a steadfast beacon. Earnings estimate revisions shape its predictions, offering a timely and balanced view of a stock’s trajectory.

Should You Brave the Waters with BBAI?

The whispers of Wall Street reveal an unchanged Zacks Consensus Estimate for BigBear.ai at -$0.79, signaling a steady ship amidst turbulent waters. With a Zacks Rank #3 (Hold) fluttering in the breeze, caution may be the anchor to keep this ship steady.

Like a seasoned sailor eyeing storm clouds on the horizon, it might be wise to approach the Buy-equivalent ABR for BigBear.ai with a weathered skepticism.

As the investing world holds its breath, tales of stock market voyages echo through the corridors of time, reminding us that amidst the swells of financial markets, a steady hand and a discerning eye are the true compasses to navigate the tumultuous seas of stock investments.