Investors take note; the consumer discretionary domain beckons with a unique chance to embrace undervalued gems.

A surefire way to spot such gems is the Relative Strength Index (RSI), a key indicator that gauges a stock’s potency when prices soar versus when they plunge. If the RSI slips below 30, as revealed by Benzinga Pro, it’s a telltale sign of an oversold asset.

Check out these top contenders, hovering near or below the 30 RSI mark:

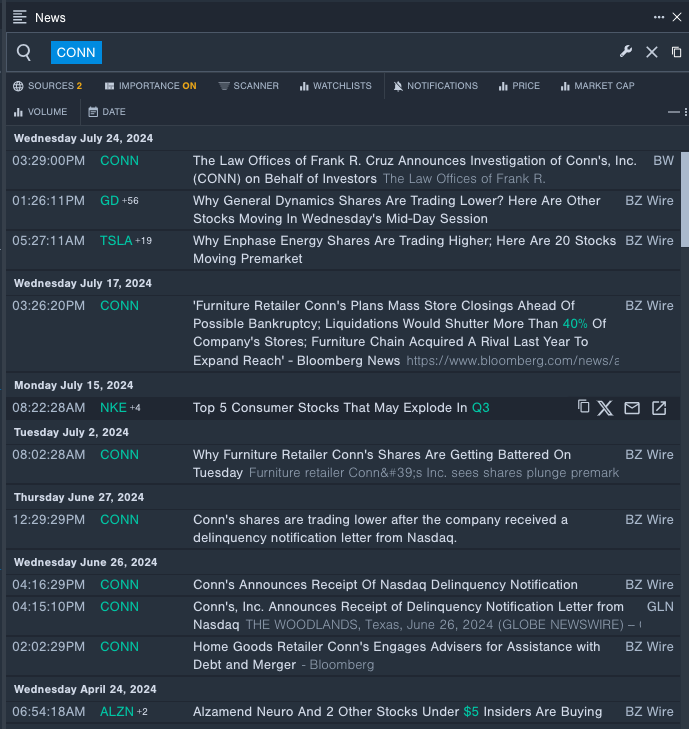

Conn’s Inc (NASDAQ: CONN)

- Recently, Conn’s received a Nasdaq delinquency notification, leading to a sharp 48% stock plummet over five days, hitting a 52-week low of $0.31.

- RSI Value: 17.61

- CONN Price Action: Closing at $0.35 last Wednesday.

- Benzinga Pro sniffed out the latest CONN updates.

Levi Strauss & Co (NYSE: LEVI)

- Levi Strauss turned heads with a robust quarterly earnings report, boasting 16 cents per share compared to the expected 11 cents per share. Michelle Gass, the CEO, credited Levi’s brand dominance, robust innovation pipeline, and expanding direct-to-consumer reach for the stellar performance. Despite this, the stock dipped by 24% in a month, hitting a 52-week low of $12.42.

- RSI Value: 25.55

- LEVI Price Action: Closed at $17.50 on Wednesday.

- Benzinga Pro’s charting tool aided in deciphering LEVI’s market trajectory.

Read Next: