The Allure of Consistent Dividend Payouts

Investors revel in steady, dependable dividend payments. After all, who can resist the gratification of cashing in?

The Dividend Aristocrats: A Stalwart Lineage

When it comes to dividend-bearing stocks, the Dividend Aristocrats stand out as venerable entities.

PepsiCo

In the world of PEP shares, stability has been the name of the game over the past year, maintaining a steadfast value. Analysts, however, have brightened their outlook for the current fiscal year, with the Zacks Consensus EPS estimate at $8.15, experiencing a 4% uptick in the past year.

Image Source: Zacks Investment Research

Having boosted its payout by 6.7% annually in the last five years, PepsiCo demonstrates a staunch commitment to its shareholders. Currently, shares yield an impressive 3.1% annually with a payout ratio resting at 66% of earnings.

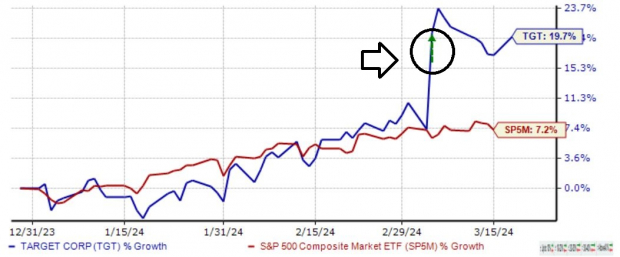

Target

Target shares have displayed remarkable strength this year, marking nearly a +20% surge in value and outshining the S&P 500 significantly. Following its recent quarterly results, shareholders witnessed a substantial upswing in shares.

Image Source: Zacks Investment Research

In this latest report, Target not only surpassed the Zacks Consensus EPS estimate by over 20% but also posted sales slightly above the consensus. With a 57% year-over-year earnings growth and a 1.5% sales climb, Target currently offers a 2.7% annual yield and maintains a sustainable 49% payout ratio.

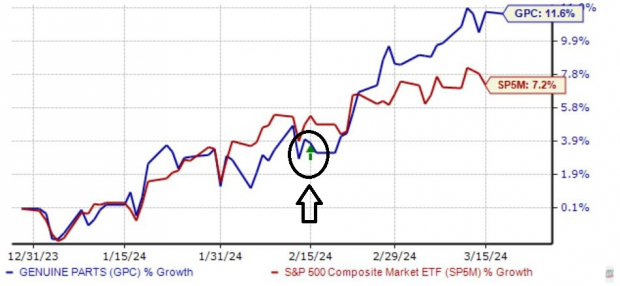

Genuine Parts

Genuine Parts shares have also proven to be a standout in the market this year, exhibiting an 11.6% increase compared to the S&P 500’s 7.2% gain. Similar to Target, shares saw an upward trajectory post-earnings following the most recent quarterly release.

Image Source: Zacks Investment Research

With an annual yield of 2.6%, exceeding the Zacks industry average of 2.2%, Genuine Parts showcases dividend growth with a 5.6% five-year annualized rate.

The Invaluable Art of Dividends

In constructing a portfolio, many investors opt for dividend-paying stocks as a strategic move to mitigate losses in other holdings, generate a passive income flow, and leverage returns through dividend reinvestment.

The Dividend Aristocrats, renowned for consistently enhancing their dividend payments for a minimum of 25 successive years, are often top-picks among savvy investors.

The trio of PepsiCo PEP, Target TGT, and Genuine Parts GPC, all esteemed members of the prestigious Dividend Aristocrat cohort, present compelling options for income-driven investors.