As Corporate America navigates into another consequential earnings season, poised to steal the limelight are the financial updates from technological juggernauts leading the race in artificial intelligence (AI). Renowned for their robust revenue streams and earnings growth, the results from these tech giants often set the tone for the broader stock market.

Microsoft (NASDAQ: MSFT) is set to unveil its fiscal 2025 first-quarter results, culminating on Sept. 30, on Oct. 30. Investors are poised to scrutinize how effectively the company is capitalizing on its burgeoning portfolio of AI products and services.

However, one specific AI metric in Microsoft’s report holds the potential to overshadow the rest.

Image source: Getty Images.

Delving into Microsoft’s AI Endeavors Under Scrutiny

Anchored early last year, Microsoft jolted the tech domain by committing an additional $10 billion to OpenAI, the brain behind ChatGPT. Leveraging OpenAI’s pioneering models, Microsoft has ushered in a plethora of AI innovations, notably its Copilot virtual assistants, proficient in generating text, images, and even code in response to simple cues.

While Copilot seamlessly integrates into Microsoft’s flagship software at no extra cost, the company does offer a supplementary monthly subscription for integrating Copilot into its Microsoft 365 suite, embracing applications like Word, PowerPoint, and Excel. With over 400 million 365 seats globally, potential customers for Copilot add-ons present a lucrative revenue avenue for Microsoft. In its fiscal 2024 fourth quarter, Microsoft reported a doubling of corporate customers purchasing over 10,000 Copilot add-ons for 365. Investors should keenly await updates on Copilot performance in the upcoming quarter.

Yet, Azure cloud computing, particularly Azure AI, is primed to take center stage in the earnings report. Azure AI empowers businesses and developers to lease cutting-edge data center computing capacity furnished with the latest chips from Nvidia and AMD, facilitating the creation of custom AI models. Further, Azure AI grants access to top-notch large language models (LLMs), such as GPT-4o from OpenAI, catalyzing the development of AI applications like chatbots and virtual assistants. Concluding Q4, Azure AI boasted 60,000 customers, marking a remarkable 60% surge from the preceding year.

The Crucial Metric Commanding Microsoft Investors’ Attention

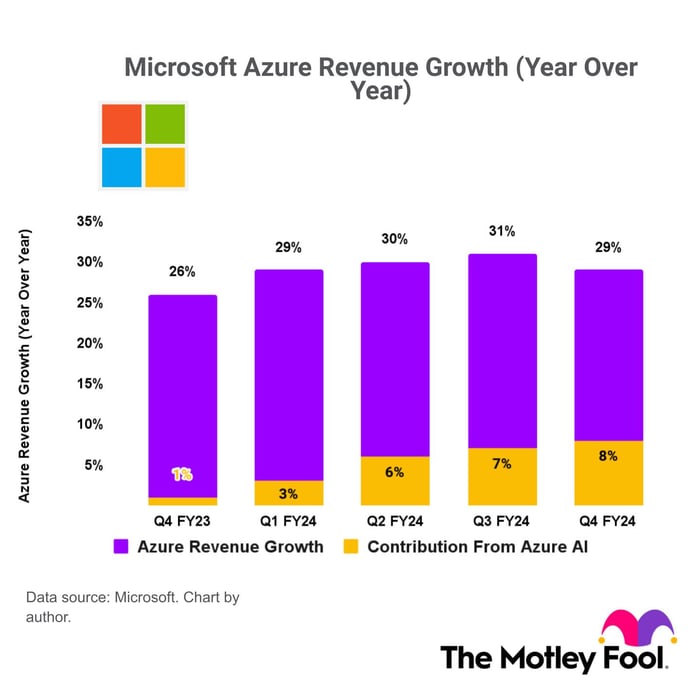

Demonstrating unwavering resilience, Azure, Microsoft’s fastest-growing segment, has consistently captivated investor interest. In Q4, Azure revenue surged by 29% year over year, marking an acceleration from the 26% growth in the prior year.

Azure’s meteoric rise is propelled by Azure AI, crystallized by Azure AI’s contribution of 8 percentage points to Azure’s overall 29% growth in Q4, an all-time high. This phenomenal feat showcases an eightfold surge compared to Azure AI’s 1 percentage point contribution in the corresponding period a year prior.

In its fiscal 2024, Microsoft allocated a staggering $55.7 billion towards capital expenditures, primarily directed at AI data center infrastructure and chips. With plans to escalate spending in fiscal 2025, assessing the revenue churned by Azure AI serves as a litmus test to gauge the returns Microsoft and its shareholders glean from these substantial investments. A rising share of Azure’s growth attributed to Azure AI would signal increased patronage from businesses and developers, fueling optimism amongst investors.

Evaluating Microsoft’s Premium Valuation

Riding on a trailing 12-month earnings per share of $11.80, Microsoft’s stock commands a price-to-earnings ratio of 35.5. This reflects a 10.5% premium to the Nasdaq-100 index’s 32.1 ratio, encompassing Microsoft’s big-tech cohorts.

The pervasive AI infrastructure investments by Microsoft serve as a near-term earnings hurdle. A continued rise in Azure AI’s significance to Azure’s performance would sustain investor confidence in endorsing the stock’s premium valuation. Conversely, any stagnation or underperformance by Azure AI could instigate a correction in Microsoft’s stock.

Thus, come Oct. 30, Azure AI’s impact on Azure’s overall revenue growth stands as the paramount metric enthusiasts and analysts alike should fixate on.

Seize the Opportunity at Hand

Ever felt the pang of missing out on lucrative stock investments?

Exceptional Opportunities in the Stock Market

Introducing a rare insight that may just change your financial fate.

The “Double Down” Phenomenon

From time to time, a specialized team of market experts unveils a unique strategy where they advocate a “Double Down” on selected stock picks, anticipating remarkable growth. If you fear losing out on lucrative investment prospects, now could be your golden ticket to dive in before the train leaves the station. The results so far have been awe-inspiring:

- Amazon: a $1,000 investment in our “Double Down” recommendation back in 2010 would be worth a staggering $21,139 today!*

- Apple: had you invested $1,000 in our endorsed stock in 2008, your capital would have ballooned to an impressive $44,239 by now!*

- Netflix: for those who heeded the call in 2004 with a $1,000 investment, the return today would be an astounding $380,729!*

The current “Double Down” alerts are flashing for three outstanding companies, presenting a today-or-never scenario that might not knock on your door again for a long while.

Explore 3 “Double Down” stock picks »

*Historical Stock Advisor returns as of October 14, 2024