Investors often seek solace in the opinions of Wall Street analysts, hoping to find a beacon amidst the market tumult. But should these brokerage recommendations be the North Star guiding your investments? Let’s delve into the enigma surrounding Symbotic Inc. and the brokers’ verdict on its fortunes.

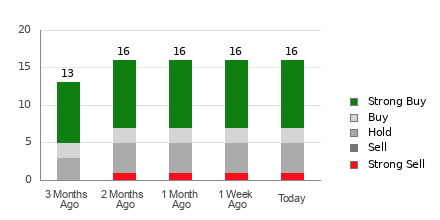

At present, the halls of Wall Street echo with an average brokerage recommendation of 1.88 for SYMBOTIC INC, nestled snugly between Strong Buy and Buy, as per assessments from 16 brokerage firms. Of these evaluations, a resounding nine hail as Strong Buy, while two advocate for a mere Buy. A tale of bullish whispers envelops the corridors, with 56.3% chanting Strong Buy and 12.5% murmuring Buy.

Peering into the Mirage: Brokerage Recommendations for SYM

While the harmonious melody of brokerage recommendations may entice, history reveals a discordant truth. Studies unveil the somber reality that such counsel seldom escorts investors to the pot of gold. As the wind whispers tales of vested interests, brokerage analysts serenade stocks with a bias that tilts towards the sun. For every “Strong Sell,” five “Strong Buys” adorn the celestial canvas.

Alas! The brokers’ tale may not align with your investment dreams. Your trusty compass lies in personal research or tools like the Zacks Rank – a beacon that illuminates the path of stock performance. The Zacks Rank, a shepherd of stocks, herds them into five bands of fortune, from the illustrious Strong Buy to the ominous Strong Sell. Aligning this compass with brokerage musings might just unfurl the treasure map to wise investments.

In the Shadows: Zacks Rank vs. ABR

Though clad in the same vestments of 1 to 5, the Zacks Rank and ABR waltz to contrasting tunes. ABR echoes the whispers of brokerage lips, donned in decimals, while the Zacks Rank dances to the tune of earnings revisions, flaunting whole numbers. The brokerage clan, in its zeal, often adorns stocks with unwarranted laurels, a stark contrast to the Zacks Rank’s pragmatic alignment with earnings prognostications.

The Zacks Rank, a tapestry woven by earnings estimates, bears testimony to the vicissitudes in stock prices. While ABR gazes through a cloudy lens, mired in the past, the Zacks Rank strides with agility, capturing the zeitgeist through real-time earnings revisions – a compass always pointing to the magnetic north of market wisdom.

Navigating the Investment Waters for SYM

Gazing into the crystal ball of earnings estimates for SYMBOTIC INC, a tempest brews. The Zacks Consensus Estimate has plummeted 40.9% in the recent moon. The chorus of analyst voices singing in unison heralds an ominous prophecy – a Zacks Rank #4 (Sell) whispers tales of caution.

In the labyrinths of investments, tread cautiously amidst the choir of brokerage hymns. The Buy equivocation for SYMBOTIC INC may be a siren’s call in disguise.

© 2024 Benzinga.com. Benzinga abstains from the oracle’s mantle of investment prophecy. Walk wisely, dear investor. All rights reserved.