The cryptocurrency market is ripe with anticipation as the next Bitcoin halving looms. This programmed event slashes the number of Bitcoin given as rewards for successful block mining. Deciphering the mechanics and repercussions of the Bitcoin halving is vital for investors seeking informed choices and adept portfolio management.

By scrutinizing the historical repercussions of past halvings and dissecting present market patterns, investors can adequately brace themselves for the imminent halving and adeptly position in the ever-shifting cryptocurrency sphere.

In partnership with crypto expert Peter Eberle, the Investing News Network (INN) delves into the nuances of the halving process and delves into the potential market turbulence that might ensue.

The Concept of Bitcoin Halving

Bitcoin is formed through mining, a competitive process where miners vie to solve algorithmic puzzles. Upon solving these puzzles, a new block is appended to the blockchain, rewarding the solver with a set amount of newly minted Bitcoin. At its inception in 2009, the reward stood at 50 Bitcoin per mined block.

The Bitcoin halving recurs approximately every four years or after processing 210,000 blocks. The halving is not triggered by time but block milestones, with the actual timeframe being slightly variable due to fluctuations in mining difficulty and network hash rate. This year’s halving is pegged for around April 20, 2024. Following past halving events in 2012, 2016, and 2020, the reward presently per block is 6.25 Bitcoin, a figure poised to drop further to 3.125 Bitcoin in the upcoming halving.

Embedded in Bitcoin’s network, the halving curbs the pace of new Bitcoin creation by scaling down block rewards. This controlled supply aims to combat inflation, ensuring Bitcoin sustains value over time. With each halving, the flow of new coins will gradually taper until all 21 million Bitcoins circulate.

Impacts of Halvings on Bitcoin Miners

Bitcoin’s halving wields substantial influence on the cryptocurrency’s mining sector and supply dynamics, hinged on the mining process.

The mining process operates on a block time of around 10 minutes, adjusting mining difficulty based on hash rate – a metric gauging computational power in Bitcoin mining and transaction processing. A surge in hash rate implies heightened competition among miners to win rewards, necessitating tougher puzzle challenges. Conversely, reduced competition leads to eased puzzle complexity. This mechanism ensures a steady block creation rate, irrespective of competing miners’ numbers.

Traditionally, hash rates ascend pre-halving only to decline post-halving, culling out inefficient miners in the process.

Eberle explained, “Inefficient miners exit as they can’t sustain outdated or energy-guzzling equipment with decreased mining rewards.” Currently, record-high hash rates are propelled by mining behemoths deploying newer, quicker, and more efficient machines, while still phasing out older models. Notably, mining firms like Riot Platforms have made strategic moves pre-halving, with significant miner acquisitions on February 27.

This operational efficiency benefits investors, with miners vending Bitcoin to offset costs and turn profits when production costs undercut sales prices.

Effects of Halvings on Bitcoin Price

Bitcoin often rallies close to halving events. However, with only three halvings historically, pinpointing definitive price trends is daunting.

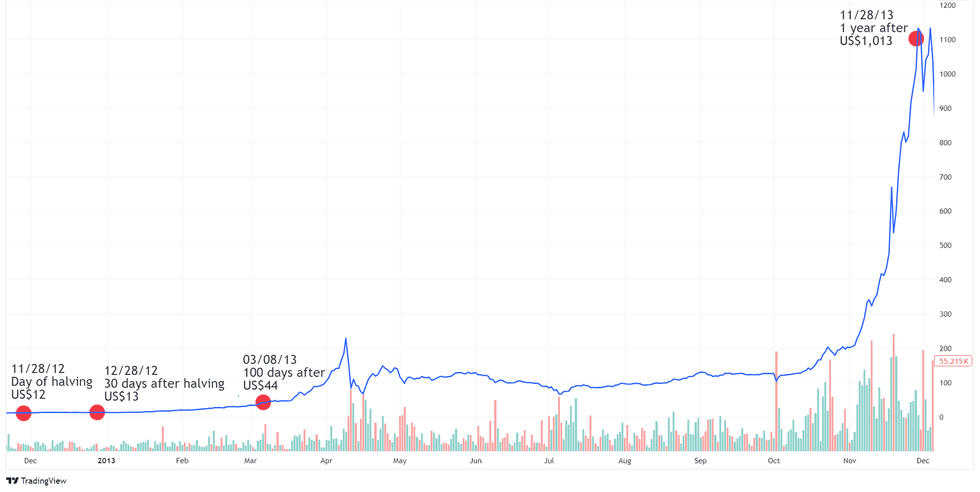

Chart via TradingView

Bitcoin USD price chart 11/21/2012 to 12/05/2013

The first halving on November 28, 2012, slashed the mining reward from 50 to 25 Bitcoins. Though Bitcoin was niche then, it garnered mainstream attention amid economic unrest in Europe. The price had surged from approximately US$5.50.

The Ever-Evolving Journey of Bitcoin: Halving, Adoption, and Price Swings

The Rollercoaster Ride of Bitcoin’s Price

In January 2012, the price of Bitcoin stood at a modest US$5. By the November halving of that year, it had climbed to about US$12, showcasing a gradual surge in interest and adoption. Subsequently, Bitcoin’s price experienced substantial growth, reaching US$1,013 a year post-halving, signaling its emergence as a potential alternative asset class. However, this ascent was short-lived, as the price tumbled back under US$300 by mid-2015.

The Rise and Fall Surrounding Halvings

As July 9, 2016, rolled around, marking the second Bitcoin halving, the cryptocurrency’s value had rebounded to US$648. Over the ensuing year, Bitcoin witnessed significant growth fueled by mounting excitement and positive sentiment, leading to fear of missing out (FOMO) among investors. This frenzy catapulted the price beyond US$2,500 by June 3, 2017. The attention from major financial institutions towards blockchain technology further bolstered Bitcoin’s value, propelling it to an all-time high of US$19,783.21 in December 2017.

The Impact of 2020 and the Unpredictable Road Ahead

The most recent halving on May 11, 2020, saw Bitcoin’s price at US$7,935.10, with the event unfolding without much fanfare or price fluctuation. Despite this, 2020 emerged as a pivotal year for cryptocurrencies due to various factors. The outbreak of COVID-19 spurred concerns about economic stability, triggering the perception of cryptocurrency, including Bitcoin, as a potential safe-haven asset. Concurrently, the rise of decentralized finance (DeFi) from mid-2020 to fall ushered in billions of dollars into the sector, further fueling Bitcoin’s momentum. Noteworthy players like PayPal and Square delved into Bitcoin and other cryptocurrencies, signaling the onset of mainstream adoption.

“I think cryptocurrency’s here to stay,” remarked Rick Rieder, BlackRock’s chief investment officer, effectively capturing the shifting sentiment towards digital currencies.

By the end of 2020, Bitcoin had soared above US$28,000, and a year post the 2020 halving, its value surged to around US$56,000. Although facing setbacks in mid-2021, Bitcoin bounced back, hitting a then all-time high of US$68,000 in November 2021.

What Lies Ahead: Anticipating the Next Bitcoin Halving

In light of the recent surge in market activity triggered by the approval of spot Bitcoin ETFs, the anticipation for 2024’s halving stands out prominently. These ETFs offer a straightforward way for risk-averse investors to engage with Bitcoin’s price movements without the complexities of direct ownership.

Reflecting on the crypto landscape post a tumultuous 2022, the latter half of 2023 ushered in a renaissance, buoyed by legal wins against the SEC and the promise of spot Bitcoin ETFs attracting more institutional investments, reigniting optimism within the industry.

Following the ruling by the US Securities and Exchange Commission, Bitcoin’s price has surged to levels unseen since 2021, with Bitcoin ETFs hitting a new volume record. The upcoming halving has been touted as a driving force propelling Bitcoin’s price above its previous peak of US$69,000 on March 5.

The Bitcoin Halving: A Precursor to Potential Market Surges

Interpreting Market Trends Preceding Bitcoin Halving

In preparation for the forthcoming Bitcoin halving event, analysts and industry insiders are dissecting various market indicators to forecast potential price movements. With historical precedents suggesting a pullback shortly before the halving followed by significant price surges post-halving, experts are closely monitoring current trends.

Insights on Forecasted Bitcoin Price

Some market analysts, such as Peter Brandt, have revised their Bitcoin price predictions, envisioning the cryptocurrency reaching unprecedented highs. Brandt’s revised estimate of Bitcoin soaring to US$200,000 by September from his previous projection of US$120,000 underscores the bullish sentiment prevalent among certain industry figures.

Discussing the likelihood of attaining new all-time highs, industry professionals are optimistic about potential price escalations post-halving. The ease of access provided by exchange-traded funds (ETFs) has the capacity to induce retail FOMO, potentially propelling prices to remarkable levels in the near future.

While estimates ranging from US$75,000 to US$150,000 are circulating, industry specialists emphasize the importance of focusing on sustainable growth rather than headline-grabbing figures, anticipating positive market sentiment as Bitcoin approaches all-time highs.

Investment Strategies for Bitcoin Integration

Incorporating Bitcoin into investment portfolios presents a unique opportunity to augment overall performance and mitigate volatility. Proposing a strategy to balance a standard 60/40 equity bond portfolio, experts recommend quarterly rebalancing by adjusting asset allocations based on performance.

Highlighting the benefits of including Bitcoin in diversified portfolios, studies suggest that a modest 3 to 5 percent Bitcoin allocation can enhance returns and reduce overall portfolio volatility. The non-correlated nature and inherent volatility of Bitcoin offer diversification benefits that can optimize portfolio performance over time.

Moreover, experts stress the importance of managing risk exposure by aligning investments with individual risk tolerance levels, emphasizing prudent asset allocation practices to optimize portfolio stability.