Even the recent resurgence of “meme stock mania” exemplified by GameStop’s unlikely rise pales in comparison to the enduring fervor surrounding semiconductor powerhouse Nvidia. A titan in the market, Nvidia has been a stalwart force since its IPO in January 1999 – a testament to the tenacity of its CEO, Jensen Huang, who founded the company in 1993 amidst a sea of industry sharks.

Nvidia has once again seized the spotlight, riding high on the wave of burgeoning artificial intelligence (AI) demand. Fueled by the insatiable appetites of tech behemoths like Microsoft and Tesla, Nvidia has ascended to the ranks of the world’s largest companies by market cap, with its stock skyrocketing over 3,000% in the past five years. This week, all eyes are on Nvidia as it executes a 10-for-1 stock split.

The Anatomy of Stock Splits

A stock split, a strategic corporate maneuver, entails increasing the number of shares issued to existing shareholders while proportionately decreasing the value of each share.

Decoding the Dynamics of Stock Splits

In layman’s terms, a stock split mirrors exchanging two nickels for a dime, symbolizing a 2-for-1 split. For instance, a pre-split $100 share would metamorphose into two $50 shares post-split. Notably, the company’s market capitalization remains constant. In Nvidia’s case, shareholders received ten shares for each pre-split share, constituting a 10-for-1 split.

Conversely, a reverse split inflates the share price while dwindling the shareholder’s share count – a tact contrary to a traditional split yet maintaining the stock’s inherent value.

The Rationale Behind Stock Splits

Entities opt for stock splits to render shares more enticing to investors. Retail players often favor lower-priced stocks, whereas institutional investors scorn penny stocks, perceiving them as substandard or brushing them off due to regulatory stipulations.

Are Stock Splits a Bullish Omen?

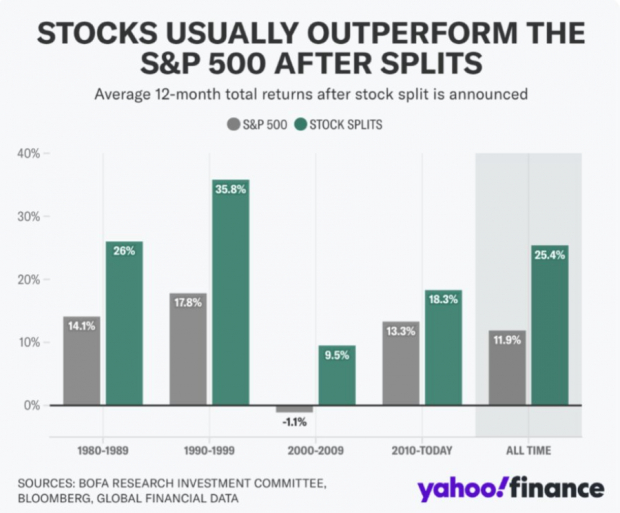

Stock splits, akin to many ventures on Wall Street, merit judicious scrutiny on a case-by-case basis. Historically, stocks undergoing splits tend to outperform the S&P 500 index in the ensuing 12 months.

Image Source: BofA Research, Bloomberg

Proceed with Caution: The Perils of Excessive Splits

Excessive stock splits – defined as two or more splits within a year – should ring alarm bells for investors. Such maneuvers might signify a desperate bid to mask deteriorating fundamentals or avarice verging on recklessness. Qualcomm, a tech luminary of the late ’90s, succumbed to this fallacy with two splits in 1999, culminating in stagnation lasting two decades.

Image Source: Zacks Investment Research

Stock Split: A Multifaceted Conundrum

A stock split represents but a solitary variable that investors must factor in. Prudence dictates an assessment of the stock’s pre-split surge and a wariness against impulsively chasing gains. Fundamentals and prospective earnings per share (EPS) serve as pivotal cornerstones in determining the stock’s trajectory. Lastly, a stock split can infuse much-needed liquidity into the options market, especially if options had become exorbitant prior to the split.

The Final Verdict

Amidst the flurry of headlines generated by Nvidia’s recent stock split, investors are advised to weigh multiple considerations when evaluating the outlook of a freshly split stock.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential

Exploring The Stock Market Amidst Election Year

As voters are energized and engaged in an election year, the market has exhibited relentless bullishness, regardless of which political party clinches victory.

Stocks Showing Extreme Upside Potential

Amidst this fervor, investors are eyeing certain stocks that offer considerable growth prospects, resonating with both Democrats and Republicans alike.

1. Resilient Gains by a Medical Manufacturer

One notable mention is a medical manufacturer that has impressively surged by +11,000% over the past 15 years, showcasing resilience and strength in the market.

2. Standout Performance of a Rental Company

A rental company has been outperforming its sector with exceptional results, establishing itself as a strong contender in the market landscape.

3. Robust Growth Plans of an Energy Powerhouse

An energy powerhouse is set to expand by enhancing its substantial dividend by an impressive 25%, indicating a promising trajectory for investors.

4. Aerospace and Defense Triumph

A standout in the aerospace and defense industry has recently secured a potentially lucrative $80 billion contract, signaling significant growth prospects in the field.

5. Giant Chipmaker Expansion

A giant chipmaker is embarking on building expansive plants within the U.S., underlining its commitment to expansion and innovation in the technological sphere.