Investors, often swayed by media reports and brokerage-firm-recommended suggestions, frequently base their decisions on analyst ratings. But are these recommendations truly reliable when it comes to stock performance?

Before diving into the veracity of brokerage recommendations and how to leverage them, let’s scrutinize what the Wall Street mavens opine about Vistra Corp. (VST).

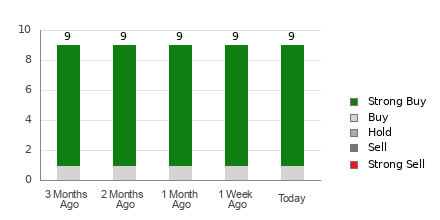

Currently boasting an average brokerage recommendation (ABR) of 1.11, Vistra sits between a Strong Buy and a Buy on a scale of 1 to 5. Out of the nine brokerage recommendations analyzed, eight strongly advocate for a buy, with the remaining one suggesting a buy. This dichotomy translates to 88.9% in favor of a Strong Buy and 11.1% advocating a Buy.

The Contours of VST Brokerage Recommendations

While the ABR clearly leans towards a positive stance on Vistra, solely relying on this figure for investment decisions might not be the wisest move. Numerous studies highlight the limited impact of brokerage recommendations on predicting stocks poised for significant price increases.

Brokerage firms often exhibit a pronounced positive bias towards stocks they cover, leading to an excess of “Strong Buy” recommendations compared to “Strong Sell” calls. This misalignment of interests underscores the necessity for independent research or verifying recommendations against a proven price-predicting indicator.

Our proprietary Zacks Rank, an extensively vetted stock rating model, segments stocks into five categories from Strong Buy to Strong Sell. Cross-referencing the ABR with the Zacks Rank can significantly enhance the potential for making lucrative investment choices.

Decoding the Nuances of Zacks Rank vs. ABR

Despite sharing a 1-5 scale, the Zacks Rank and ABR diverge in their methodologies. The ABR hinges solely on brokerage insights, often sporting decimal values, while the Zacks Rank integrates earnings estimate revisions and appears as whole numbers from 1 to 5.

Analysts affiliated with brokerage firms tend to skew their recommendations optimistically due to vested interests, leading to a pattern of overzealous positivity. Conversely, the Zacks Rank’s foundation in earnings estimate revisions creates a more reliable predictive framework linked to short-term stock price movements.

The Zacks Rank’s dynamic nature ensures timely updates reflecting analysts’ revised earnings estimates, thereby offering a more contemporaneous gauge for anticipating stock price shifts.

Navigating the VST Investment Landscape

For Vistra, the consistent Zacks Consensus Estimate for the current year ($) over the past month underpins a Zacks Rank #3 (Hold) designation. This steadfast projection suggests Vistra’s stock may track the broader market performance in the near future.

Given the current consensus estimate stability and the resultant Zacks Rank, exercising moderation with the Buy-equivalent ABR recommendation for Vistra appears judicious.

Maintaining a balanced perspective and corroborating brokerage recommendations with sound investment strategies can steer investors towards more informed decisions in the ever-fluctuating stock market.